Forensic data analytics focuses on investigating financial discrepancies and detecting fraud through detailed analysis of transactional data and patterns. Management accounting involves providing financial insights and forecasts to support strategic decision-making and operational efficiency within an organization. Explore the key differences and applications to understand how each discipline enhances financial governance.

Why it is important

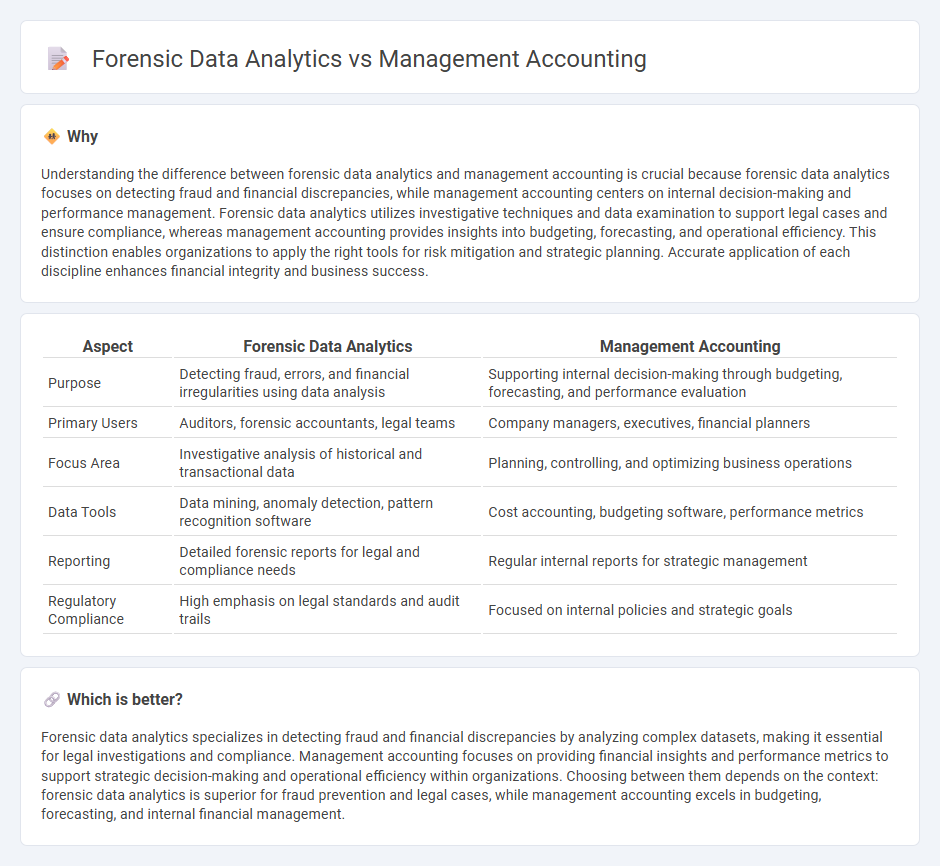

Understanding the difference between forensic data analytics and management accounting is crucial because forensic data analytics focuses on detecting fraud and financial discrepancies, while management accounting centers on internal decision-making and performance management. Forensic data analytics utilizes investigative techniques and data examination to support legal cases and ensure compliance, whereas management accounting provides insights into budgeting, forecasting, and operational efficiency. This distinction enables organizations to apply the right tools for risk mitigation and strategic planning. Accurate application of each discipline enhances financial integrity and business success.

Comparison Table

| Aspect | Forensic Data Analytics | Management Accounting |

|---|---|---|

| Purpose | Detecting fraud, errors, and financial irregularities using data analysis | Supporting internal decision-making through budgeting, forecasting, and performance evaluation |

| Primary Users | Auditors, forensic accountants, legal teams | Company managers, executives, financial planners |

| Focus Area | Investigative analysis of historical and transactional data | Planning, controlling, and optimizing business operations |

| Data Tools | Data mining, anomaly detection, pattern recognition software | Cost accounting, budgeting software, performance metrics |

| Reporting | Detailed forensic reports for legal and compliance needs | Regular internal reports for strategic management |

| Regulatory Compliance | High emphasis on legal standards and audit trails | Focused on internal policies and strategic goals |

Which is better?

Forensic data analytics specializes in detecting fraud and financial discrepancies by analyzing complex datasets, making it essential for legal investigations and compliance. Management accounting focuses on providing financial insights and performance metrics to support strategic decision-making and operational efficiency within organizations. Choosing between them depends on the context: forensic data analytics is superior for fraud prevention and legal cases, while management accounting excels in budgeting, forecasting, and internal financial management.

Connection

Forensic data analytics enhances management accounting by identifying financial discrepancies and potential fraud through detailed examination of transactional data. Management accounting leverages these insights to improve internal controls and support strategic decision-making based on accurate, verified financial information. Integrating forensic techniques into management accounting workflows ensures more reliable budgeting, forecasting, and performance evaluation.

Key Terms

**Management accounting:**

Management accounting centers on analyzing financial data to aid internal decision-making, budgeting, and performance evaluation by providing detailed cost control and financial forecasting. It emphasizes establishing financial strategies, preparing variance reports, and supporting operational management to optimize company resources and profitability. Explore more insights on how management accounting drives strategic and tactical business success.

Budgeting

Management accounting emphasizes budgeting by analyzing financial data to plan and control organizational resources effectively, ensuring cost efficiency and strategic alignment. Forensic data analytics in budgeting involves scrutinizing financial transactions to detect anomalies, fraud, or compliance issues that could impact budget integrity. Explore how integrating these disciplines enhances budgeting accuracy and organizational accountability.

Cost analysis

Management accounting emphasizes detailed cost analysis to enhance budgeting, forecasting, and internal decision-making processes, leveraging tools like variance analysis and activity-based costing. Forensic data analytics targets identifying anomalies and fraudulent costs by scrutinizing large datasets for irregularities, discrepancies, and suspicious transactions linked to financial misconduct. Explore further to understand how cost analysis techniques differ in optimizing operational efficiency versus detecting financial fraud.

Source and External Links

Managerial Accounting - Definition, Objectives & Techniques - This webpage provides an overview of managerial accounting, focusing on its role in decision-making processes and business operations.

Managerial Accounting Made Easy - This guide explains managerial accounting as a strategic tool for business decision-making, combining financial data with organizational strategy.

A Guide to Managerial Accounting - This article discusses how managerial accounting helps businesses understand financial progress and make strategic decisions through financial analysis.

dowidth.com

dowidth.com