Workflow automation in accounting streamlines repetitive tasks by using software to manage data entry, invoicing, and reconciliation, significantly reducing errors compared to paper-based bookkeeping. Paper-based bookkeeping relies on manual entries and physical record-keeping, which can lead to inefficiencies and difficulty in data retrieval. Explore deeper insights into how workflow automation transforms accounting processes for improved accuracy and productivity.

Why it is important

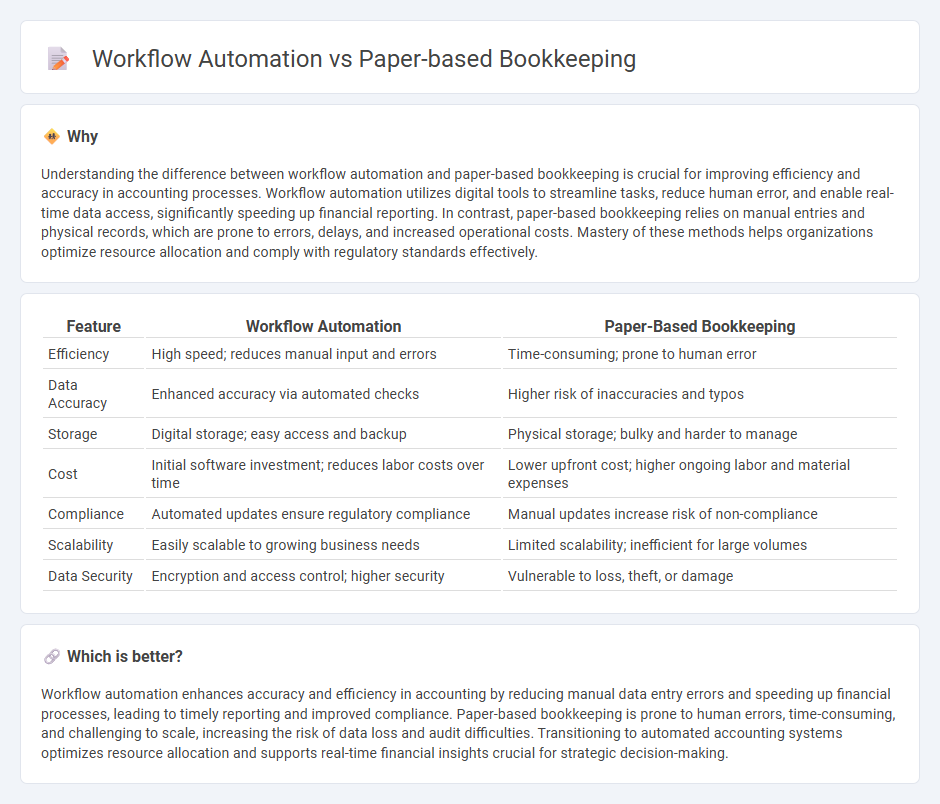

Understanding the difference between workflow automation and paper-based bookkeeping is crucial for improving efficiency and accuracy in accounting processes. Workflow automation utilizes digital tools to streamline tasks, reduce human error, and enable real-time data access, significantly speeding up financial reporting. In contrast, paper-based bookkeeping relies on manual entries and physical records, which are prone to errors, delays, and increased operational costs. Mastery of these methods helps organizations optimize resource allocation and comply with regulatory standards effectively.

Comparison Table

| Feature | Workflow Automation | Paper-Based Bookkeeping |

|---|---|---|

| Efficiency | High speed; reduces manual input and errors | Time-consuming; prone to human error |

| Data Accuracy | Enhanced accuracy via automated checks | Higher risk of inaccuracies and typos |

| Storage | Digital storage; easy access and backup | Physical storage; bulky and harder to manage |

| Cost | Initial software investment; reduces labor costs over time | Lower upfront cost; higher ongoing labor and material expenses |

| Compliance | Automated updates ensure regulatory compliance | Manual updates increase risk of non-compliance |

| Scalability | Easily scalable to growing business needs | Limited scalability; inefficient for large volumes |

| Data Security | Encryption and access control; higher security | Vulnerable to loss, theft, or damage |

Which is better?

Workflow automation enhances accuracy and efficiency in accounting by reducing manual data entry errors and speeding up financial processes, leading to timely reporting and improved compliance. Paper-based bookkeeping is prone to human errors, time-consuming, and challenging to scale, increasing the risk of data loss and audit difficulties. Transitioning to automated accounting systems optimizes resource allocation and supports real-time financial insights crucial for strategic decision-making.

Connection

Workflow automation streamlines accounting processes by reducing manual data entry typically associated with paper-based bookkeeping, enhancing accuracy and efficiency. Integrating digital workflows with traditional paper records allows for seamless data capture, minimizing errors and accelerating financial reporting. Automation tools facilitate the conversion of paper documents into digital formats, enabling real-time tracking and improved compliance in accounting practices.

Key Terms

Ledger

Paper-based bookkeeping relies heavily on manual data entry and physical ledger maintenance, increasing the risk of human error and data loss. Workflow automation streamlines ledger management by integrating real-time data processing, enhancing accuracy, and ensuring compliance with financial regulations. Explore how transitioning to automated ledger systems can optimize your accounting processes and improve financial transparency.

Manual Entry

Paper-based bookkeeping relies heavily on manual entry, increasing the risk of human error and consuming significant time for data input and reconciliation. Workflow automation streamlines these processes by integrating digital tools that minimize manual intervention, improving accuracy and efficiency. Discover how transitioning to automated workflows can transform your bookkeeping operations.

Digital Workflow

Paper-based bookkeeping relies on manual data entry and physical document storage, increasing the risk of errors and inefficiencies. Workflow automation streamlines digital workflows through integrated software platforms, enabling real-time data synchronization, faster approvals, and enhanced accuracy. Explore how digital workflow solutions can transform your bookkeeping processes for greater productivity.

Source and External Links

Digital vs. Paper: Which Bookkeeping Ledger Book is Right for You? - This article compares digital and paper bookkeeping methods, highlighting the pros and cons of each, including the simplicity and tangibility of paper ledgers.

Cloud-Based Bookkeeping Software vs. Traditional Paper-Based ... - This blog post discusses the contrast between cloud-based software and traditional paper-based bookkeeping systems, emphasizing the advantages and disadvantages of each approach.

Big E-Z Bookkeeping Paper Ledger System - This webpage offers a paper-based ledger system that allows businesses to track income and expenses, providing a physical record and tools for bank reconciliation and financial reporting.

dowidth.com

dowidth.com