Data lake reconciliation involves harmonizing vast, unstructured data sets from multiple sources to ensure accuracy for advanced analytics, while financial close reconciliation focuses on verifying and matching financial transactions at period-end to guarantee precise financial statements. Both processes are critical for maintaining data integrity but serve different organizational needs: operational insights versus regulatory compliance. Explore more to understand how these reconciliation methods optimize your accounting workflows.

Why it is important

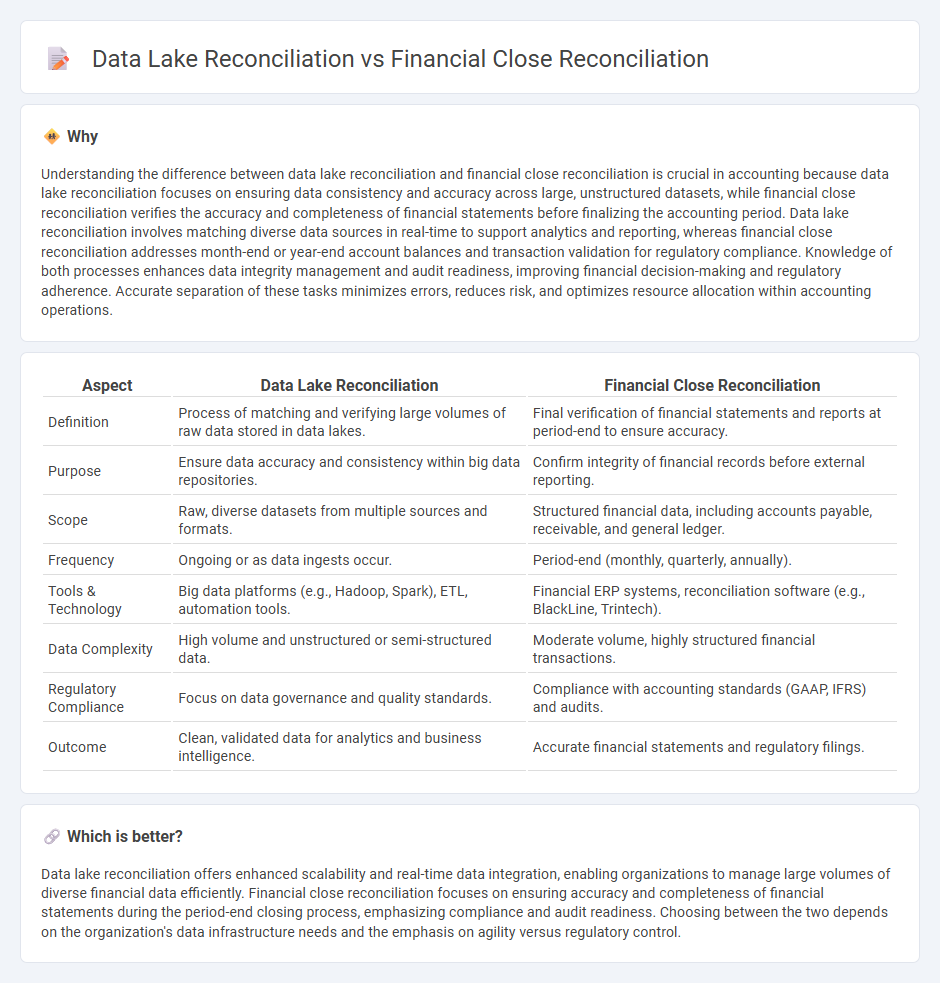

Understanding the difference between data lake reconciliation and financial close reconciliation is crucial in accounting because data lake reconciliation focuses on ensuring data consistency and accuracy across large, unstructured datasets, while financial close reconciliation verifies the accuracy and completeness of financial statements before finalizing the accounting period. Data lake reconciliation involves matching diverse data sources in real-time to support analytics and reporting, whereas financial close reconciliation addresses month-end or year-end account balances and transaction validation for regulatory compliance. Knowledge of both processes enhances data integrity management and audit readiness, improving financial decision-making and regulatory adherence. Accurate separation of these tasks minimizes errors, reduces risk, and optimizes resource allocation within accounting operations.

Comparison Table

| Aspect | Data Lake Reconciliation | Financial Close Reconciliation |

|---|---|---|

| Definition | Process of matching and verifying large volumes of raw data stored in data lakes. | Final verification of financial statements and reports at period-end to ensure accuracy. |

| Purpose | Ensure data accuracy and consistency within big data repositories. | Confirm integrity of financial records before external reporting. |

| Scope | Raw, diverse datasets from multiple sources and formats. | Structured financial data, including accounts payable, receivable, and general ledger. |

| Frequency | Ongoing or as data ingests occur. | Period-end (monthly, quarterly, annually). |

| Tools & Technology | Big data platforms (e.g., Hadoop, Spark), ETL, automation tools. | Financial ERP systems, reconciliation software (e.g., BlackLine, Trintech). |

| Data Complexity | High volume and unstructured or semi-structured data. | Moderate volume, highly structured financial transactions. |

| Regulatory Compliance | Focus on data governance and quality standards. | Compliance with accounting standards (GAAP, IFRS) and audits. |

| Outcome | Clean, validated data for analytics and business intelligence. | Accurate financial statements and regulatory filings. |

Which is better?

Data lake reconciliation offers enhanced scalability and real-time data integration, enabling organizations to manage large volumes of diverse financial data efficiently. Financial close reconciliation focuses on ensuring accuracy and completeness of financial statements during the period-end closing process, emphasizing compliance and audit readiness. Choosing between the two depends on the organization's data infrastructure needs and the emphasis on agility versus regulatory control.

Connection

Data lake reconciliation and financial close reconciliation connect through the consolidation of vast financial data sets to ensure accuracy and completeness. Data lakes aggregate raw transactional data from multiple sources, enabling comprehensive validation during the financial close process. This integration supports timely identification of discrepancies, streamlining audit trails and regulatory compliance.

Key Terms

Trial Balance

Financial close reconciliation involves verifying that the trial balance accurately reflects all accounting entries during the period-end close, ensuring completeness and correctness of financial reports. Data lake reconciliation focuses on validating the consistency and integrity of trial balance data ingested from multiple sources into a centralized repository for analytics and reporting. Explore best practices and tools to optimize trial balance reconciliation across financial close and data lake environments.

Data Consistency

Financial close reconciliation ensures the accuracy of financial records by verifying transactions between accounting systems and external statements, maintaining regulatory compliance and audit readiness. Data lake reconciliation focuses on data consistency across vast, diverse datasets, validating data ingestion, transformation, and storage processes to support reliable analytics and business intelligence. Explore best practices for maintaining data integrity in both financial and big data environments to enhance decision-making accuracy.

Source System

Financial close reconciliation emphasizes matching transactions and balances directly from core accounting systems like ERP to ensure accuracy in financial statements, relying heavily on source system integrity. Data lake reconciliation involves aggregating, transforming, and validating data from multiple source systems, including CRM, ERP, and external feeds, to maintain consistency and completeness across vast data repositories. Explore how optimizing source system integration enhances both reconciliation processes for improved financial accuracy and data governance.

Source and External Links

The Financial Close Process - Financial close reconciliation involves detailed steps like reconciling bank balances, revenue, expense accounts, payables, receivables, accrued and prepaid accounts, sub-ledgers, petty cash, and assets/liabilities as part of the overall monthly close checklist to ensure accuracy before closing the books.

Account Reconciliation - A Vital Step of the Financial Close Process - Account reconciliation is crucial within financial close as it matches transactions and balances to detect and resolve discrepancies, assuring accuracy and completeness of accounting records, though many still rely on manual, error-prone processes.

What is the Financial Close Process? | F&A Glossary - Financial reconciliation during close involves reviewing and reducing account balances, reconciling debits and credits, and validating data through account reconciliations and balance sheet reviews before producing final financial statements.

dowidth.com

dowidth.com