Outsourced bookkeeping services specialize in managing daily financial records, offering cost-effective solutions for small and medium-sized businesses seeking accurate transaction tracking. Accounting firms provide comprehensive financial expertise, including tax planning, auditing, and strategic financial advising tailored to business growth. Discover how each option can align with your company's financial management needs.

Why it is important

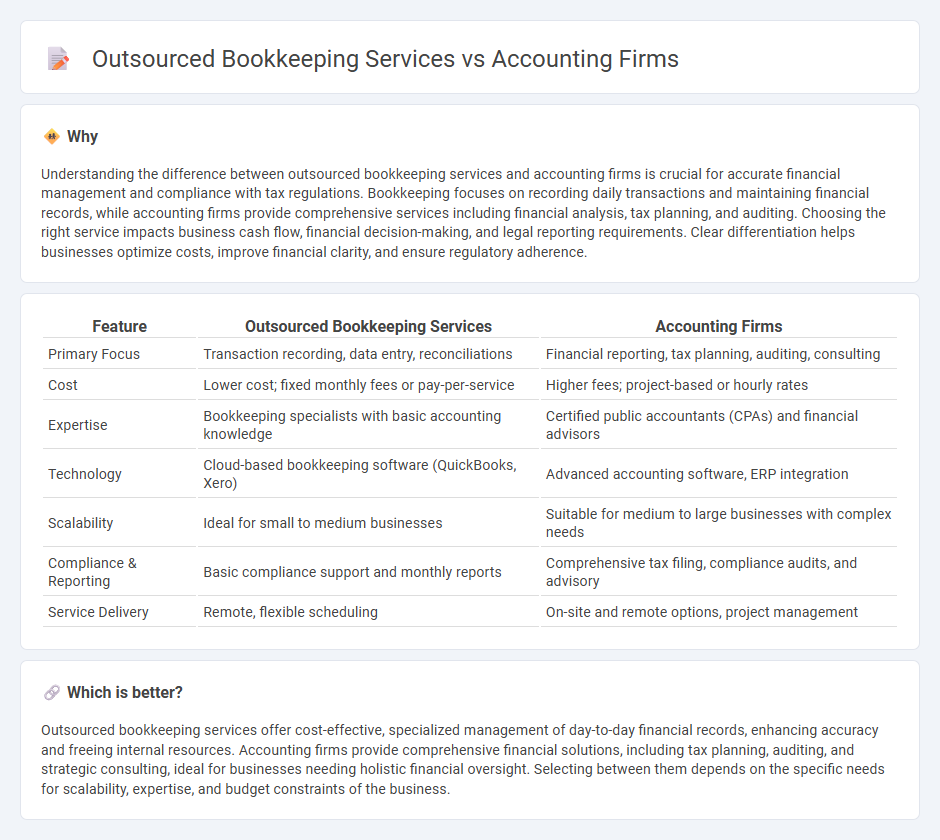

Understanding the difference between outsourced bookkeeping services and accounting firms is crucial for accurate financial management and compliance with tax regulations. Bookkeeping focuses on recording daily transactions and maintaining financial records, while accounting firms provide comprehensive services including financial analysis, tax planning, and auditing. Choosing the right service impacts business cash flow, financial decision-making, and legal reporting requirements. Clear differentiation helps businesses optimize costs, improve financial clarity, and ensure regulatory adherence.

Comparison Table

| Feature | Outsourced Bookkeeping Services | Accounting Firms |

|---|---|---|

| Primary Focus | Transaction recording, data entry, reconciliations | Financial reporting, tax planning, auditing, consulting |

| Cost | Lower cost; fixed monthly fees or pay-per-service | Higher fees; project-based or hourly rates |

| Expertise | Bookkeeping specialists with basic accounting knowledge | Certified public accountants (CPAs) and financial advisors |

| Technology | Cloud-based bookkeeping software (QuickBooks, Xero) | Advanced accounting software, ERP integration |

| Scalability | Ideal for small to medium businesses | Suitable for medium to large businesses with complex needs |

| Compliance & Reporting | Basic compliance support and monthly reports | Comprehensive tax filing, compliance audits, and advisory |

| Service Delivery | Remote, flexible scheduling | On-site and remote options, project management |

Which is better?

Outsourced bookkeeping services offer cost-effective, specialized management of day-to-day financial records, enhancing accuracy and freeing internal resources. Accounting firms provide comprehensive financial solutions, including tax planning, auditing, and strategic consulting, ideal for businesses needing holistic financial oversight. Selecting between them depends on the specific needs for scalability, expertise, and budget constraints of the business.

Connection

Outsourced bookkeeping services provide specialized financial record-keeping that complements the broader financial analysis and reporting tasks handled by accounting firms. Both entities collaborate to streamline financial processes, ensuring accuracy, compliance, and timely data for decision-making. Integration of outsourced bookkeeping with accounting firms enhances operational efficiency and supports scalable financial management solutions.

Key Terms

Audit

Accounting firms provide comprehensive audit services that ensure financial statements comply with regulatory standards and offer in-depth risk assessment to enhance business transparency. Outsourced bookkeeping services primarily manage day-to-day financial record-keeping without the specialized audit expertise or regulatory compliance focus found in accounting firms. Explore how partnering with professional accounting firms can deliver superior audit assurance and financial oversight tailored to your business needs.

Payroll Processing

Accounting firms typically offer comprehensive payroll processing services, including tax filing, compliance management, and employee payment administration, ensuring accuracy and adherence to regulations. Outsourced bookkeeping services often provide basic payroll support that may specialize in data entry and record maintenance but might lack the full spectrum of compliance expertise found in accounting firms. Explore the differences in payroll processing solutions to determine the best fit for your business needs.

Financial Statement Preparation

Accounting firms specialize in comprehensive financial statement preparation, ensuring compliance with GAAP and providing detailed analysis for stakeholders, while outsourced bookkeeping services primarily handle transactional record-keeping and data entry. Financial statements prepared by accounting firms include audited and reviewed reports that support strategic decision-making and investor relations. Discover how partnering with expert accounting firms enhances financial accuracy and business insights.

Source and External Links

Top 10 Accounting Firms in Chicago - Webgility - Lists and compares the leading accounting firms in Chicago, highlighting services, strengths, and pricing for large organizations.

The Big 4 Accounting Firms - The Complete Guide - Profiles Deloitte, EY, PwC, and KPMG, outlining their dominance in the industry, service offerings, and industry outlook.

IPA | Rankings of INSIDE Public Accounting's Top 500 CPA Firms - Provides annual rankings of the largest CPA firms in the U.S. by net revenue, with analysis of growth, profitability, and trends.

dowidth.com

dowidth.com