Digital asset taxation involves the assessment of cryptocurrencies and other virtual assets for income, capital gains, and transaction taxes, reflecting their unique regulatory challenges and valuation methods. Gift taxation applies to the transfer of digital assets without consideration, requiring accurate reporting of fair market value to comply with IRS thresholds and exemptions. Explore the complexities of both tax types to ensure proper compliance and strategic financial planning.

Why it is important

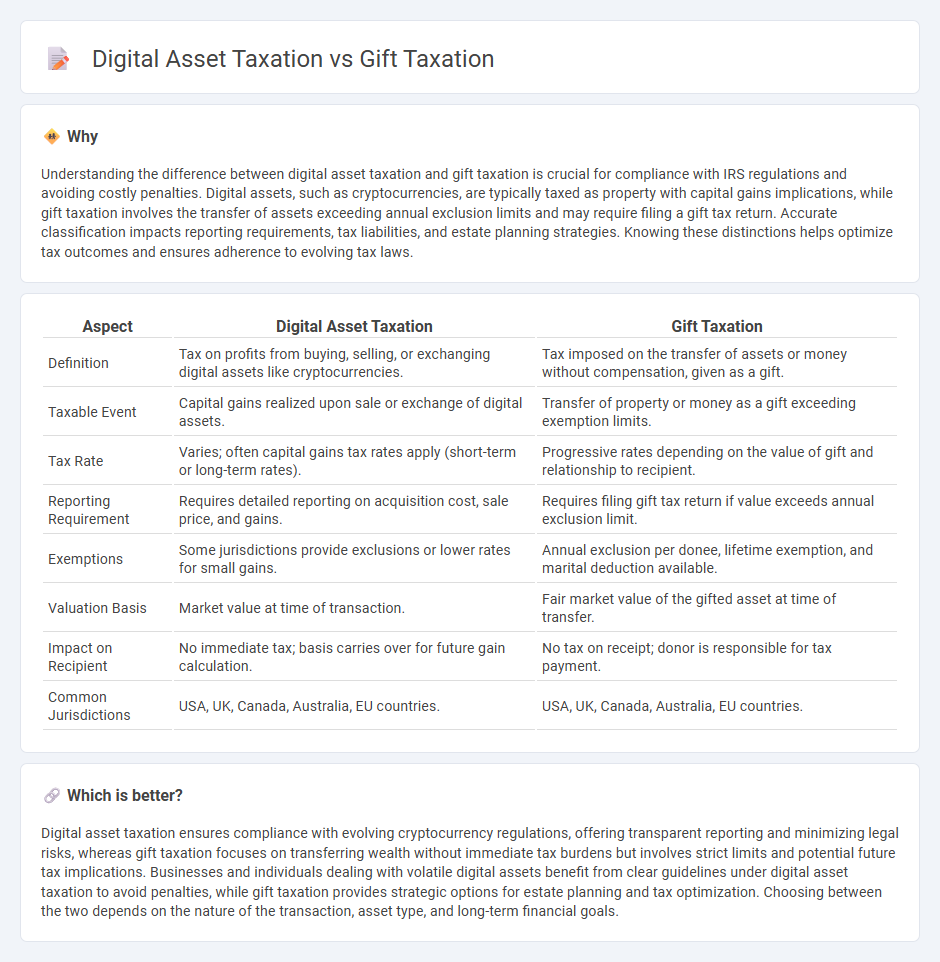

Understanding the difference between digital asset taxation and gift taxation is crucial for compliance with IRS regulations and avoiding costly penalties. Digital assets, such as cryptocurrencies, are typically taxed as property with capital gains implications, while gift taxation involves the transfer of assets exceeding annual exclusion limits and may require filing a gift tax return. Accurate classification impacts reporting requirements, tax liabilities, and estate planning strategies. Knowing these distinctions helps optimize tax outcomes and ensures adherence to evolving tax laws.

Comparison Table

| Aspect | Digital Asset Taxation | Gift Taxation |

|---|---|---|

| Definition | Tax on profits from buying, selling, or exchanging digital assets like cryptocurrencies. | Tax imposed on the transfer of assets or money without compensation, given as a gift. |

| Taxable Event | Capital gains realized upon sale or exchange of digital assets. | Transfer of property or money as a gift exceeding exemption limits. |

| Tax Rate | Varies; often capital gains tax rates apply (short-term or long-term rates). | Progressive rates depending on the value of gift and relationship to recipient. |

| Reporting Requirement | Requires detailed reporting on acquisition cost, sale price, and gains. | Requires filing gift tax return if value exceeds annual exclusion limit. |

| Exemptions | Some jurisdictions provide exclusions or lower rates for small gains. | Annual exclusion per donee, lifetime exemption, and marital deduction available. |

| Valuation Basis | Market value at time of transaction. | Fair market value of the gifted asset at time of transfer. |

| Impact on Recipient | No immediate tax; basis carries over for future gain calculation. | No tax on receipt; donor is responsible for tax payment. |

| Common Jurisdictions | USA, UK, Canada, Australia, EU countries. | USA, UK, Canada, Australia, EU countries. |

Which is better?

Digital asset taxation ensures compliance with evolving cryptocurrency regulations, offering transparent reporting and minimizing legal risks, whereas gift taxation focuses on transferring wealth without immediate tax burdens but involves strict limits and potential future tax implications. Businesses and individuals dealing with volatile digital assets benefit from clear guidelines under digital asset taxation to avoid penalties, while gift taxation provides strategic options for estate planning and tax optimization. Choosing between the two depends on the nature of the transaction, asset type, and long-term financial goals.

Connection

Digital asset taxation and gift taxation intersect when cryptocurrencies or other digital assets are transferred as gifts, triggering specific tax reporting requirements. The fair market value of the digital asset at the time of transfer determines the gift tax basis and potential taxable amounts under IRS regulations. Proper valuation and documentation are crucial to ensure compliance with both digital asset taxation and gift taxation laws.

Key Terms

Fair Market Value

Gift taxation requires valuation of transferred assets at their Fair Market Value (FMV) at the time of the gift to determine tax liability, ensuring accurate reporting of the gift's worth. Digital asset taxation also hinges on FMV, where cryptocurrencies and NFTs are assessed based on their market price during transactions for capital gains and income tax calculations. Explore more to understand how FMV impacts tax strategies for gifts and digital assets.

Basis

Gift taxation involves transferring property without receiving full compensation, where the recipient's basis typically equals the donor's adjusted basis, impacting future capital gains. Digital asset taxation requires tracking the cost basis for cryptocurrencies or NFTs to determine taxable gains upon sale or exchange, often complicated by volatile valuations and transaction histories. Explore detailed strategies and compliance tips to optimize basis calculation for both gift and digital asset taxation.

Reporting Requirements

Gift taxation requires detailed reporting of transfers exceeding the annual exclusion limit, including IRS Form 709 for United States taxpayers, while digital asset taxation mandates disclosure of cryptocurrency transactions and holdings on forms such as IRS Form 8949 and Schedule D. Both tax categories emphasize accurate record-keeping to ensure compliance with valuation rules and prevent underreporting of taxable events. Explore further to understand nuanced filing deadlines and documentation standards for each tax type.

Source and External Links

Gift Tax: 2025 Exemptions and Limits - NerdWallet - Gift tax rates range from 18% to 40% on amounts above the annual exclusion ($19,000 in 2025), but most taxpayers only pay if they exceed the lifetime exclusion ($13.99 million in 2025).

Gift tax, how it works and the limits - Jackson Hewitt - The gift tax applies to transfers of money or property without payment, and any amount over the annual exclusion ($19,000 in 2025) must be reported on IRS Form 709.

Do I Have to Pay Taxes on a Gift? | Gift Tax Calculator - TaxAct - Recipients do not pay tax on gifts; the giver files the return and pays any tax due, with rates from 18% to 40% depending on the gift value.

dowidth.com

dowidth.com