Predictive close leverages historical data and advanced analytics to forecast financial outcomes before the end of a reporting period, enhancing accuracy and decision-making. Virtual close accelerates the closing process by simulating financial close activities in real-time, enabling companies to identify discrepancies earlier and reduce cycle time. Explore detailed comparisons to optimize your accounting close strategy and improve financial performance.

Why it is important

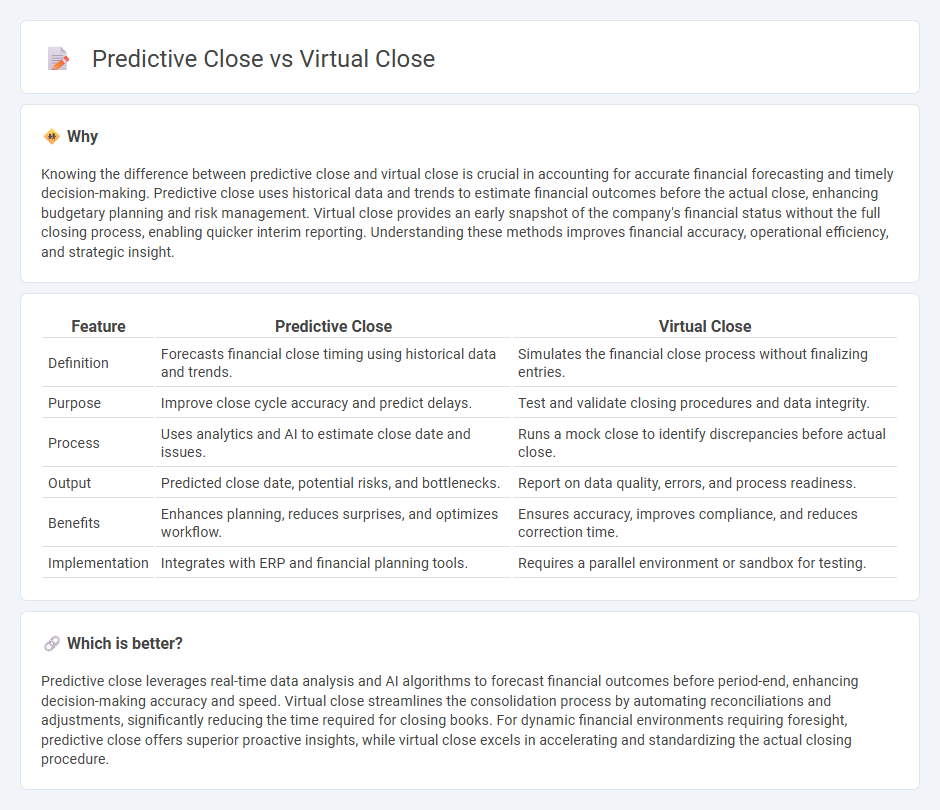

Knowing the difference between predictive close and virtual close is crucial in accounting for accurate financial forecasting and timely decision-making. Predictive close uses historical data and trends to estimate financial outcomes before the actual close, enhancing budgetary planning and risk management. Virtual close provides an early snapshot of the company's financial status without the full closing process, enabling quicker interim reporting. Understanding these methods improves financial accuracy, operational efficiency, and strategic insight.

Comparison Table

| Feature | Predictive Close | Virtual Close |

|---|---|---|

| Definition | Forecasts financial close timing using historical data and trends. | Simulates the financial close process without finalizing entries. |

| Purpose | Improve close cycle accuracy and predict delays. | Test and validate closing procedures and data integrity. |

| Process | Uses analytics and AI to estimate close date and issues. | Runs a mock close to identify discrepancies before actual close. |

| Output | Predicted close date, potential risks, and bottlenecks. | Report on data quality, errors, and process readiness. |

| Benefits | Enhances planning, reduces surprises, and optimizes workflow. | Ensures accuracy, improves compliance, and reduces correction time. |

| Implementation | Integrates with ERP and financial planning tools. | Requires a parallel environment or sandbox for testing. |

Which is better?

Predictive close leverages real-time data analysis and AI algorithms to forecast financial outcomes before period-end, enhancing decision-making accuracy and speed. Virtual close streamlines the consolidation process by automating reconciliations and adjustments, significantly reducing the time required for closing books. For dynamic financial environments requiring foresight, predictive close offers superior proactive insights, while virtual close excels in accelerating and standardizing the actual closing procedure.

Connection

Predictive close and virtual close both enhance accounting accuracy by leveraging real-time data to forecast financial positions before the official close. Predictive close uses historical patterns and current inputs to estimate outcomes, while virtual close simulates the closing process continuously within the accounting period. Their integration streamlines financial reporting, reduces closing cycle times, and supports proactive decision-making in accounting.

Key Terms

Real-time data processing

Virtual close accelerates financial reporting by processing real-time data to finalize books instantly at period-end, reducing manual reconciliation efforts. Predictive close leverages real-time analytics and AI to forecast closing outcomes, identify bottlenecks, and streamline workflows before the actual close occurs. Explore how integrating these real-time data processing techniques can transform your financial close cycle.

Financial forecasting

Virtual close automates the consolidation of financial data to provide near real-time visibility into an organization's financial position, enhancing accuracy and reducing the traditional month-end close cycle. Predictive close uses advanced analytics and machine learning algorithms to forecast potential variances and cash flow trends, enabling proactive decision-making. Explore how integrating virtual and predictive close techniques can revolutionize your financial forecasting strategy.

Automation

Virtual close automates the financial close process by aggregating data from multiple sources in real time, reducing manual intervention and errors. Predictive close utilizes machine learning algorithms to forecast close timelines and identify potential bottlenecks, enhancing accuracy and efficiency. Explore how integrating these automation techniques transforms financial operations and accelerates close cycles.

Source and External Links

What Is Virtual Close Meaning & Definition - Virtual close is a remote and technology-driven approach to completing financial closing processes, allowing organizations to finalize financial statements digitally.

VirtualClose - VirtualClose offers remote closing and notarization services, empowering agents and sellers with fully digital closings through a collaborative platform.

What to Expect at a Remote House Closing - Remote closing, often called virtual closing, involves verifying identities virtually and signing documents online, streamlining the real estate transaction process.

dowidth.com

dowidth.com