Digital asset reporting involves tracking and managing financial information related to cryptocurrencies and other blockchain-based assets, emphasizing transparency and real-time verification. Cloud-based reporting leverages remote servers to streamline data processing and storage, enabling scalable, accessible, and collaborative financial reporting solutions. Explore the advantages and challenges of each approach to optimize your accounting strategies.

Why it is important

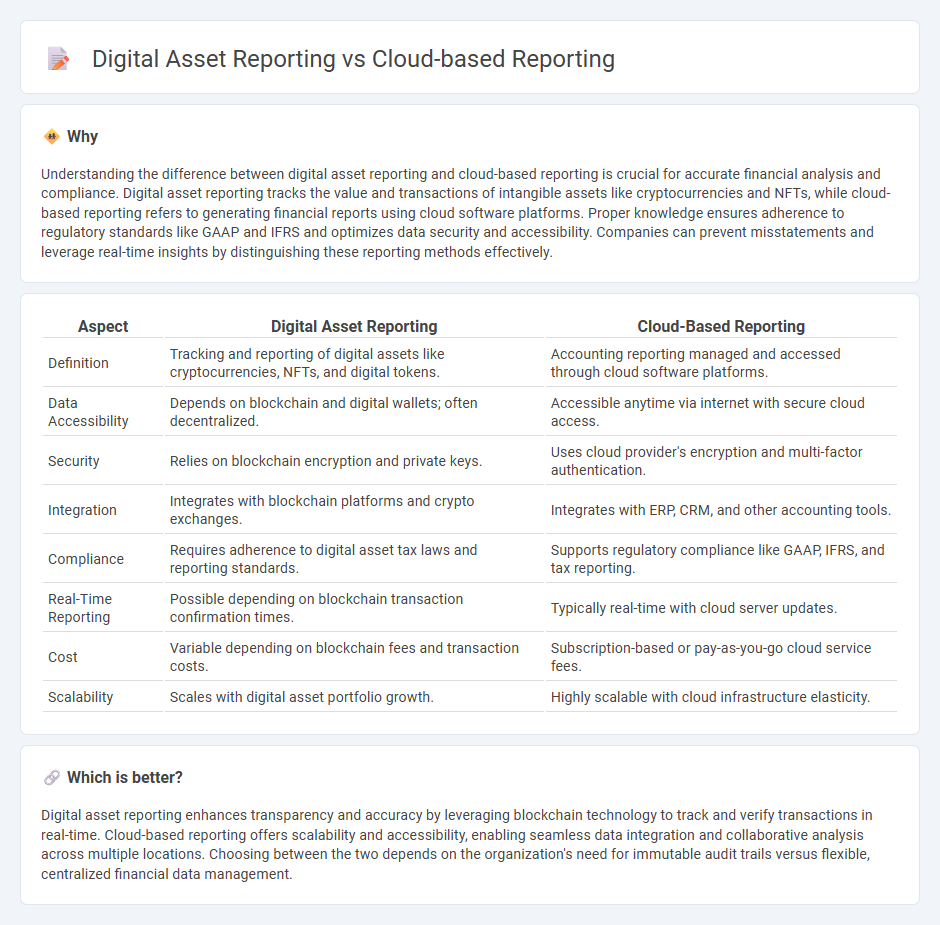

Understanding the difference between digital asset reporting and cloud-based reporting is crucial for accurate financial analysis and compliance. Digital asset reporting tracks the value and transactions of intangible assets like cryptocurrencies and NFTs, while cloud-based reporting refers to generating financial reports using cloud software platforms. Proper knowledge ensures adherence to regulatory standards like GAAP and IFRS and optimizes data security and accessibility. Companies can prevent misstatements and leverage real-time insights by distinguishing these reporting methods effectively.

Comparison Table

| Aspect | Digital Asset Reporting | Cloud-Based Reporting |

|---|---|---|

| Definition | Tracking and reporting of digital assets like cryptocurrencies, NFTs, and digital tokens. | Accounting reporting managed and accessed through cloud software platforms. |

| Data Accessibility | Depends on blockchain and digital wallets; often decentralized. | Accessible anytime via internet with secure cloud access. |

| Security | Relies on blockchain encryption and private keys. | Uses cloud provider's encryption and multi-factor authentication. |

| Integration | Integrates with blockchain platforms and crypto exchanges. | Integrates with ERP, CRM, and other accounting tools. |

| Compliance | Requires adherence to digital asset tax laws and reporting standards. | Supports regulatory compliance like GAAP, IFRS, and tax reporting. |

| Real-Time Reporting | Possible depending on blockchain transaction confirmation times. | Typically real-time with cloud server updates. |

| Cost | Variable depending on blockchain fees and transaction costs. | Subscription-based or pay-as-you-go cloud service fees. |

| Scalability | Scales with digital asset portfolio growth. | Highly scalable with cloud infrastructure elasticity. |

Which is better?

Digital asset reporting enhances transparency and accuracy by leveraging blockchain technology to track and verify transactions in real-time. Cloud-based reporting offers scalability and accessibility, enabling seamless data integration and collaborative analysis across multiple locations. Choosing between the two depends on the organization's need for immutable audit trails versus flexible, centralized financial data management.

Connection

Digital asset reporting increasingly relies on cloud-based reporting platforms to ensure real-time data accuracy, enhanced security, and streamlined consolidation of diverse financial assets. Cloud technology facilitates automated data integration and scalable storage necessary for handling complex digital asset transactions and regulatory compliance. This connectivity improves transparency and auditability, crucial for accurate financial accounting and reporting in the evolving digital asset landscape.

Key Terms

Data Integration

Cloud-based reporting excels in data integration by aggregating real-time information from multiple sources, enabling seamless access across platforms and enhancing data accuracy. Digital asset reporting primarily emphasizes tracking and managing digital content but may face challenges in integrating diverse data formats and sources effectively. Explore how advanced data integration techniques can optimize both cloud-based and digital asset reporting systems for more comprehensive insights.

Real-time Analytics

Cloud-based reporting offers scalable infrastructure enabling real-time data processing and instantaneous analytics across distributed sources, enhancing decision-making speed. Digital asset reporting focuses on tracking, managing, and analyzing digital assets with real-time updates to optimize asset utilization and performance. Explore deeper insights into how real-time analytics transforms cloud-based and digital asset reporting strategies.

Security Compliance

Cloud-based reporting platforms leverage advanced encryption protocols and centralized data governance to enhance security compliance, ensuring real-time monitoring and incident response capabilities. In contrast, digital asset reporting depends heavily on blockchain technology to provide immutable records and transparent audit trails, strengthening compliance with regulatory standards. Explore detailed comparisons to determine which reporting method best aligns with your organization's security compliance requirements.

Source and External Links

10 Best Cloud Reporting Tools in 2025 - Cloud-based reporting collects, analyzes, and visualizes business data through cloud environments, offering benefits like increased accessibility, scalability, cost savings, improved security, and enhanced efficiency for better decision-making.

What is Cloud Reporting? - Cloud reporting involves hosting report-authoring tools and data sources in the cloud, allowing users to access reports via web browsers with scalable services, multilayered security, and simplified collaboration for financial and operational reporting.

The 15 Best Cloud Reporting Tools To Consider In 2025 - Cloud reporting differs from traditional methods by providing real-time insights, reducing software maintenance costs, enabling pay-as-you-go capabilities, improving collaboration, automating anomaly detection, and sharing dashboards easily.

dowidth.com

dowidth.com