Real-time audit continuously monitors financial transactions as they occur, enabling immediate detection of errors and fraud through direct data access from accounting systems. Automated audit leverages software tools and algorithms to analyze large volumes of financial data efficiently, reducing manual intervention and increasing audit accuracy. Explore the key differences and benefits of real-time versus automated audits to optimize your auditing strategy.

Why it is important

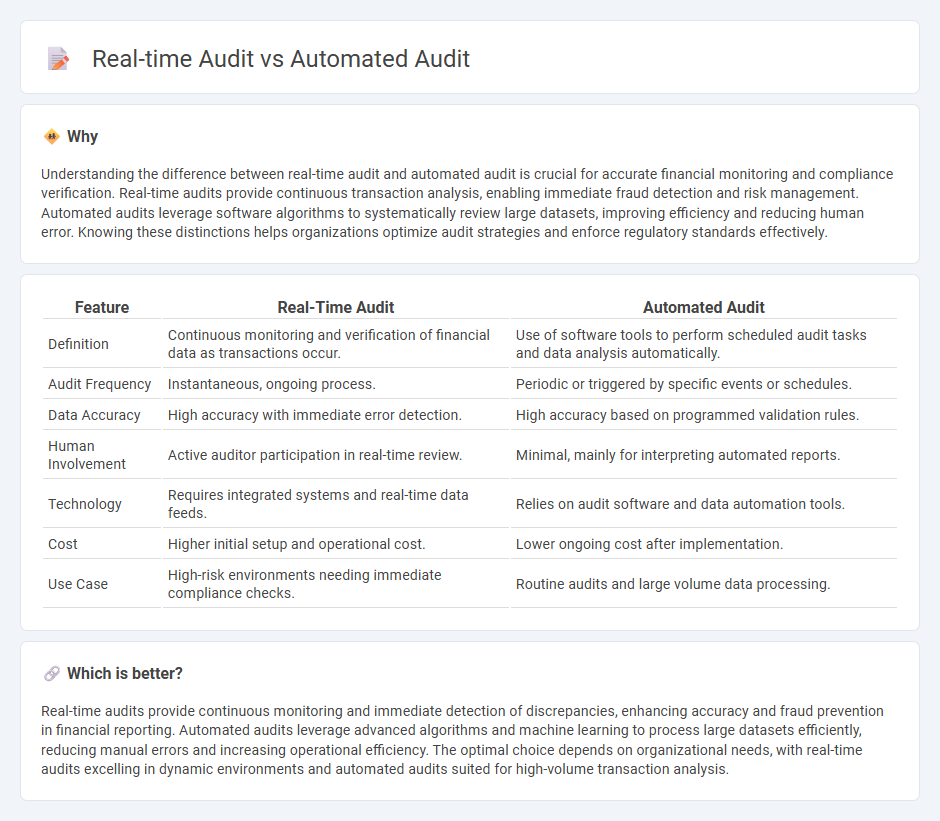

Understanding the difference between real-time audit and automated audit is crucial for accurate financial monitoring and compliance verification. Real-time audits provide continuous transaction analysis, enabling immediate fraud detection and risk management. Automated audits leverage software algorithms to systematically review large datasets, improving efficiency and reducing human error. Knowing these distinctions helps organizations optimize audit strategies and enforce regulatory standards effectively.

Comparison Table

| Feature | Real-Time Audit | Automated Audit |

|---|---|---|

| Definition | Continuous monitoring and verification of financial data as transactions occur. | Use of software tools to perform scheduled audit tasks and data analysis automatically. |

| Audit Frequency | Instantaneous, ongoing process. | Periodic or triggered by specific events or schedules. |

| Data Accuracy | High accuracy with immediate error detection. | High accuracy based on programmed validation rules. |

| Human Involvement | Active auditor participation in real-time review. | Minimal, mainly for interpreting automated reports. |

| Technology | Requires integrated systems and real-time data feeds. | Relies on audit software and data automation tools. |

| Cost | Higher initial setup and operational cost. | Lower ongoing cost after implementation. |

| Use Case | High-risk environments needing immediate compliance checks. | Routine audits and large volume data processing. |

Which is better?

Real-time audits provide continuous monitoring and immediate detection of discrepancies, enhancing accuracy and fraud prevention in financial reporting. Automated audits leverage advanced algorithms and machine learning to process large datasets efficiently, reducing manual errors and increasing operational efficiency. The optimal choice depends on organizational needs, with real-time audits excelling in dynamic environments and automated audits suited for high-volume transaction analysis.

Connection

Real-time audit and automated audit are interconnected through the use of advanced technologies such as artificial intelligence, machine learning, and data analytics, enabling continuous monitoring and immediate analysis of financial transactions. This integration enhances accuracy, reduces human error, and accelerates the detection of discrepancies, fraud, or compliance issues within accounting processes. Implementing these innovations allows organizations to maintain up-to-date audit trails and improve decision-making efficiency in financial reporting.

Key Terms

Continuous Monitoring

Automated audit leverages software to analyze historical financial data for irregularities, while real-time audit uses continuous monitoring systems to evaluate transactions as they occur, enabling immediate detection of anomalies. Continuous monitoring integrates data analytics and artificial intelligence to provide ongoing assurance, reducing the risk of fraud and compliance issues in dynamic business environments. Discover how continuous monitoring transforms audit effectiveness and compliance strategies by exploring the latest tools and methodologies.

Data Analytics

Automated audits leverage data analytics to process large datasets efficiently, identifying anomalies and patterns that suggest risks or compliance issues. Real-time audits use continuous data monitoring and advanced analytics to provide immediate insights, enabling quicker responses to potential discrepancies. Explore the benefits and technologies behind automated and real-time audits to enhance your data-driven assurance processes.

Transaction Processing

Automated audits use pre-programmed algorithms to analyze transaction processing data periodically, identifying discrepancies and compliance issues efficiently. Real-time audits monitor transactions as they occur, enabling immediate detection of anomalies and quicker response to potential fraud or errors in financial records. Explore how integrating both methods enhances accuracy and security in transaction processing.

Source and External Links

AI-driven audit automation: streamlining processes for scalable ... - AI-driven audit automation enables continuous, real-time analysis of 100% of financial transactions, enhancing risk detection, compliance, and providing more accurate, timely assessments compared to traditional sampling methods.

What Is Audit Automation And How Can It Benefit Firms? - INAA - Audit automation uses cloud-based technologies to streamline workflows, allowing auditors to collaborate remotely, improve data accuracy, and gain deeper business insights through advanced analytics.

How AI-powered automation is redefining audit and controls testing - AI-powered automation expands data sample sizes, improves testing accuracy by eliminating manual errors, and enables continuous, real-time monitoring of controls for immediate risk mitigation.

dowidth.com

dowidth.com