Triple entry accounting enhances transparency by incorporating a cryptographic receipt for every transaction, creating an immutable ledger that reduces errors and fraud. Tax accounting focuses on preparing financial statements and records to comply with tax regulations, optimizing tax liabilities through accurate reporting. Explore the nuances between these accounting methods to understand their impact on financial integrity and compliance.

Why it is important

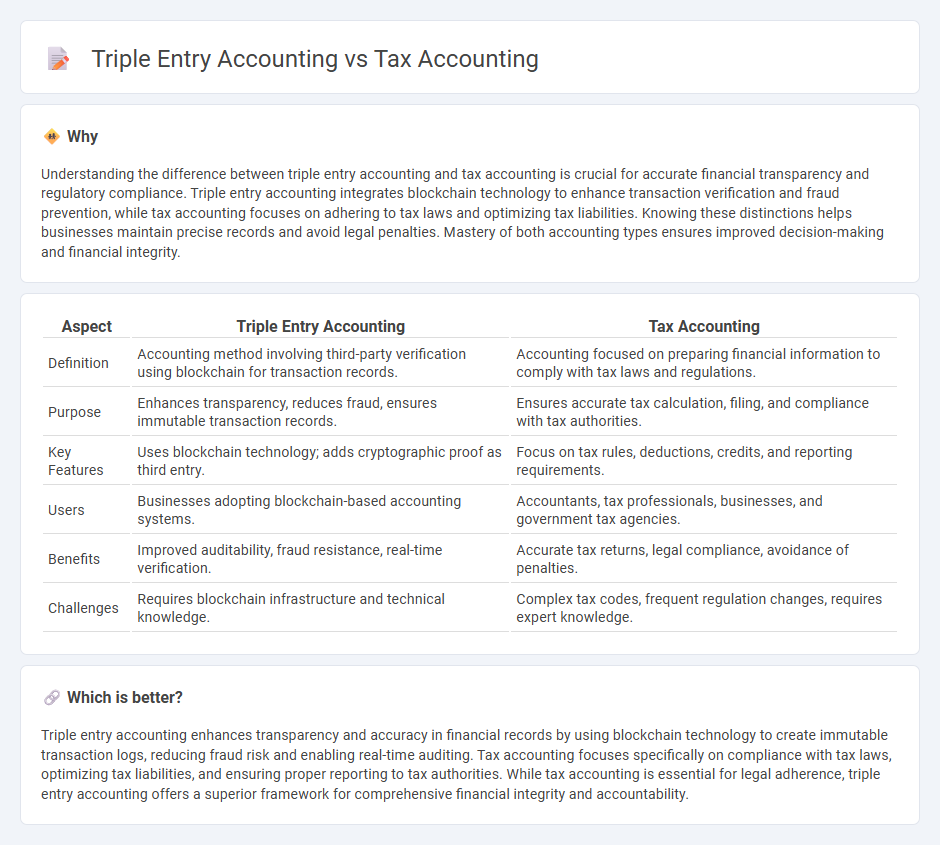

Understanding the difference between triple entry accounting and tax accounting is crucial for accurate financial transparency and regulatory compliance. Triple entry accounting integrates blockchain technology to enhance transaction verification and fraud prevention, while tax accounting focuses on adhering to tax laws and optimizing tax liabilities. Knowing these distinctions helps businesses maintain precise records and avoid legal penalties. Mastery of both accounting types ensures improved decision-making and financial integrity.

Comparison Table

| Aspect | Triple Entry Accounting | Tax Accounting |

|---|---|---|

| Definition | Accounting method involving third-party verification using blockchain for transaction records. | Accounting focused on preparing financial information to comply with tax laws and regulations. |

| Purpose | Enhances transparency, reduces fraud, ensures immutable transaction records. | Ensures accurate tax calculation, filing, and compliance with tax authorities. |

| Key Features | Uses blockchain technology; adds cryptographic proof as third entry. | Focus on tax rules, deductions, credits, and reporting requirements. |

| Users | Businesses adopting blockchain-based accounting systems. | Accountants, tax professionals, businesses, and government tax agencies. |

| Benefits | Improved auditability, fraud resistance, real-time verification. | Accurate tax returns, legal compliance, avoidance of penalties. |

| Challenges | Requires blockchain infrastructure and technical knowledge. | Complex tax codes, frequent regulation changes, requires expert knowledge. |

Which is better?

Triple entry accounting enhances transparency and accuracy in financial records by using blockchain technology to create immutable transaction logs, reducing fraud risk and enabling real-time auditing. Tax accounting focuses specifically on compliance with tax laws, optimizing tax liabilities, and ensuring proper reporting to tax authorities. While tax accounting is essential for legal adherence, triple entry accounting offers a superior framework for comprehensive financial integrity and accountability.

Connection

Triple entry accounting enhances tax accounting accuracy by creating a blockchain-based transaction record that ensures data integrity and transparency. This system reduces errors and fraud risk in tax reporting, providing a verifiable audit trail for tax authorities. Integrating triple entry accounting with tax accounting streamlines compliance and improves trust between businesses and tax regulators.

Key Terms

**Tax accounting:**

Tax accounting primarily involves recording, analyzing, and reporting financial transactions to comply with tax laws and regulations set by authorities like the IRS. It ensures accurate calculation of taxable income, proper documentation of deductions, credits, and tax liabilities specific to different jurisdictions and business structures. Explore in-depth insights and comparisons to understand how tax accounting streamlines compliance and financial planning.

Compliance

Tax accounting ensures adherence to tax laws by accurately recording income, expenses, and deductions for filing returns, ensuring compliance with regulatory requirements. Triple entry accounting introduces an immutable blockchain-based ledger that enhances transparency and auditability, reducing errors and fraud in financial reporting. Explore how these systems optimize compliance and transform tax practices.

Deductions

Tax accounting prioritizes accurately identifying and documenting deductible expenses to minimize taxable income and comply with IRS regulations. Triple-entry accounting enhances transparency and fraud prevention by recording transactions in three separate ledgers, ensuring deductions are verified across multiple records. Explore how each method impacts your business deductions and tax strategy in detail.

Source and External Links

Tax Accounting | Definition, Types & Examples - Study.com - Tax accounting is a specialized field focused on minimizing tax liability and ensuring compliance with tax laws for individuals and businesses, distinct from financial accounting by its focus on tax code rules and preparation of tax returns.

Tax Accountant Careers - Tax accountants prepare tax filings, advise clients on tax strategies, analyze financial data for tax efficiency, and stay updated on tax law changes to optimize clients' tax obligations.

What Is a Tax Accountant? - TurboTax Tax Tips & Videos - Intuit - A tax accountant specializes in tax filing, planning, and compliance services, helping individuals and businesses reduce tax liability, manage payments, and navigate audits through professional expertise and certifications.

dowidth.com

dowidth.com