Forensic analytics focuses on detecting and investigating financial fraud, irregularities, and compliance breaches using advanced data analysis techniques. Performance evaluation measures a company's financial health and operational efficiency through systematic assessment of key performance indicators and financial metrics. Explore the distinctions between these accounting approaches to enhance your financial oversight strategies.

Why it is important

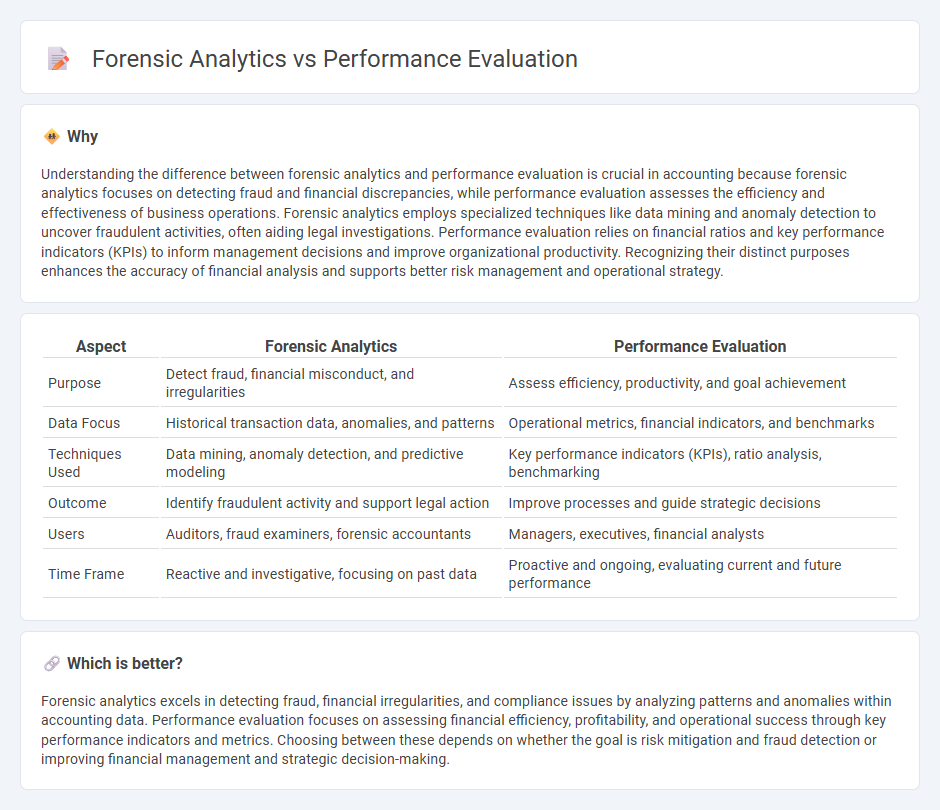

Understanding the difference between forensic analytics and performance evaluation is crucial in accounting because forensic analytics focuses on detecting fraud and financial discrepancies, while performance evaluation assesses the efficiency and effectiveness of business operations. Forensic analytics employs specialized techniques like data mining and anomaly detection to uncover fraudulent activities, often aiding legal investigations. Performance evaluation relies on financial ratios and key performance indicators (KPIs) to inform management decisions and improve organizational productivity. Recognizing their distinct purposes enhances the accuracy of financial analysis and supports better risk management and operational strategy.

Comparison Table

| Aspect | Forensic Analytics | Performance Evaluation |

|---|---|---|

| Purpose | Detect fraud, financial misconduct, and irregularities | Assess efficiency, productivity, and goal achievement |

| Data Focus | Historical transaction data, anomalies, and patterns | Operational metrics, financial indicators, and benchmarks |

| Techniques Used | Data mining, anomaly detection, and predictive modeling | Key performance indicators (KPIs), ratio analysis, benchmarking |

| Outcome | Identify fraudulent activity and support legal action | Improve processes and guide strategic decisions |

| Users | Auditors, fraud examiners, forensic accountants | Managers, executives, financial analysts |

| Time Frame | Reactive and investigative, focusing on past data | Proactive and ongoing, evaluating current and future performance |

Which is better?

Forensic analytics excels in detecting fraud, financial irregularities, and compliance issues by analyzing patterns and anomalies within accounting data. Performance evaluation focuses on assessing financial efficiency, profitability, and operational success through key performance indicators and metrics. Choosing between these depends on whether the goal is risk mitigation and fraud detection or improving financial management and strategic decision-making.

Connection

Forensic analytics enhances performance evaluation by identifying financial inconsistencies, fraud, and errors that impact the accuracy of performance metrics. Integrating forensic techniques with performance evaluation ensures more reliable financial reporting and informed decision-making. This connection improves organizational accountability and optimizes resource allocation through detailed data analysis.

Key Terms

**Performance evaluation:**

Performance evaluation systematically measures employee productivity, goal achievement, and skill competency using quantitative metrics and qualitative assessments to enhance organizational efficiency. It employs tools like key performance indicators (KPIs), 360-degree feedback, and performance appraisals to identify strengths and improvement areas. Explore deeper insights into how performance evaluation drives strategic growth and workforce development.

Variance Analysis

Performance evaluation involves measuring actual results against predetermined benchmarks to identify deviations and optimize operations. Forensic analytics employs variance analysis to detect anomalies suggesting fraud or financial misstatements within transactional data. Explore how integrating both approaches enhances accuracy in uncovering operational inefficiencies and financial irregularities.

Benchmarking

Performance evaluation measures an organization's efficiency and effectiveness using key performance indicators, while forensic analytics focuses on detecting anomalies, fraud, and compliance issues through detailed data examination. Benchmarking in performance evaluation facilitates comparison against industry standards or competitors to identify areas for improvement and best practices. Explore more to understand how integrating forensic analytics with benchmarking enhances business insights and decision-making.

Source and External Links

1000+ Performance Review Phrases for Employee Evaluation - Provides comprehensive lists of performance review phrases to evaluate employees across productivity, quality, and goal achievement, with both positive ("exceeds expectations") and negative ("below expectations") examples for clear, actionable feedback.

Effective Employee Performance Evaluation: Best Practices - Highlights that setting clear, collaborative goals between managers and employees is essential for objective, fair, and growth-focused performance evaluations that align with both individual and company objectives.

Performance Evaluation - Definition, Method, Survey and Example - Outlines a structured process for performance evaluation, including regular tracking, employee surveys, face-to-face meetings, and emphasizes the importance of probationary periods and ongoing feedback for employee development.

dowidth.com

dowidth.com