Real-time expense management leverages automated systems to capture and categorize expenditures instantly, enhancing accuracy and cash flow control. Digital audit trails provide a secure, chronological record of all financial transactions, ensuring transparency and compliance with regulatory standards. Explore how integrating these technologies can revolutionize your accounting processes.

Why it is important

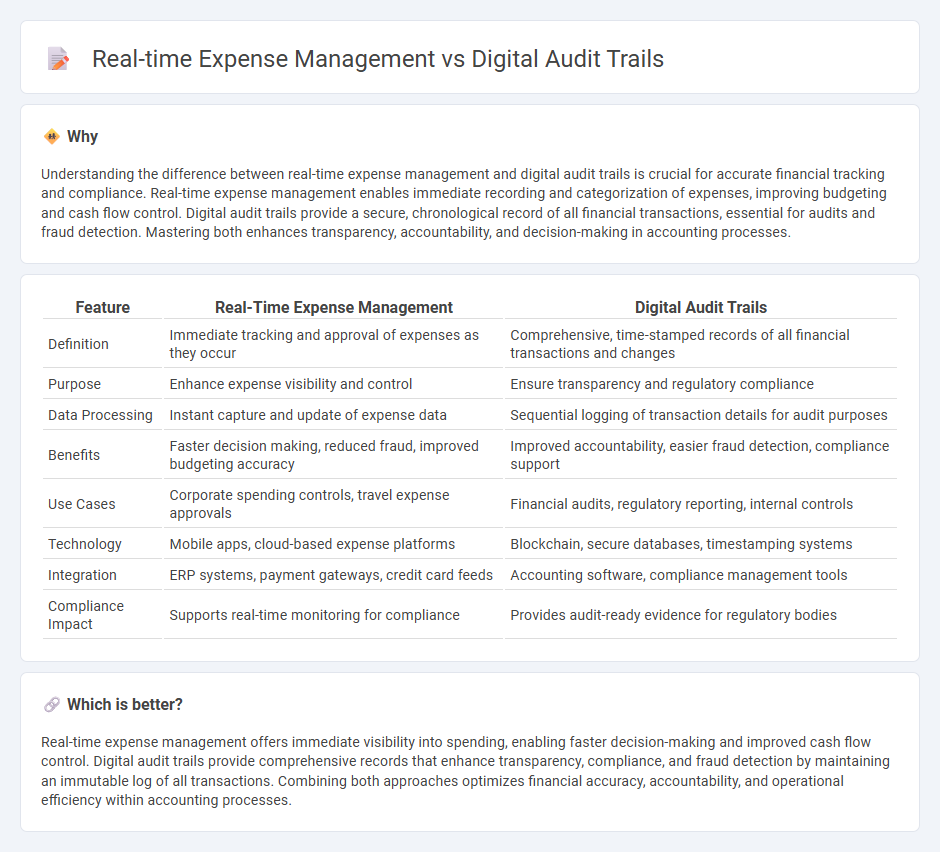

Understanding the difference between real-time expense management and digital audit trails is crucial for accurate financial tracking and compliance. Real-time expense management enables immediate recording and categorization of expenses, improving budgeting and cash flow control. Digital audit trails provide a secure, chronological record of all financial transactions, essential for audits and fraud detection. Mastering both enhances transparency, accountability, and decision-making in accounting processes.

Comparison Table

| Feature | Real-Time Expense Management | Digital Audit Trails |

|---|---|---|

| Definition | Immediate tracking and approval of expenses as they occur | Comprehensive, time-stamped records of all financial transactions and changes |

| Purpose | Enhance expense visibility and control | Ensure transparency and regulatory compliance |

| Data Processing | Instant capture and update of expense data | Sequential logging of transaction details for audit purposes |

| Benefits | Faster decision making, reduced fraud, improved budgeting accuracy | Improved accountability, easier fraud detection, compliance support |

| Use Cases | Corporate spending controls, travel expense approvals | Financial audits, regulatory reporting, internal controls |

| Technology | Mobile apps, cloud-based expense platforms | Blockchain, secure databases, timestamping systems |

| Integration | ERP systems, payment gateways, credit card feeds | Accounting software, compliance management tools |

| Compliance Impact | Supports real-time monitoring for compliance | Provides audit-ready evidence for regulatory bodies |

Which is better?

Real-time expense management offers immediate visibility into spending, enabling faster decision-making and improved cash flow control. Digital audit trails provide comprehensive records that enhance transparency, compliance, and fraud detection by maintaining an immutable log of all transactions. Combining both approaches optimizes financial accuracy, accountability, and operational efficiency within accounting processes.

Connection

Real-time expense management relies on digital audit trails to provide continuous, accurate tracking of financial transactions, enhancing transparency and compliance. Digital audit trails capture detailed records of expense approvals, modifications, and payments, enabling immediate detection of discrepancies and fraud. This seamless integration supports efficient financial reporting and regulatory adherence in accounting.

Key Terms

Traceability

Digital audit trails enhance traceability by providing a chronological record of all transactions, ensuring compliance and accountability in expense management systems. Real-time expense management enables immediate tracking and verification of expenses, reducing errors and preventing fraud through instant data capture and validation. Explore how integrating digital audit trails with real-time expense management can optimize financial transparency and control.

Automation

Digital audit trails enhance transparency by automatically recording every transaction, reducing errors and enabling seamless compliance. Real-time expense management leverages automation to instantly capture, categorize, and approve expenses, boosting operational efficiency and reducing processing time. Explore how integrating these automated systems can optimize financial workflows and compliance.

Compliance

Digital audit trails provide a comprehensive, immutable record of financial transactions essential for regulatory compliance and forensic investigations. Real-time expense management platforms optimize compliance by automating policy enforcement, instantaneously flagging discrepancies and reducing the risk of fraud. Discover how integrating these technologies enhances your organization's financial governance and compliance efforts.

Source and External Links

What Is A Digital Audit Trail? - A digital audit trail is an absolute, immutable log of every step, event, or action taken in a system, documenting what was done, by whom, and when, used for legal, compliance, or forensic purposes while protecting personal information.

How a Digital Audit Trail Helps with Authority Submissions - Digital audit trails provide systematic and chronological records of document changes and interactions, reducing errors, speeding approvals, and supporting compliance across sectors like construction, pharmaceuticals, finance, and clinical trials.

Electronic signature audit trails: A quick guide - Electronic signature audit trails offer a detailed chronological record including signer identity, timestamps, document history, and authentication to ensure the validity and security of digitally signed documents.

dowidth.com

dowidth.com