Crypto asset valuation requires real-time market data to reflect volatile prices, contrasting with the traditional accounting method of historical cost that records assets at their original purchase price. While historical cost ensures consistency and reliability, it may not capture the current economic value of digital currencies. Explore more about how evolving accounting standards address these challenges.

Why it is important

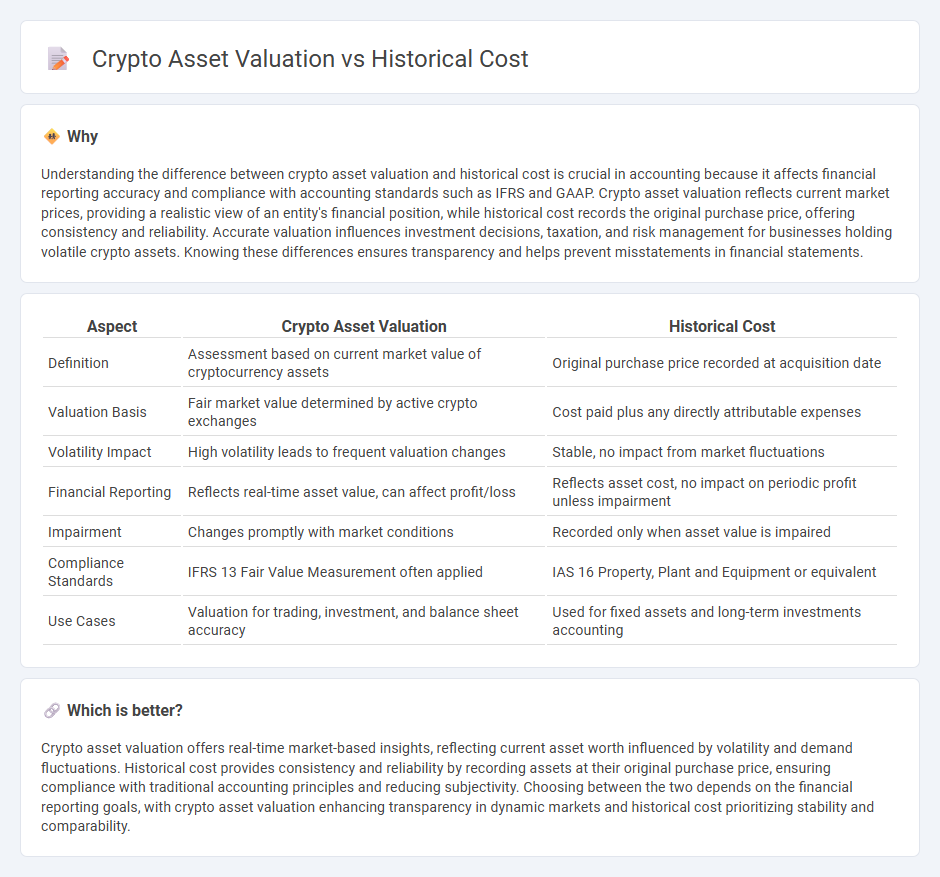

Understanding the difference between crypto asset valuation and historical cost is crucial in accounting because it affects financial reporting accuracy and compliance with accounting standards such as IFRS and GAAP. Crypto asset valuation reflects current market prices, providing a realistic view of an entity's financial position, while historical cost records the original purchase price, offering consistency and reliability. Accurate valuation influences investment decisions, taxation, and risk management for businesses holding volatile crypto assets. Knowing these differences ensures transparency and helps prevent misstatements in financial statements.

Comparison Table

| Aspect | Crypto Asset Valuation | Historical Cost |

|---|---|---|

| Definition | Assessment based on current market value of cryptocurrency assets | Original purchase price recorded at acquisition date |

| Valuation Basis | Fair market value determined by active crypto exchanges | Cost paid plus any directly attributable expenses |

| Volatility Impact | High volatility leads to frequent valuation changes | Stable, no impact from market fluctuations |

| Financial Reporting | Reflects real-time asset value, can affect profit/loss | Reflects asset cost, no impact on periodic profit unless impairment |

| Impairment | Changes promptly with market conditions | Recorded only when asset value is impaired |

| Compliance Standards | IFRS 13 Fair Value Measurement often applied | IAS 16 Property, Plant and Equipment or equivalent |

| Use Cases | Valuation for trading, investment, and balance sheet accuracy | Used for fixed assets and long-term investments accounting |

Which is better?

Crypto asset valuation offers real-time market-based insights, reflecting current asset worth influenced by volatility and demand fluctuations. Historical cost provides consistency and reliability by recording assets at their original purchase price, ensuring compliance with traditional accounting principles and reducing subjectivity. Choosing between the two depends on the financial reporting goals, with crypto asset valuation enhancing transparency in dynamic markets and historical cost prioritizing stability and comparability.

Connection

Crypto asset valuation often relies on historical cost as a foundational accounting principle, recording assets at their original purchase price. This method provides consistency and verifiability but may not reflect current market value amid crypto volatility. Financial statements must disclose both historical cost and fair value to ensure transparency and regulatory compliance in crypto asset reporting.

Key Terms

Fair Value

Historical cost valuation records crypto assets based on their original purchase price, reflecting actual transaction data without adjustments for market fluctuations. Fair value valuation assesses crypto assets at their current market price, offering a real-time snapshot that better captures volatility and investor sentiment in the rapidly changing crypto ecosystem. Explore the nuances of fair value accounting to better understand its impact on crypto asset reporting and investment decisions.

Impairment

Impairment in historical cost accounting requires crypto assets to be recorded at purchase price minus any accumulated impairment losses, reflecting a conservative approach that avoids recognizing unrealized gains. Crypto asset valuation under current fair value models often relies on market prices, allowing gains and losses to be recognized promptly but introducing volatility to financial statements. Explore further to understand the implications of impairment on financial reporting and investor decision-making in the evolving crypto landscape.

Volatility

Historical cost accounting records crypto assets at their original purchase price, ignoring market price fluctuations and leading to potentially outdated valuations. Crypto asset valuation based on fair value accounts for market volatility, reflecting real-time price changes but introducing earnings volatility and measurement challenges. Explore more about the impact of volatility on financial reporting and investment decisions in the crypto market.

Source and External Links

Historical cost definition - Historical cost is the original purchase price of an asset plus any costs incurred to bring it to usable condition, recorded at acquisition value and not adjusted upward, except when market value falls below the recorded cost, according to the historical cost principle.

Historical Cost - Overview, Example, Accounting Adjustment - Historical cost refers to the original monetary value or purchase price of an asset, recorded in the financial statements based on the cost principle that disallows adjustments for market fluctuations or inflation.

Historical cost - Historical cost accounting records asset values at the acquisition costs without updating for changes in market or economic conditions, providing verifiable but sometimes outdated values on financial statements; some accounting standards require disclosures of current values in notes.

dowidth.com

dowidth.com