Lease accounting software automates compliance with ASC 842, IFRS 16, and GASB 87 standards, reducing errors common in manual spreadsheet calculations. Spreadsheets, while flexible and familiar, often lack real-time data integration and robust audit trails necessary for complex lease portfolios. Explore how advanced lease accounting solutions can enhance accuracy and efficiency in your financial reporting.

Why it is important

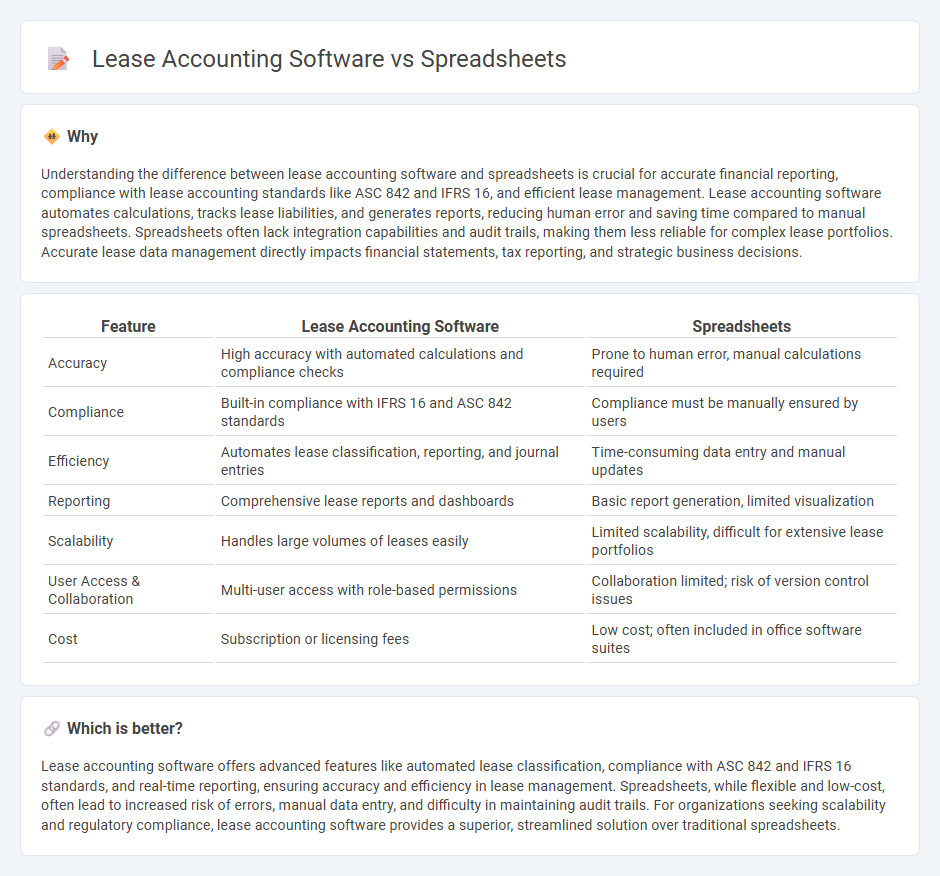

Understanding the difference between lease accounting software and spreadsheets is crucial for accurate financial reporting, compliance with lease accounting standards like ASC 842 and IFRS 16, and efficient lease management. Lease accounting software automates calculations, tracks lease liabilities, and generates reports, reducing human error and saving time compared to manual spreadsheets. Spreadsheets often lack integration capabilities and audit trails, making them less reliable for complex lease portfolios. Accurate lease data management directly impacts financial statements, tax reporting, and strategic business decisions.

Comparison Table

| Feature | Lease Accounting Software | Spreadsheets |

|---|---|---|

| Accuracy | High accuracy with automated calculations and compliance checks | Prone to human error, manual calculations required |

| Compliance | Built-in compliance with IFRS 16 and ASC 842 standards | Compliance must be manually ensured by users |

| Efficiency | Automates lease classification, reporting, and journal entries | Time-consuming data entry and manual updates |

| Reporting | Comprehensive lease reports and dashboards | Basic report generation, limited visualization |

| Scalability | Handles large volumes of leases easily | Limited scalability, difficult for extensive lease portfolios |

| User Access & Collaboration | Multi-user access with role-based permissions | Collaboration limited; risk of version control issues |

| Cost | Subscription or licensing fees | Low cost; often included in office software suites |

Which is better?

Lease accounting software offers advanced features like automated lease classification, compliance with ASC 842 and IFRS 16 standards, and real-time reporting, ensuring accuracy and efficiency in lease management. Spreadsheets, while flexible and low-cost, often lead to increased risk of errors, manual data entry, and difficulty in maintaining audit trails. For organizations seeking scalability and regulatory compliance, lease accounting software provides a superior, streamlined solution over traditional spreadsheets.

Connection

Lease accounting software integrates seamlessly with spreadsheets by exporting detailed lease data in compatible formats such as Excel, enabling advanced financial analysis and reporting. Spreadsheets allow customization and manipulation of lease schedules, while accounting software ensures compliance with ASC 842 and IFRS 16 standards. This connection enhances accuracy and efficiency in managing lease liabilities and right-of-use assets.

Key Terms

Data Entry

Spreadsheets require manual data entry, increasing the risk of errors and inefficiencies in managing lease accounting information. Lease accounting software automates data capture through integrations and templates, ensuring accuracy and compliance with ASC 842 and IFRS 16 standards. Explore the benefits of streamlined data entry by understanding how lease accounting software enhances accuracy and saves time.

Compliance

Lease accounting software ensures compliance with IFRS 16 and ASC 842 standards more effectively than traditional spreadsheets by automating lease data management and reducing human errors. It offers real-time reporting, audit trails, and comprehensive lease liability calculations critical for accurate financial statements. Explore how dedicated lease accounting tools can streamline compliance and enhance financial accuracy in your organization.

Automation

Lease accounting software automates complex calculations, compliance checks, and financial reporting processes that are time-consuming and error-prone in spreadsheets. With features like real-time data synchronization, automated lease classification, and lease liability tracking, software solutions significantly reduce manual effort and improve accuracy. Explore the advantages of automation in lease accounting to optimize your financial management practices.

Source and External Links

Spreadsheet - Spreadsheets are software applications that let users organize, analyze, and compute data in a tabular format, with automatic calculations based on cell content, supporting both numerical and text data.

Google Sheets on the App Store - Google Sheets allows users to create, edit, and collaborate on spreadsheets in real time, even offline, with automatic saving and seamless compatibility with Excel files.

Google Sheets: Online Spreadsheets & Templates - Google Sheets provides AI-powered features for generating tables, visualizations, and formulas, plus collaborative tools for real-time editing and version tracking.

dowidth.com

dowidth.com