Continuous assurance leverages real-time data monitoring and automated controls to provide ongoing validation of financial transactions, enhancing accuracy and reducing risk throughout the reporting period. Substantive testing involves detailed examination of financial records and transactions at specific intervals to verify account balances and detect material misstatements. Explore the differences between continuous assurance and substantive testing to improve your accounting audit strategies.

Why it is important

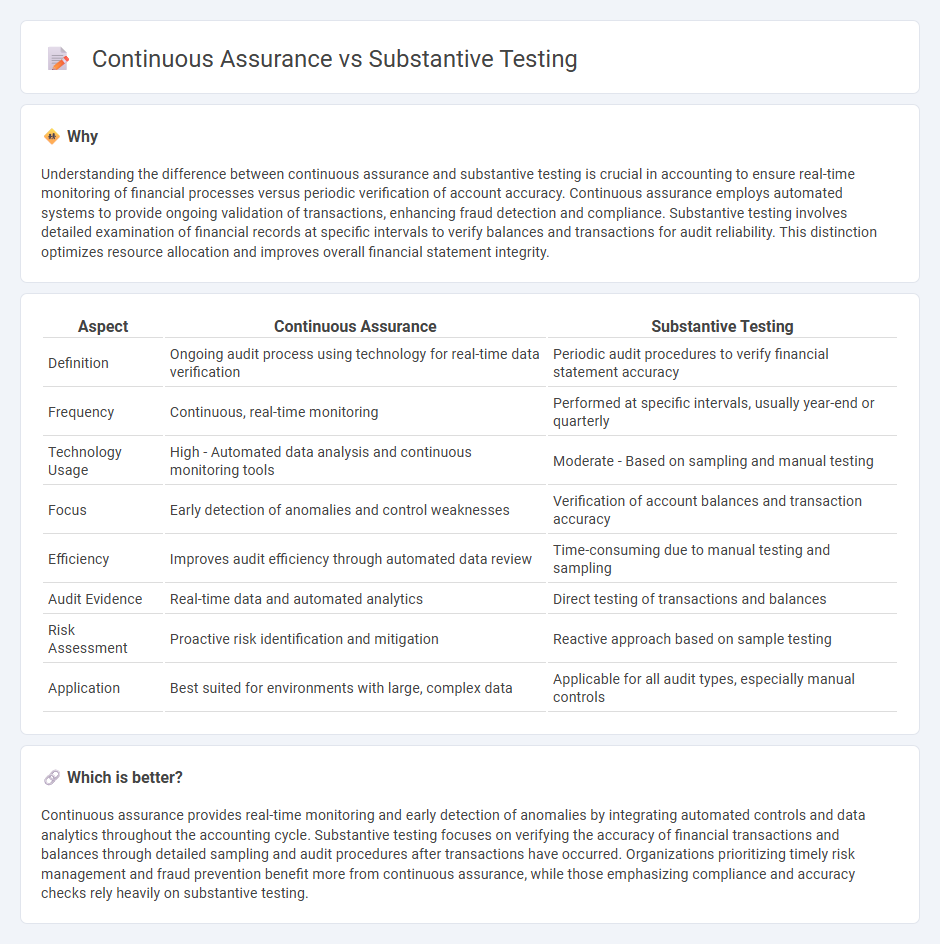

Understanding the difference between continuous assurance and substantive testing is crucial in accounting to ensure real-time monitoring of financial processes versus periodic verification of account accuracy. Continuous assurance employs automated systems to provide ongoing validation of transactions, enhancing fraud detection and compliance. Substantive testing involves detailed examination of financial records at specific intervals to verify balances and transactions for audit reliability. This distinction optimizes resource allocation and improves overall financial statement integrity.

Comparison Table

| Aspect | Continuous Assurance | Substantive Testing |

|---|---|---|

| Definition | Ongoing audit process using technology for real-time data verification | Periodic audit procedures to verify financial statement accuracy |

| Frequency | Continuous, real-time monitoring | Performed at specific intervals, usually year-end or quarterly |

| Technology Usage | High - Automated data analysis and continuous monitoring tools | Moderate - Based on sampling and manual testing |

| Focus | Early detection of anomalies and control weaknesses | Verification of account balances and transaction accuracy |

| Efficiency | Improves audit efficiency through automated data review | Time-consuming due to manual testing and sampling |

| Audit Evidence | Real-time data and automated analytics | Direct testing of transactions and balances |

| Risk Assessment | Proactive risk identification and mitigation | Reactive approach based on sample testing |

| Application | Best suited for environments with large, complex data | Applicable for all audit types, especially manual controls |

Which is better?

Continuous assurance provides real-time monitoring and early detection of anomalies by integrating automated controls and data analytics throughout the accounting cycle. Substantive testing focuses on verifying the accuracy of financial transactions and balances through detailed sampling and audit procedures after transactions have occurred. Organizations prioritizing timely risk management and fraud prevention benefit more from continuous assurance, while those emphasizing compliance and accuracy checks rely heavily on substantive testing.

Connection

Continuous assurance enhances the frequency and reliability of financial data verification by providing ongoing monitoring through automated controls, which reduces the risk of material misstatements. Substantive testing complements this by performing detailed examinations of account balances and transactions to validate the accuracy and completeness of financial records. Together, continuous assurance and substantive testing create a robust audit framework that ensures financial statements are both timely and accurate, improving overall audit quality.

Key Terms

Audit Evidence

Substantive testing involves examining financial transactions and balances to gather audit evidence supporting the accuracy and completeness of financial statements at a specific point in time. Continuous assurance leverages ongoing data analytics and monitoring tools to provide real-time audit evidence, enhancing the timeliness and relevance of audit conclusions. Explore further to understand how these approaches impact audit quality and decision-making.

Real-time Monitoring

Substantive testing involves detailed examination of financial transactions and balances at a specific point in time to ensure accuracy, while continuous assurance employs real-time monitoring techniques to provide ongoing validation of controls and data integrity. Real-time monitoring utilizes automated data analytics and dashboards to detect anomalies instantly, enhancing the timeliness and effectiveness of risk management. Explore how integrating real-time continuous assurance can transform audit processes and improve financial oversight.

Data Analytics

Substantive testing uses data analytics to validate financial transactions by examining specific samples for accuracy and compliance, ensuring transaction-level detail is accurate. Continuous assurance leverages real-time data analytics tools to monitor and analyze entire datasets continuously, enabling immediate detection of anomalies and risks throughout the audit period. Explore how integrating advanced data analytics transforms audit effectiveness and accuracy in both approaches.

Source and External Links

Substantive Testing: Key Definitions, Goals, and Best Practices - Substantive testing involves detailed audit procedures to gather evidence confirming that financial statements are free from material errors and presented fairly, focusing on accuracy rather than on testing internal controls.

The Importance of Substantive Testing in Audits - Substantive testing examines financial statements, transactions, balances, and disclosures to verify their accuracy and completeness, detect fraud or errors, and support the reliability of financial reporting.

Audit substantive test - Substantive procedures are audit activities performed to detect material misstatements at the assertion level, gathering evidence to assess whether account balances and classes of transactions are materially complete, valid, and accurate.

dowidth.com

dowidth.com