Real-time auditing involves the immediate examination of financial transactions as they occur, enabling instant detection of discrepancies and errors. Continuous auditing employs automated processes to systematically assess financial data over a period, ensuring ongoing compliance and risk management. Explore the differences and benefits of these auditing methods to enhance your financial oversight.

Why it is important

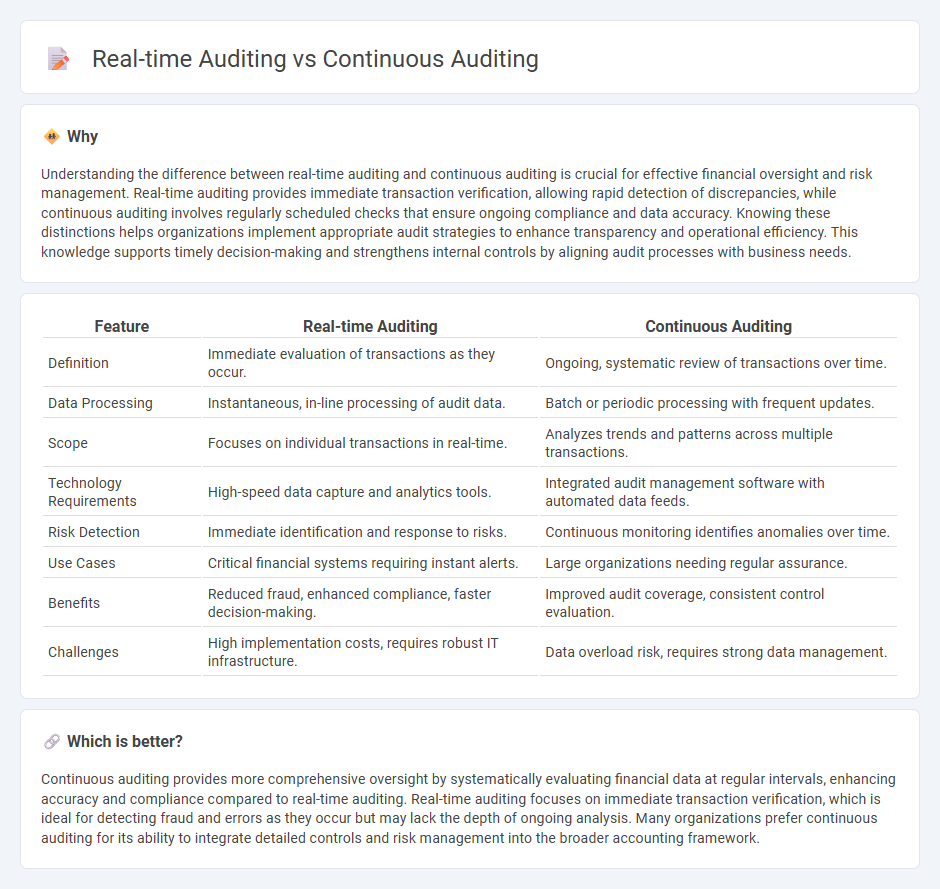

Understanding the difference between real-time auditing and continuous auditing is crucial for effective financial oversight and risk management. Real-time auditing provides immediate transaction verification, allowing rapid detection of discrepancies, while continuous auditing involves regularly scheduled checks that ensure ongoing compliance and data accuracy. Knowing these distinctions helps organizations implement appropriate audit strategies to enhance transparency and operational efficiency. This knowledge supports timely decision-making and strengthens internal controls by aligning audit processes with business needs.

Comparison Table

| Feature | Real-time Auditing | Continuous Auditing |

|---|---|---|

| Definition | Immediate evaluation of transactions as they occur. | Ongoing, systematic review of transactions over time. |

| Data Processing | Instantaneous, in-line processing of audit data. | Batch or periodic processing with frequent updates. |

| Scope | Focuses on individual transactions in real-time. | Analyzes trends and patterns across multiple transactions. |

| Technology Requirements | High-speed data capture and analytics tools. | Integrated audit management software with automated data feeds. |

| Risk Detection | Immediate identification and response to risks. | Continuous monitoring identifies anomalies over time. |

| Use Cases | Critical financial systems requiring instant alerts. | Large organizations needing regular assurance. |

| Benefits | Reduced fraud, enhanced compliance, faster decision-making. | Improved audit coverage, consistent control evaluation. |

| Challenges | High implementation costs, requires robust IT infrastructure. | Data overload risk, requires strong data management. |

Which is better?

Continuous auditing provides more comprehensive oversight by systematically evaluating financial data at regular intervals, enhancing accuracy and compliance compared to real-time auditing. Real-time auditing focuses on immediate transaction verification, which is ideal for detecting fraud and errors as they occur but may lack the depth of ongoing analysis. Many organizations prefer continuous auditing for its ability to integrate detailed controls and risk management into the broader accounting framework.

Connection

Real-time auditing and continuous auditing are interconnected through their shared objective of providing immediate, ongoing evaluation of financial transactions and controls. Continuous auditing utilizes automated processes and data analytics to monitor financial activities in real time, enabling auditors to identify anomalies and risks without delay. This integration enhances accuracy and transparency in financial reporting while supporting proactive risk management strategies.

Key Terms

Automation

Continuous auditing harnesses automated tools to systematically evaluate financial and operational data at regular intervals, enhancing accuracy and reducing manual effort. Real-time auditing employs advanced automation technologies to provide instantaneous analysis and reporting, enabling immediate detection of anomalies and compliance issues. Discover how automation transforms auditing efficiency and accuracy in both approaches.

Data Timeliness

Continuous auditing processes data at regular intervals, ensuring timely detection of anomalies but with inherent time lags between audits. Real-time auditing offers instantaneous data analysis, enabling immediate identification of risks and compliance issues as transactions occur. Explore how integrating real-time auditing can enhance your organization's audit efficiency and data timeliness.

Monitoring Frequency

Continuous auditing employs scheduled, automated reviews at regular intervals to ensure ongoing compliance and timely detection of anomalies. Real-time auditing provides instantaneous monitoring and analysis of transactions, enabling immediate identification and resolution of risks. Explore detailed comparisons to understand how monitoring frequency impacts audit effectiveness.

Source and External Links

PwC Vietnam - Continuous Audit and Monitoring - Continuous auditing enables organizations to detect anomalies and risks in real-time by automating the analysis of transactional data, allowing for immediate investigation and remediation when issues are identified.

Journal of Accountancy - A framework for continuous auditing - Continuous auditing automates control and risk assessments on a frequent basis, enhancing traditional audit methods by providing ongoing, data-driven insights rather than relying solely on periodic sampling.

DataSnipper - Continuous Auditing: Advantages & Challenges - Continuous auditing leverages technology to provide auditors with comprehensive, near real-time reviews of all transactions, improving accuracy and enabling proactive risk management.

dowidth.com

dowidth.com