Outsourced bookkeeping services offer specialized financial record management with cost-effective scalability, ideal for small to medium-sized businesses lacking internal accounting resources. ERP accounting systems provide integrated, real-time financial data across departments, enhancing accuracy and decision-making for larger enterprises with complex workflows. Discover how each solution can optimize your financial operations and support your business growth.

Why it is important

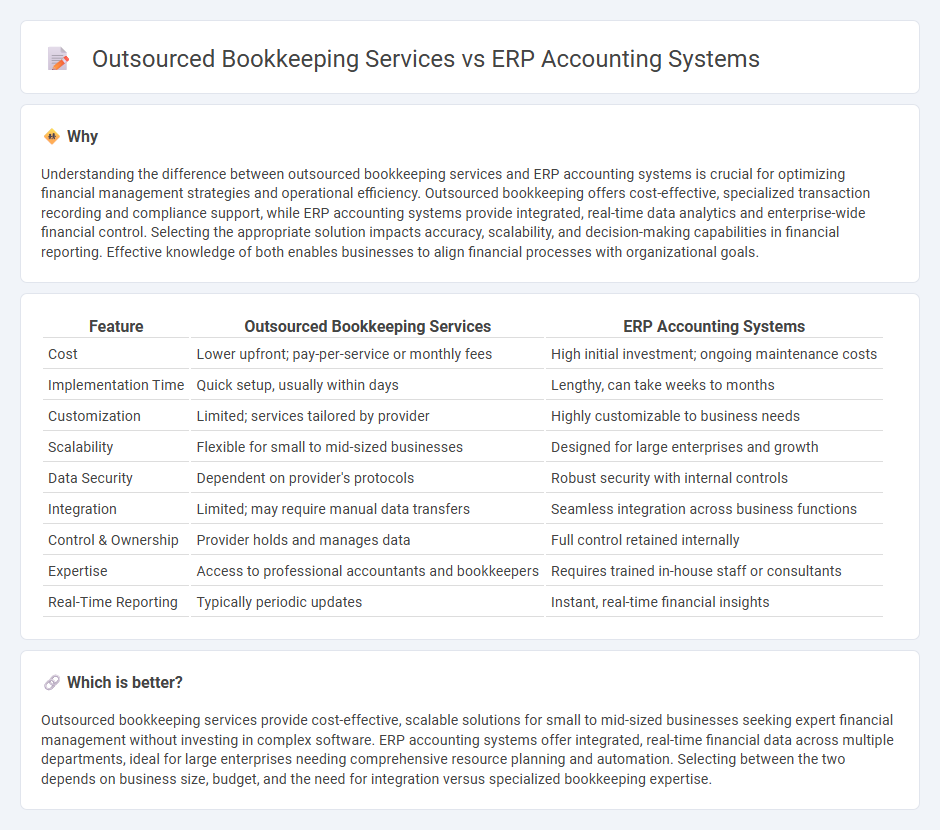

Understanding the difference between outsourced bookkeeping services and ERP accounting systems is crucial for optimizing financial management strategies and operational efficiency. Outsourced bookkeeping offers cost-effective, specialized transaction recording and compliance support, while ERP accounting systems provide integrated, real-time data analytics and enterprise-wide financial control. Selecting the appropriate solution impacts accuracy, scalability, and decision-making capabilities in financial reporting. Effective knowledge of both enables businesses to align financial processes with organizational goals.

Comparison Table

| Feature | Outsourced Bookkeeping Services | ERP Accounting Systems |

|---|---|---|

| Cost | Lower upfront; pay-per-service or monthly fees | High initial investment; ongoing maintenance costs |

| Implementation Time | Quick setup, usually within days | Lengthy, can take weeks to months |

| Customization | Limited; services tailored by provider | Highly customizable to business needs |

| Scalability | Flexible for small to mid-sized businesses | Designed for large enterprises and growth |

| Data Security | Dependent on provider's protocols | Robust security with internal controls |

| Integration | Limited; may require manual data transfers | Seamless integration across business functions |

| Control & Ownership | Provider holds and manages data | Full control retained internally |

| Expertise | Access to professional accountants and bookkeepers | Requires trained in-house staff or consultants |

| Real-Time Reporting | Typically periodic updates | Instant, real-time financial insights |

Which is better?

Outsourced bookkeeping services provide cost-effective, scalable solutions for small to mid-sized businesses seeking expert financial management without investing in complex software. ERP accounting systems offer integrated, real-time financial data across multiple departments, ideal for large enterprises needing comprehensive resource planning and automation. Selecting between the two depends on business size, budget, and the need for integration versus specialized bookkeeping expertise.

Connection

Outsourced bookkeeping services streamline data entry and financial record maintenance, feeding accurate information directly into ERP accounting systems to enhance real-time financial reporting and decision-making. These integrated solutions reduce manual errors and improve efficiency by automating transaction recording and reconciliation within ERP platforms like SAP or Oracle. Leveraging both outsourced bookkeeping and ERP systems enables businesses to maintain up-to-date financial data, supporting compliance, audit readiness, and strategic planning.

Key Terms

Integration

ERP accounting systems provide seamless integration across various business functions, enabling real-time financial data synchronization and enhanced reporting accuracy. Outsourced bookkeeping services often rely on external software, which can lead to challenges in data consistency and delayed updates due to lack of direct system integration. Discover how integration impacts financial management efficiency and decision-making by exploring detailed comparisons today.

Data Security

ERP accounting systems offer robust data security features such as encryption, role-based access controls, and real-time monitoring to protect sensitive financial information from cyber threats. Outsourced bookkeeping services rely on third-party providers, whose security measures can vary significantly, making it essential to evaluate their compliance with industry standards like SOC 2 or ISO 27001. Explore the key differences in data protection strategies to decide the best fit for your business needs.

Scalability

ERP accounting systems offer robust scalability by integrating various business functions into a single platform, supporting complex financial processes as companies grow. Outsourced bookkeeping services provide flexibility by adjusting service levels to business needs without the overhead of software management, ideal for fluctuating workloads. Explore more to determine which scalable solution aligns best with your business growth strategy.

Source and External Links

ERP for Accounting and Financial Management - Oracle's ERP system offers integrated capabilities for automating finance and accounting processes, enhancing operational efficiency and analytics for strategic decision-making.

What Is an ERP System in Accounting? - ERP systems automate core business processes, providing crucial insights and controls based on centralized data, which is particularly useful for integrating with accounting software.

ERP vs. Accounting Software Explained - This article highlights the differences between ERP and accounting software, with ERP managing all business operations and accounting software focusing on financial management.

dowidth.com

dowidth.com