Data lake reconciliation involves aggregating vast amounts of raw financial data from diverse sources into a centralized repository for comprehensive analysis and error detection. Transaction matching focuses specifically on identifying and resolving discrepancies between corresponding financial entries to ensure ledger accuracy. Explore the key differences and applications of these accounting processes to enhance financial integrity.

Why it is important

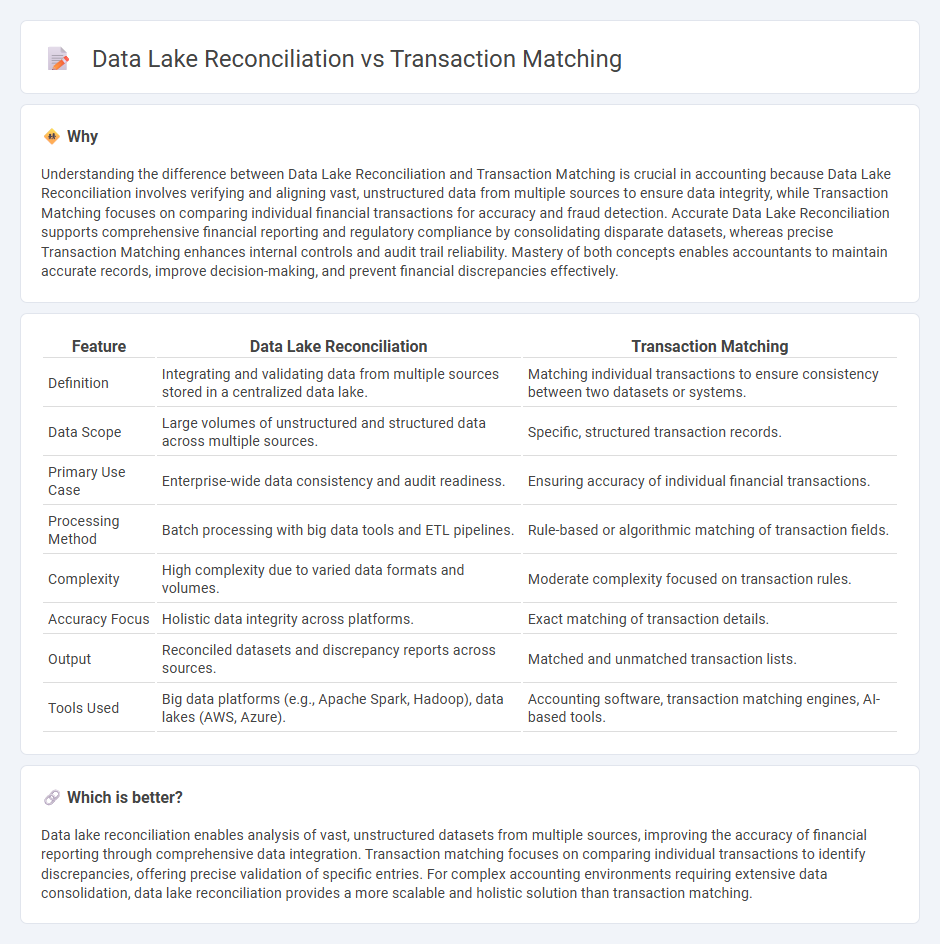

Understanding the difference between Data Lake Reconciliation and Transaction Matching is crucial in accounting because Data Lake Reconciliation involves verifying and aligning vast, unstructured data from multiple sources to ensure data integrity, while Transaction Matching focuses on comparing individual financial transactions for accuracy and fraud detection. Accurate Data Lake Reconciliation supports comprehensive financial reporting and regulatory compliance by consolidating disparate datasets, whereas precise Transaction Matching enhances internal controls and audit trail reliability. Mastery of both concepts enables accountants to maintain accurate records, improve decision-making, and prevent financial discrepancies effectively.

Comparison Table

| Feature | Data Lake Reconciliation | Transaction Matching |

|---|---|---|

| Definition | Integrating and validating data from multiple sources stored in a centralized data lake. | Matching individual transactions to ensure consistency between two datasets or systems. |

| Data Scope | Large volumes of unstructured and structured data across multiple sources. | Specific, structured transaction records. |

| Primary Use Case | Enterprise-wide data consistency and audit readiness. | Ensuring accuracy of individual financial transactions. |

| Processing Method | Batch processing with big data tools and ETL pipelines. | Rule-based or algorithmic matching of transaction fields. |

| Complexity | High complexity due to varied data formats and volumes. | Moderate complexity focused on transaction rules. |

| Accuracy Focus | Holistic data integrity across platforms. | Exact matching of transaction details. |

| Output | Reconciled datasets and discrepancy reports across sources. | Matched and unmatched transaction lists. |

| Tools Used | Big data platforms (e.g., Apache Spark, Hadoop), data lakes (AWS, Azure). | Accounting software, transaction matching engines, AI-based tools. |

Which is better?

Data lake reconciliation enables analysis of vast, unstructured datasets from multiple sources, improving the accuracy of financial reporting through comprehensive data integration. Transaction matching focuses on comparing individual transactions to identify discrepancies, offering precise validation of specific entries. For complex accounting environments requiring extensive data consolidation, data lake reconciliation provides a more scalable and holistic solution than transaction matching.

Connection

Data lake reconciliation enhances accounting accuracy by consolidating diverse financial data into a centralized repository, enabling efficient transaction matching through automated comparison of records. Transaction matching verifies the consistency between accounts payable and receivable, reducing discrepancies and ensuring compliance with financial reporting standards. Integrating data lake reconciliation with transaction matching streamlines audit processes, minimizes errors, and improves real-time financial analysis for informed decision-making.

Key Terms

Source-to-Target Mapping

Transaction matching ensures accurate pairing of financial records by directly comparing source entries to target accounts, maximizing data integrity and reducing reconciliation errors. Data lake reconciliation aggregates vast, diverse datasets from multiple origins, enabling comprehensive source-to-target mapping through unified schemas and metadata management. Explore the nuances of source-to-target mapping in transaction matching and data lake reconciliation to optimize your financial data management strategies.

Data Consistency

Transaction matching ensures data consistency by directly comparing individual transactions across systems to identify discrepancies and resolve errors, maintaining precise alignment of financial records. Data lake reconciliation aggregates vast volumes of heterogeneous data, using data lakes to centralize and harmonize records from multiple sources, enabling comprehensive consistency checks at scale. Discover how advanced techniques blend transaction matching with data lake reconciliation for robust data consistency management.

Exception Handling

Transaction matching automates the identification of corresponding entries across datasets, reducing manual errors during exception handling in financial operations. Data lake reconciliation aggregates vast, diverse data, enabling complex exception detection by cross-referencing unstructured and structured information in near real-time. Explore how advanced exception handling techniques optimize accuracy and efficiency in both transaction matching and data lake reconciliation processes.

Source and External Links

What is Transaction Matching? | Trintech - Transaction matching involves comparing multiple data sources to ensure accurate recording of events, supporting various types of matches and common use cases like bank reconciliation and intercompany reconciliations.

Setting Up and Configuring Account Reconciliation - Oracle's transaction matching automates complex reconciliations by loading transactions from multiple sources, matching them using predefined rules, and identifying exceptions for further analysis.

What is Transaction Matching? - SolveXia - Transaction matching is a process that compares transactions from different data sources to identify discrepancies, involving steps like data integration, rule application, exception management, and reporting.

dowidth.com

dowidth.com