Forensic accounting software specializes in detecting fraud, analyzing financial discrepancies, and supporting legal investigations by providing detailed transaction tracing and data analytics. Bookkeeping software focuses on recording daily financial transactions, maintaining ledgers, and generating standard financial reports to ensure accurate and organized business records. Explore the key features and benefits of each to determine the best fit for your financial management needs.

Why it is important

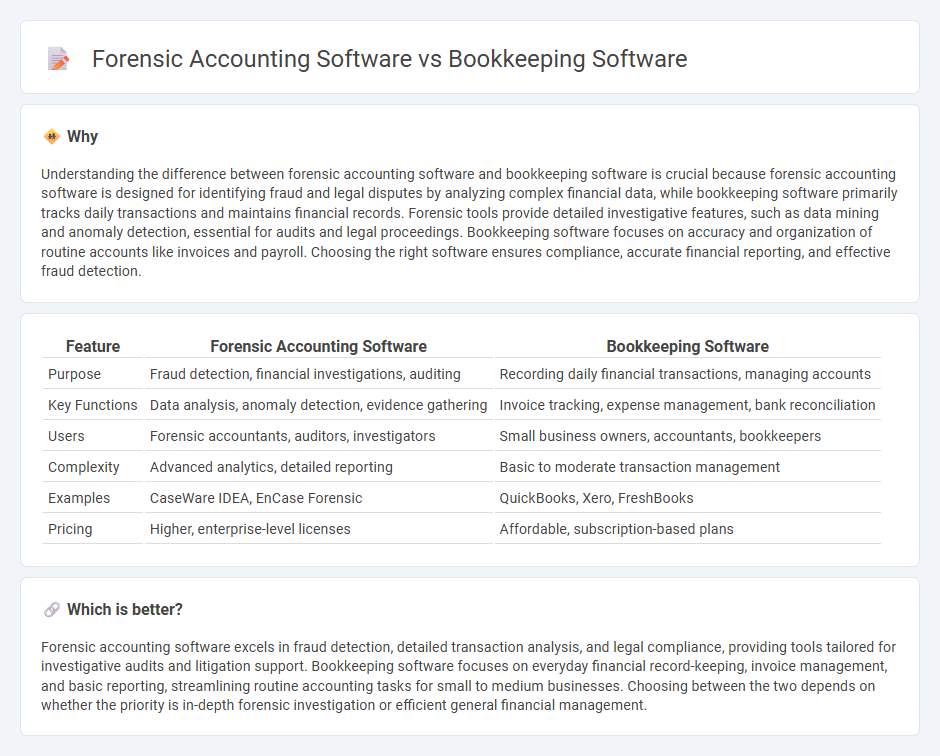

Understanding the difference between forensic accounting software and bookkeeping software is crucial because forensic accounting software is designed for identifying fraud and legal disputes by analyzing complex financial data, while bookkeeping software primarily tracks daily transactions and maintains financial records. Forensic tools provide detailed investigative features, such as data mining and anomaly detection, essential for audits and legal proceedings. Bookkeeping software focuses on accuracy and organization of routine accounts like invoices and payroll. Choosing the right software ensures compliance, accurate financial reporting, and effective fraud detection.

Comparison Table

| Feature | Forensic Accounting Software | Bookkeeping Software |

|---|---|---|

| Purpose | Fraud detection, financial investigations, auditing | Recording daily financial transactions, managing accounts |

| Key Functions | Data analysis, anomaly detection, evidence gathering | Invoice tracking, expense management, bank reconciliation |

| Users | Forensic accountants, auditors, investigators | Small business owners, accountants, bookkeepers |

| Complexity | Advanced analytics, detailed reporting | Basic to moderate transaction management |

| Examples | CaseWare IDEA, EnCase Forensic | QuickBooks, Xero, FreshBooks |

| Pricing | Higher, enterprise-level licenses | Affordable, subscription-based plans |

Which is better?

Forensic accounting software excels in fraud detection, detailed transaction analysis, and legal compliance, providing tools tailored for investigative audits and litigation support. Bookkeeping software focuses on everyday financial record-keeping, invoice management, and basic reporting, streamlining routine accounting tasks for small to medium businesses. Choosing between the two depends on whether the priority is in-depth forensic investigation or efficient general financial management.

Connection

Forensic accounting software and bookkeeping software are interconnected through their shared role in managing and analyzing financial data to ensure accuracy and detect discrepancies. Bookkeeping software records daily transactions and maintains organized financial records, providing a foundation for forensic accounting software to perform in-depth investigations, fraud detection, and compliance audits. Integrating these technologies enhances precision in financial reporting and strengthens the ability to uncover financial irregularities.

Key Terms

Automation

Bookkeeping software automates routine financial tasks such as data entry, invoice generation, and transaction categorization to improve efficiency and accuracy in everyday accounting processes. Forensic accounting software specializes in automating the detection, analysis, and reporting of financial discrepancies, fraud, and compliance issues using advanced algorithms and data analytics. Explore detailed comparisons to understand which software best meets your automation needs.

Audit trail

Bookkeeping software primarily maintains a comprehensive audit trail by recording all financial transactions systematically, ensuring traceability and compliance with accounting standards. Forensic accounting software enhances this capability by offering advanced features such as data analysis, fraud detection, and detailed audit trail reconstruction to support investigations and legal proceedings. Explore more to understand how each software type optimizes audit trail functionalities for different financial oversight needs.

Data analysis

Bookkeeping software primarily manages daily financial transactions, organizing data for accurate record-keeping and compliance, while forensic accounting software specializes in analyzing complex financial data to detect fraud, discrepancies, and legal irregularities. Forensic tools use advanced analytics, including pattern recognition and data mining techniques, to uncover hidden insights beyond routine bookkeeping scope. Explore detailed comparisons to understand how data analysis capabilities differ and which solution best fits your financial investigation needs.

Source and External Links

Free Accounting Tools for Small Businesses | CO - Sunrise and Freshbooks offer bookkeeping software solutions ideal for small businesses, with Sunrise providing free tools for transaction import and expense monitoring, and Freshbooks offering a 30-day free trial with invoicing and payment features.

Online Accounting Software for Your Small Business - Xero is cloud-based accounting software for small businesses that automates invoicing, bank transaction reconciliation, and reporting, helping manage cash flow and tax returns efficiently.

Akaunting: Free Accounting Software for Small Businesses - Akaunting provides free, open-source, cloud-based accounting software with tools for invoicing, expense tracking, and client portals, ensuring privacy and flexibility for small businesses and freelancers.

dowidth.com

dowidth.com