Cryptotax regulations specifically address the reporting and taxation of cryptocurrency transactions, distinguishing them from traditional capital gains tax rules applied to stocks or real estate. While capital gains tax focuses on the profit made from asset sales, cryptotax encompasses unique considerations like token swaps, airdrops, and mining income, which require meticulous record-keeping. Explore more to understand how evolving tax laws impact cryptocurrency holders differently than standard capital gains scenarios.

Why it is important

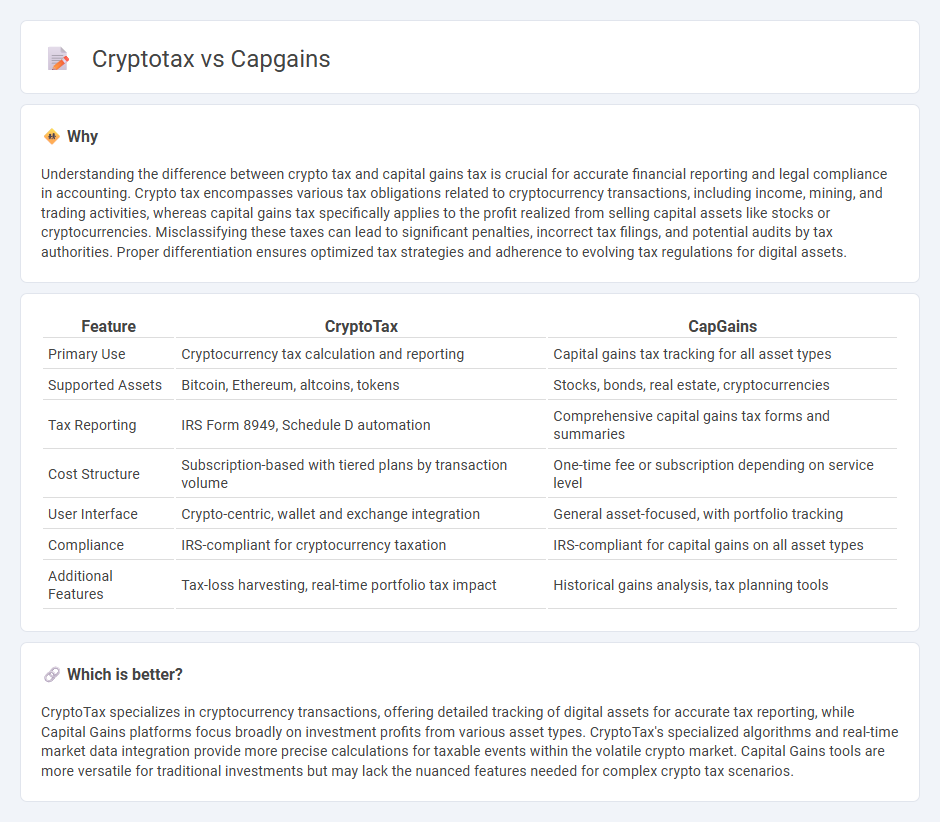

Understanding the difference between crypto tax and capital gains tax is crucial for accurate financial reporting and legal compliance in accounting. Crypto tax encompasses various tax obligations related to cryptocurrency transactions, including income, mining, and trading activities, whereas capital gains tax specifically applies to the profit realized from selling capital assets like stocks or cryptocurrencies. Misclassifying these taxes can lead to significant penalties, incorrect tax filings, and potential audits by tax authorities. Proper differentiation ensures optimized tax strategies and adherence to evolving tax regulations for digital assets.

Comparison Table

| Feature | CryptoTax | CapGains |

|---|---|---|

| Primary Use | Cryptocurrency tax calculation and reporting | Capital gains tax tracking for all asset types |

| Supported Assets | Bitcoin, Ethereum, altcoins, tokens | Stocks, bonds, real estate, cryptocurrencies |

| Tax Reporting | IRS Form 8949, Schedule D automation | Comprehensive capital gains tax forms and summaries |

| Cost Structure | Subscription-based with tiered plans by transaction volume | One-time fee or subscription depending on service level |

| User Interface | Crypto-centric, wallet and exchange integration | General asset-focused, with portfolio tracking |

| Compliance | IRS-compliant for cryptocurrency taxation | IRS-compliant for capital gains on all asset types |

| Additional Features | Tax-loss harvesting, real-time portfolio tax impact | Historical gains analysis, tax planning tools |

Which is better?

CryptoTax specializes in cryptocurrency transactions, offering detailed tracking of digital assets for accurate tax reporting, while Capital Gains platforms focus broadly on investment profits from various asset types. CryptoTax's specialized algorithms and real-time market data integration provide more precise calculations for taxable events within the volatile crypto market. Capital Gains tools are more versatile for traditional investments but may lack the nuanced features needed for complex crypto tax scenarios.

Connection

Cryptotax regulations require accurate reporting of capital gains realized from cryptocurrency transactions, impacting how individuals calculate taxable income. Capital gains tax applies to profits made from selling or exchanging digital assets, with different rates depending on the holding period. Proper accounting systems ensure compliance by tracking acquisition costs, sale prices, and relevant tax implications for each cryptocurrency trade.

Key Terms

Capital Gains

Capital gains tax applies to the profit earned from selling assets like stocks, real estate, or cryptocurrency, calculated as the difference between the sale price and the original purchase price. This tax rate varies depending on the holding period, with short-term capital gains typically taxed at ordinary income rates and long-term gains benefiting from lower tax rates. Explore in-depth insights on capital gains tax implications and how they specifically impact cryptocurrency transactions.

Taxable Events

Capital gains tax applies to the profit realized from the sale of assets like stocks and real estate, while crypto tax encompasses taxable events such as trading, spending, or converting cryptocurrency. Taxable events for cryptocurrency include selling crypto for fiat currency, exchanging one crypto for another, and using crypto for purchases, all of which may trigger capital gains tax. Explore detailed guidelines and strategies to accurately report and optimize your tax obligations on both capital gains and cryptocurrency transactions.

Cost Basis

Cost basis in capital gains tax plays a crucial role in determining taxable profit, typically calculated by the original purchase price plus any fees. Cryptocurrency tax rules emphasize accurate cost basis tracking to avoid overpaying taxes due to price volatility and multiple transactions. Explore how understanding cost basis in crypto taxation can optimize your tax strategy and compliance.

Source and External Links

CapGains - A platform designed for fund CFOs to automate the management of tax strategies, unlocking value for clients through tax incentives.

CapGains - Automates tax strategy management using proprietary software to simplify and optimize tax incentives for clients.

SBI CapGains Plus Account - Offers a way for NRIs to park proceeds from selling property and claim exemptions on long-term capital gains tax.

dowidth.com

dowidth.com