Fractional CFO services provide strategic financial leadership on a part-time basis, focusing on long-term planning, cash flow management, and investor relations, while controllership primarily involves overseeing daily accounting operations and financial reporting accuracy. Businesses seeking high-level financial guidance without full-time executive costs often choose fractional CFOs, whereas companies needing robust internal controls and compliance depend on controllership. Explore more about how these roles can transform your company's financial management.

Why it is important

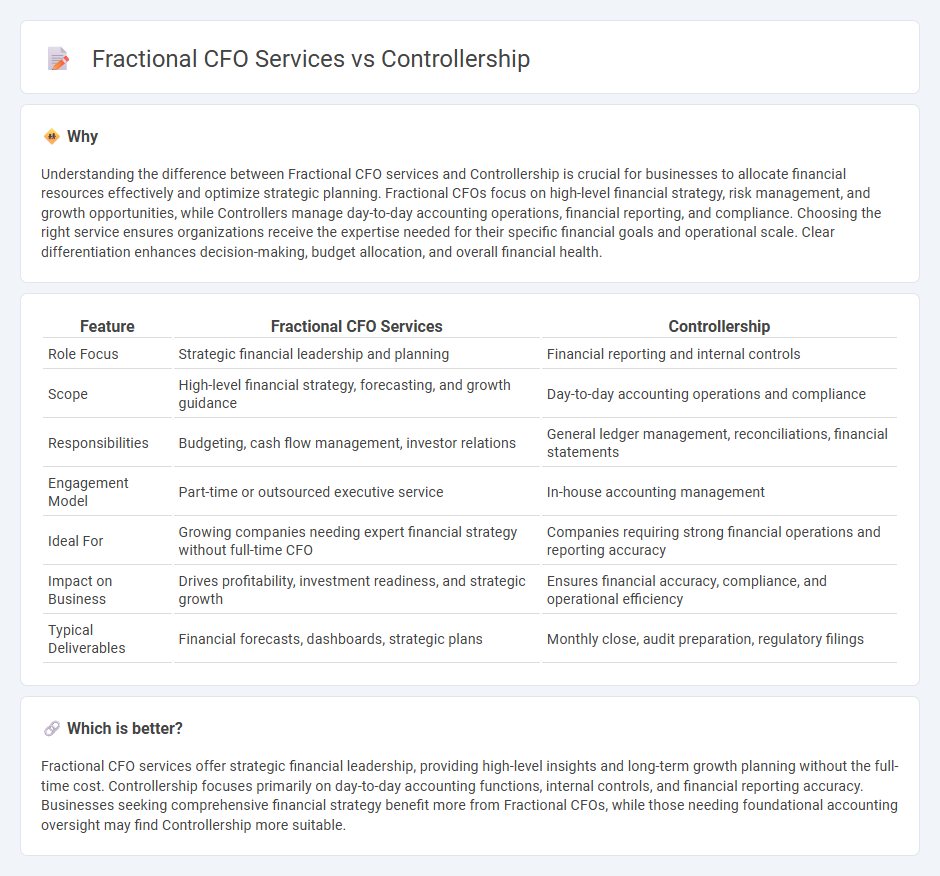

Understanding the difference between Fractional CFO services and Controllership is crucial for businesses to allocate financial resources effectively and optimize strategic planning. Fractional CFOs focus on high-level financial strategy, risk management, and growth opportunities, while Controllers manage day-to-day accounting operations, financial reporting, and compliance. Choosing the right service ensures organizations receive the expertise needed for their specific financial goals and operational scale. Clear differentiation enhances decision-making, budget allocation, and overall financial health.

Comparison Table

| Feature | Fractional CFO Services | Controllership |

|---|---|---|

| Role Focus | Strategic financial leadership and planning | Financial reporting and internal controls |

| Scope | High-level financial strategy, forecasting, and growth guidance | Day-to-day accounting operations and compliance |

| Responsibilities | Budgeting, cash flow management, investor relations | General ledger management, reconciliations, financial statements |

| Engagement Model | Part-time or outsourced executive service | In-house accounting management |

| Ideal For | Growing companies needing expert financial strategy without full-time CFO | Companies requiring strong financial operations and reporting accuracy |

| Impact on Business | Drives profitability, investment readiness, and strategic growth | Ensures financial accuracy, compliance, and operational efficiency |

| Typical Deliverables | Financial forecasts, dashboards, strategic plans | Monthly close, audit preparation, regulatory filings |

Which is better?

Fractional CFO services offer strategic financial leadership, providing high-level insights and long-term growth planning without the full-time cost. Controllership focuses primarily on day-to-day accounting functions, internal controls, and financial reporting accuracy. Businesses seeking comprehensive financial strategy benefit more from Fractional CFOs, while those needing foundational accounting oversight may find Controllership more suitable.

Connection

Fractional CFO services provide strategic financial leadership on a part-time basis, complementing controllership by overseeing accurate financial reporting and compliance. Both roles focus on ensuring robust accounting systems, helping businesses manage cash flow, budgets, and financial risks effectively. Integrating fractional CFO expertise with controllership enhances decision-making through insightful financial analysis and operational control.

Key Terms

Financial Reporting

Controllership services emphasize accurate and timely financial reporting, internal controls, and adherence to accounting standards to ensure reliable financial statements. Fractional CFO services provide strategic financial insights, forecasting, and analysis to support high-level decision-making beyond standard reporting tasks. Discover how each role impacts your business's financial health by exploring their distinct contributions.

Strategic Planning

Controllership services primarily manage financial reporting, compliance, and internal controls, ensuring accurate and timely financial data. Fractional CFO services encompass expansive strategic planning, budgeting, cash flow management, and growth initiatives to align financial goals with business objectives. Explore how leveraging fractional CFO expertise can elevate your strategic financial planning beyond traditional controllership roles.

Cost Management

Controllership services emphasize accurate financial reporting, budgeting, and internal controls to optimize cost management at a transactional level. Fractional CFO services provide strategic oversight, focusing on long-term financial planning, cash flow optimization, and cost reduction initiatives to enhance overall business profitability. Explore the key differences and benefits of each service to determine the best fit for your cost management needs.

Source and External Links

Controllership | VMG Financial - Controllership involves overseeing financial affairs, auditing accounts, and providing financial analysis to maintain business health.

What Is Controllership Definition & Meaning - Emagia - Controllership is a critical function focusing on financial oversight, compliance, and accurate reporting to support strategic decision-making.

Controllership Department in Accounting: Definition and Importance - The Controllership Department manages financial operations, ensuring accurate recording, compliance, and internal controls under the leadership of the Controller or CFO.

dowidth.com

dowidth.com