Fractional CFO services offer flexible, cost-effective financial leadership tailored to small and medium-sized businesses, enabling access to expert CFO skills on a part-time basis. Full-time CFOs provide comprehensive, in-house financial management critical for larger organizations requiring continuous oversight and strategic planning. Explore how choosing between Fractional and Full-Time CFO services can optimize your company's financial growth and operational efficiency.

Why it is important

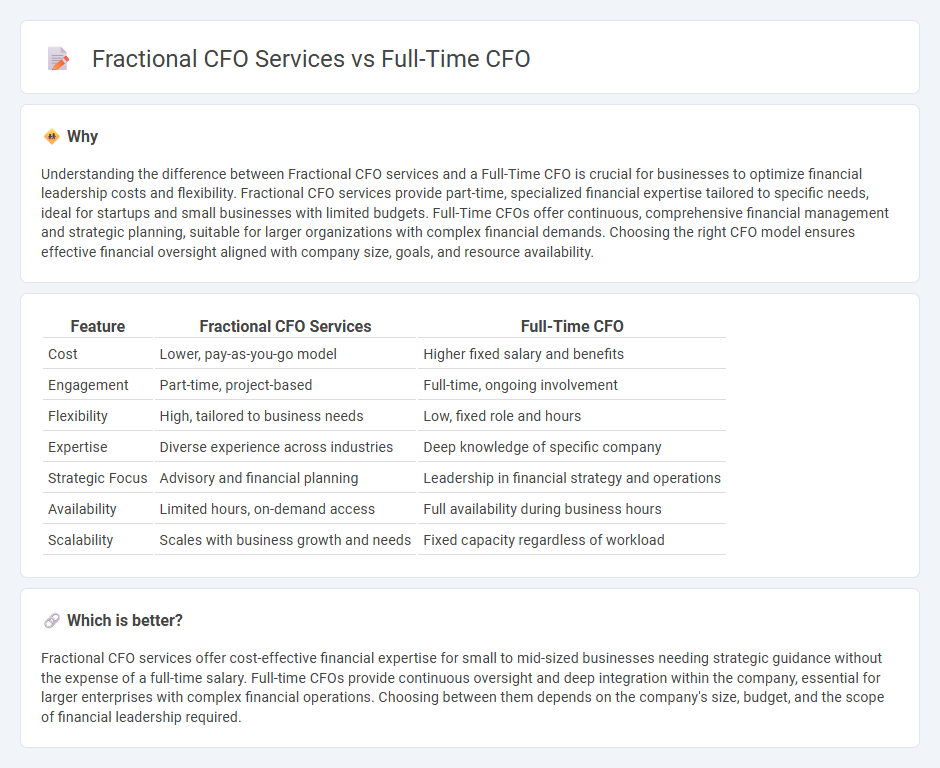

Understanding the difference between Fractional CFO services and a Full-Time CFO is crucial for businesses to optimize financial leadership costs and flexibility. Fractional CFO services provide part-time, specialized financial expertise tailored to specific needs, ideal for startups and small businesses with limited budgets. Full-Time CFOs offer continuous, comprehensive financial management and strategic planning, suitable for larger organizations with complex financial demands. Choosing the right CFO model ensures effective financial oversight aligned with company size, goals, and resource availability.

Comparison Table

| Feature | Fractional CFO Services | Full-Time CFO |

|---|---|---|

| Cost | Lower, pay-as-you-go model | Higher fixed salary and benefits |

| Engagement | Part-time, project-based | Full-time, ongoing involvement |

| Flexibility | High, tailored to business needs | Low, fixed role and hours |

| Expertise | Diverse experience across industries | Deep knowledge of specific company |

| Strategic Focus | Advisory and financial planning | Leadership in financial strategy and operations |

| Availability | Limited hours, on-demand access | Full availability during business hours |

| Scalability | Scales with business growth and needs | Fixed capacity regardless of workload |

Which is better?

Fractional CFO services offer cost-effective financial expertise for small to mid-sized businesses needing strategic guidance without the expense of a full-time salary. Full-time CFOs provide continuous oversight and deep integration within the company, essential for larger enterprises with complex financial operations. Choosing between them depends on the company's size, budget, and the scope of financial leadership required.

Connection

Fractional CFO services provide strategic financial leadership on a part-time basis, aligning closely with the responsibilities of a Full-Time CFO by overseeing budgeting, forecasting, and financial planning. Both roles focus on enhancing cash flow management, optimizing financial performance, and supporting business growth through data-driven decision-making. Companies often transition from fractional to full-time CFOs as their financial complexity and organizational scale increase.

Key Terms

Cost Efficiency

Full-time CFOs typically demand higher salaries, benefits, and overhead expenses, making them less cost-efficient for small to medium-sized businesses. Fractional CFO services offer flexible, on-demand financial expertise, significantly reducing operational costs without sacrificing strategic financial guidance. Discover how choosing the right CFO model can optimize your company's financial performance and budget.

Commitment Level

Full-Time CFOs provide unwavering commitment by dedicating their entire work schedule exclusively to one company, ensuring deep immersion in its financial strategy and operations. Fractional CFOs offer flexible engagement, tailoring their involvement to specific needs and budgets, making them ideal for startups and growing businesses seeking expert guidance without the overhead of a full-time executive. Explore how commitment levels in CFO services impact your company's financial leadership and strategic growth by learning more about each option's benefits.

Strategic Involvement

Full-time CFOs provide continuous strategic financial leadership, deeply integrating with company operations and long-term business planning to drive sustained growth. Fractional CFOs offer flexible, part-time expertise tailored for targeted financial initiatives, delivering strategic insights without the commitment of a full-time executive. Explore how each option can align with your business goals for optimal financial management.

Source and External Links

Do You Need a Part-time, Full-time, or Fractional CFO? - This article discusses the role of a full-time CFO, focusing on strategic financial planning, fundraising, and team leadership, and compares it with part-time and fractional alternatives.

Part-Time CFO vs. Full-Time CFO: Which Is Right for Your Business? - This blog post explores the differences between part-time and full-time CFOs, highlighting their responsibilities such as cash flow management and tax planning, and their suitability for different businesses.

Fractional CFO Vs Full-Time CFO - This article provides an overview of full-time CFOs, discussing their involvement in financial strategy and the challenges associated with hiring them, such as high costs and less flexibility compared to fractional models.

dowidth.com

dowidth.com