Digital asset reporting streamlines financial documentation with real-time data integration and enhanced accuracy compared to traditional paper-based methods, which often involve manual entry and delayed processing. Blockchain technology and automated reconciliation tools boost transparency and reduce errors in digital reporting, contrasting the labor-intensive and error-prone nature of paper records. Explore how embracing digital asset reporting can transform your accounting practices and improve compliance.

Why it is important

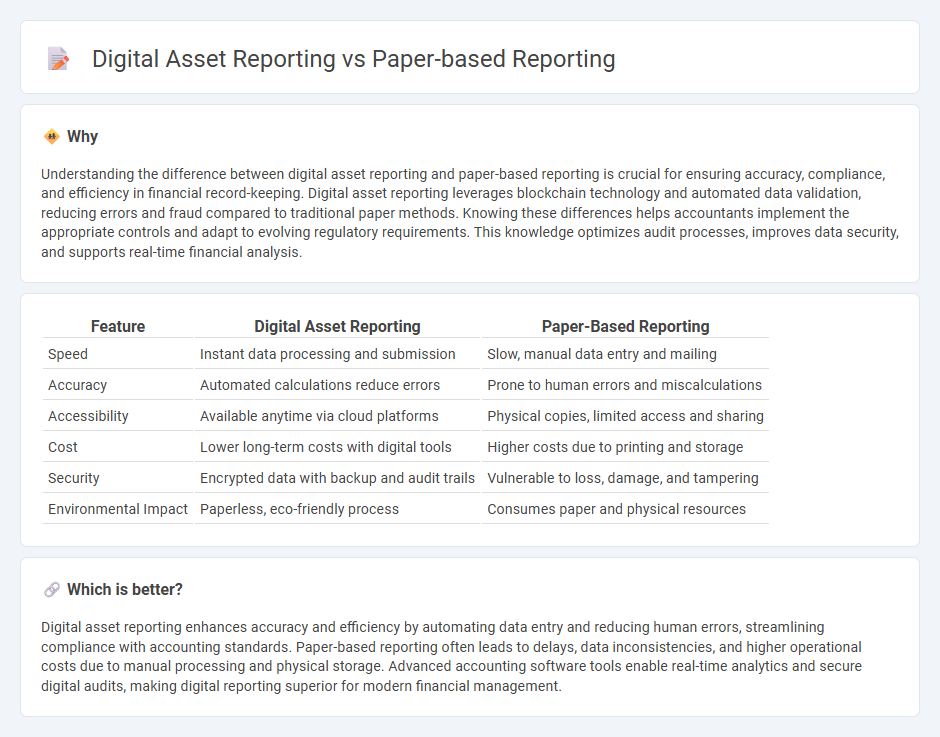

Understanding the difference between digital asset reporting and paper-based reporting is crucial for ensuring accuracy, compliance, and efficiency in financial record-keeping. Digital asset reporting leverages blockchain technology and automated data validation, reducing errors and fraud compared to traditional paper methods. Knowing these differences helps accountants implement the appropriate controls and adapt to evolving regulatory requirements. This knowledge optimizes audit processes, improves data security, and supports real-time financial analysis.

Comparison Table

| Feature | Digital Asset Reporting | Paper-Based Reporting |

|---|---|---|

| Speed | Instant data processing and submission | Slow, manual data entry and mailing |

| Accuracy | Automated calculations reduce errors | Prone to human errors and miscalculations |

| Accessibility | Available anytime via cloud platforms | Physical copies, limited access and sharing |

| Cost | Lower long-term costs with digital tools | Higher costs due to printing and storage |

| Security | Encrypted data with backup and audit trails | Vulnerable to loss, damage, and tampering |

| Environmental Impact | Paperless, eco-friendly process | Consumes paper and physical resources |

Which is better?

Digital asset reporting enhances accuracy and efficiency by automating data entry and reducing human errors, streamlining compliance with accounting standards. Paper-based reporting often leads to delays, data inconsistencies, and higher operational costs due to manual processing and physical storage. Advanced accounting software tools enable real-time analytics and secure digital audits, making digital reporting superior for modern financial management.

Connection

Digital asset reporting and paper-based reporting intersect through their shared goal of documenting financial transactions and ensuring regulatory compliance in accounting. Both methods rely on systematic record-keeping to track asset ownership, valuation, and transfer, with digital reporting leveraging automated processes and blockchain technology to enhance accuracy and transparency. Integration of digital data into traditional paper-based systems often requires standardized formats and reconciliation procedures to maintain consistency and auditability.

Key Terms

Recordkeeping

Paper-based reporting relies heavily on physical documents, increasing risks of loss, misfiling, and delayed access during audits. Digital asset reporting utilizes automated recordkeeping systems that offer real-time updates, secure cloud storage, and enhanced data retrieval capabilities. Explore the advantages of digital recordkeeping to optimize accuracy and efficiency in asset reporting.

Audit Trail

Paper-based reporting relies heavily on manual documentation, which increases the risk of errors and makes maintaining a reliable audit trail challenging. In contrast, digital asset reporting leverages automated data capture and blockchain technology to ensure tamper-proof, transparent audit trails with real-time verification. Explore the benefits of digital audit trails for enhanced accuracy and compliance.

Data Integrity

Paper-based reporting often faces challenges in maintaining data integrity due to manual entry errors, physical damage, and difficulty in tracking changes. Digital asset reporting enhances data accuracy and security through automated validation, encryption, and audit trails, ensuring more reliable and tamper-proof records. Explore how transitioning to digital reporting can safeguard your data integrity and streamline reporting processes.

Source and External Links

Paper-based to a digital document system - QUASR Blog - Paper-based reporting in hospitals involves manually filling out forms, passing them between staff, and taking weeks to complete each incident, which increases the risk of lost or delayed information.

The Drawbacks of Paper-Based Systems: A 2024 Perspective - Paper-based reporting leads to inefficiency, as employees spend excessive time searching for documents, and collaboration is hampered by the physical limitations of paper, causing communication breakdowns and project delays.

Ask the Expert: Paper Incident Reports Work for Us. Why Should We Go Digital? - Circadian Risk - While paper incident reports capture basic details of an event, they lack the ability to integrate multimedia, spatial data, or enable easy analysis and comparison across incidents, unlike digital reporting systems.

dowidth.com

dowidth.com