Fair value measurement reflects the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, providing a market-based valuation. Replacement cost represents the current cost to replace an asset with a similar one, focusing on the cost to acquire equivalent resources rather than market conditions. Explore the nuances of fair value measurement and replacement cost to understand their impact on financial reporting and decision-making.

Why it is important

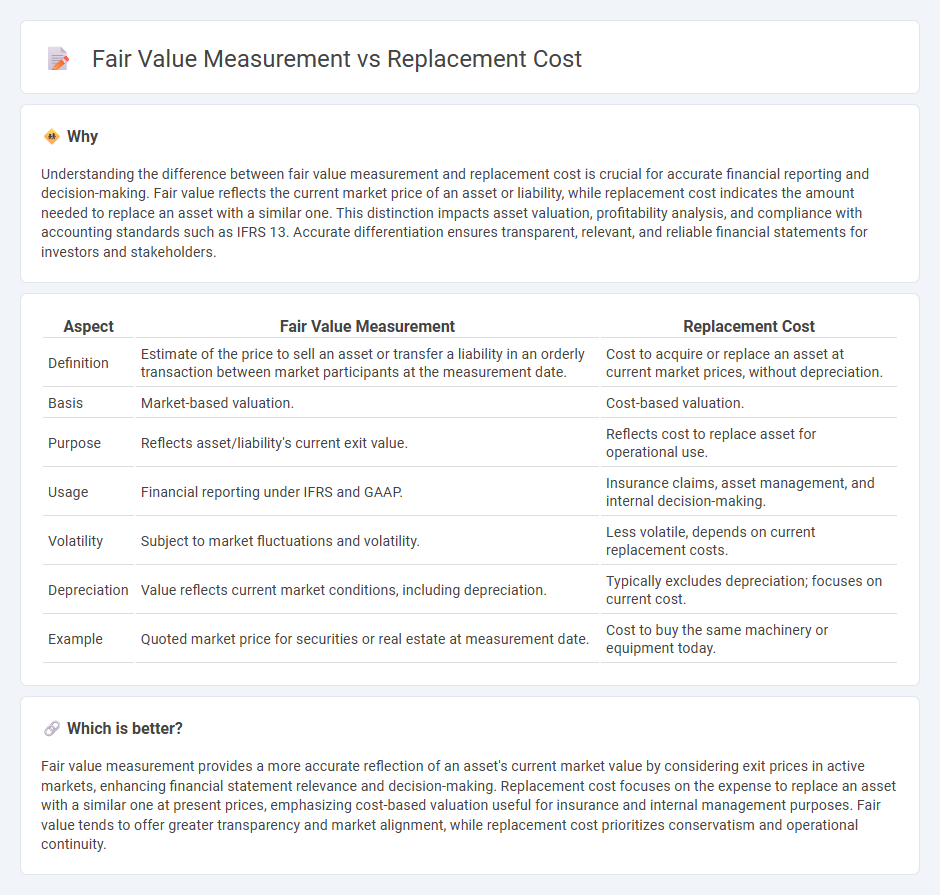

Understanding the difference between fair value measurement and replacement cost is crucial for accurate financial reporting and decision-making. Fair value reflects the current market price of an asset or liability, while replacement cost indicates the amount needed to replace an asset with a similar one. This distinction impacts asset valuation, profitability analysis, and compliance with accounting standards such as IFRS 13. Accurate differentiation ensures transparent, relevant, and reliable financial statements for investors and stakeholders.

Comparison Table

| Aspect | Fair Value Measurement | Replacement Cost |

|---|---|---|

| Definition | Estimate of the price to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date. | Cost to acquire or replace an asset at current market prices, without depreciation. |

| Basis | Market-based valuation. | Cost-based valuation. |

| Purpose | Reflects asset/liability's current exit value. | Reflects cost to replace asset for operational use. |

| Usage | Financial reporting under IFRS and GAAP. | Insurance claims, asset management, and internal decision-making. |

| Volatility | Subject to market fluctuations and volatility. | Less volatile, depends on current replacement costs. |

| Depreciation | Value reflects current market conditions, including depreciation. | Typically excludes depreciation; focuses on current cost. |

| Example | Quoted market price for securities or real estate at measurement date. | Cost to buy the same machinery or equipment today. |

Which is better?

Fair value measurement provides a more accurate reflection of an asset's current market value by considering exit prices in active markets, enhancing financial statement relevance and decision-making. Replacement cost focuses on the expense to replace an asset with a similar one at present prices, emphasizing cost-based valuation useful for insurance and internal management purposes. Fair value tends to offer greater transparency and market alignment, while replacement cost prioritizes conservatism and operational continuity.

Connection

Fair value measurement and replacement cost are interconnected through their focus on asset valuation in accounting. Fair value represents the price at which an asset could be exchanged in an orderly transaction between market participants, while replacement cost estimates the current cost to replace an asset with a similar one. Both methods reflect market conditions and aim to provide relevant, up-to-date measures for accurate financial reporting and asset assessment.

Key Terms

Current Replacement Cost

Current Replacement Cost (CRC) represents the expense incurred to replace an asset with a similar one at present market prices, emphasizing the cost aspect rather than market value fluctuations. Unlike fair value measurement, which reflects the price an asset would fetch in an orderly market transaction, CRC focuses strictly on the cost to replace, excluding other market-based considerations. Explore more about the distinctions and applications of replacement cost versus fair value to enhance your asset valuation strategies.

Market Value

Replacement cost measures asset value based on the expense to replace it, emphasizing current market prices for equivalent goods or services. Fair value measurement reflects the price received to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date, often incorporating market value but adjusted for condition and utility. Explore comprehensive differences and applications of market value in financial reporting to enhance asset valuation understanding.

Observable Inputs

Replacement cost measurement relies primarily on observable inputs such as current market prices for identical or similar assets to determine the cost required to replace an asset. Fair value measurement prioritizes observable inputs within a three-level hierarchy, emphasizing market-based inputs, including quoted prices in active markets, to estimate an asset's exit price. Explore more about how these measurement bases impact financial reporting and decision-making.

Source and External Links

What Is Replacement Cost? - Lemonade Insurance - Replacement cost is the estimated amount to replace or repair an item damaged or stolen with a similar one today, reflecting the current market price without depreciation, unlike actual cash value which factors in depreciation.

Replacement Cost (Real Estate) - Definition, Calculate - Replacement cost is the price to replace an existing asset, such as a building, with a similar asset at current prices, covering materials and labor but excluding costs like demolition and debris removal, often included in homeowner's insurance policies.

replacement cost (RC) - IRMI - Replacement cost is an insurance valuation method defining the cost to replace damaged property with materials of like kind and quality without deducting for depreciation.

dowidth.com

dowidth.com