Continuous close accounting maintains real-time financial records by integrating transactions immediately, enhancing accuracy and decision-making speed. Soft close, on the other hand, allows for periodic adjustments and reconciliations within a specific timeframe before finalizing accounts, offering flexibility in reporting. Explore how each method impacts your financial reporting efficiency and compliance by learning more about their unique advantages.

Why it is important

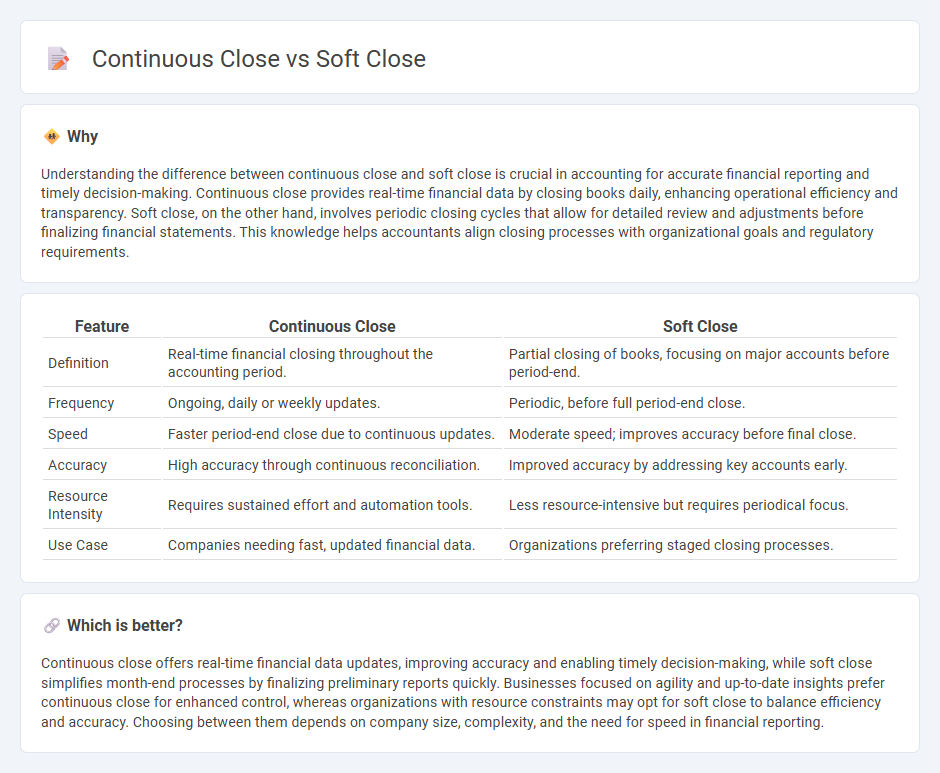

Understanding the difference between continuous close and soft close is crucial in accounting for accurate financial reporting and timely decision-making. Continuous close provides real-time financial data by closing books daily, enhancing operational efficiency and transparency. Soft close, on the other hand, involves periodic closing cycles that allow for detailed review and adjustments before finalizing financial statements. This knowledge helps accountants align closing processes with organizational goals and regulatory requirements.

Comparison Table

| Feature | Continuous Close | Soft Close |

|---|---|---|

| Definition | Real-time financial closing throughout the accounting period. | Partial closing of books, focusing on major accounts before period-end. |

| Frequency | Ongoing, daily or weekly updates. | Periodic, before full period-end close. |

| Speed | Faster period-end close due to continuous updates. | Moderate speed; improves accuracy before final close. |

| Accuracy | High accuracy through continuous reconciliation. | Improved accuracy by addressing key accounts early. |

| Resource Intensity | Requires sustained effort and automation tools. | Less resource-intensive but requires periodical focus. |

| Use Case | Companies needing fast, updated financial data. | Organizations preferring staged closing processes. |

Which is better?

Continuous close offers real-time financial data updates, improving accuracy and enabling timely decision-making, while soft close simplifies month-end processes by finalizing preliminary reports quickly. Businesses focused on agility and up-to-date insights prefer continuous close for enhanced control, whereas organizations with resource constraints may opt for soft close to balance efficiency and accuracy. Choosing between them depends on company size, complexity, and the need for speed in financial reporting.

Connection

Continuous close in accounting involves ongoing transaction recording and real-time financial statement updates, enabling faster month-end reporting. Soft close refers to preliminary financial closing activities performed before the actual period-end close, facilitating issue identification and adjustments. Together, they streamline the financial close process by improving accuracy and reducing the time required to finalize financial statements.

Key Terms

Period-End Processing

Soft close and continuous close are key strategies in period-end processing, with soft close involving a preliminary accounting lock to finalize most transactions before the official close, reducing last-minute adjustments. Continuous close maintains real-time transaction finality throughout the period, minimizing closing workload and enhancing financial accuracy and timeliness. Explore detailed comparisons and implementation benefits to optimize your period-end financial cycles.

Real-Time Reporting

Soft close in real-time reporting allows incremental data updates without halting operations, enabling timely financial insights and improved decision-making. Continuous close automates the consolidation of records, ensuring the most current information is always available and reducing the risk of errors. Explore the advantages of soft close and continuous close for enhancing your real-time financial reporting accuracy and efficiency.

Interim Financial Statements

Interim Financial Statements require accurate reflection of a company's financial position, where soft close methods help by temporarily settling accounts for reporting without finalizing all transactions, ensuring timely and flexible reporting. Continuous close enables real-time data updates, integrating daily transaction processing to maintain up-to-date interim statements, improving accuracy and decision-making speed. Explore how these closing methods impact financial transparency and reporting efficiency by learning more about their application in interim periods.

Source and External Links

What Are Soft-Close Hinges and How Do They Work? - Soft-close hinges use a dampening mechanism to absorb excess closing force, allowing doors to close quietly and slowly without slamming, thereby reducing noise and protecting surfaces from damage.

Soft-Close vs. Self-Close Hinges: What's the Difference? - Soft-close cabinet door hinges catch the door a few inches before fully closed, using a hydraulic damper to gently slow and quiet the closing action, even if the door is pushed shut with force.

Soft-Close Hinges - Soft-close mechanisms are integrated directly into the hinge, providing a clean look and ensuring cabinet doors close slowly and silently without slamming, regardless of hinge style or door type.

dowidth.com

dowidth.com