Tokenized assets accounting involves recording ownership of digital representations of physical or intangible assets on a blockchain, enabling enhanced transparency, liquidity, and fractional ownership. Physical asset accounting tracks tangible assets such as machinery, real estate, or inventory through traditional methods focused on depreciation, valuation, and physical verification. Explore the distinct methodologies and benefits of tokenized asset accounting compared to physical asset accounting.

Why it is important

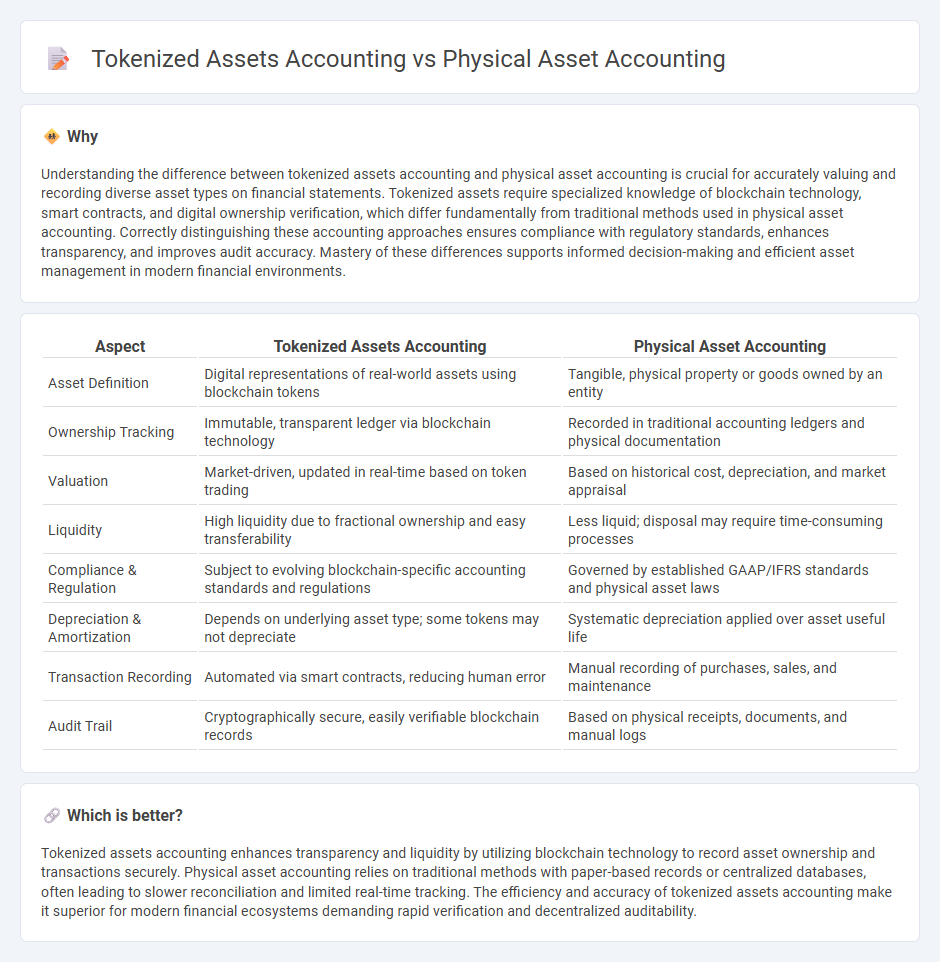

Understanding the difference between tokenized assets accounting and physical asset accounting is crucial for accurately valuing and recording diverse asset types on financial statements. Tokenized assets require specialized knowledge of blockchain technology, smart contracts, and digital ownership verification, which differ fundamentally from traditional methods used in physical asset accounting. Correctly distinguishing these accounting approaches ensures compliance with regulatory standards, enhances transparency, and improves audit accuracy. Mastery of these differences supports informed decision-making and efficient asset management in modern financial environments.

Comparison Table

| Aspect | Tokenized Assets Accounting | Physical Asset Accounting |

|---|---|---|

| Asset Definition | Digital representations of real-world assets using blockchain tokens | Tangible, physical property or goods owned by an entity |

| Ownership Tracking | Immutable, transparent ledger via blockchain technology | Recorded in traditional accounting ledgers and physical documentation |

| Valuation | Market-driven, updated in real-time based on token trading | Based on historical cost, depreciation, and market appraisal |

| Liquidity | High liquidity due to fractional ownership and easy transferability | Less liquid; disposal may require time-consuming processes |

| Compliance & Regulation | Subject to evolving blockchain-specific accounting standards and regulations | Governed by established GAAP/IFRS standards and physical asset laws |

| Depreciation & Amortization | Depends on underlying asset type; some tokens may not depreciate | Systematic depreciation applied over asset useful life |

| Transaction Recording | Automated via smart contracts, reducing human error | Manual recording of purchases, sales, and maintenance |

| Audit Trail | Cryptographically secure, easily verifiable blockchain records | Based on physical receipts, documents, and manual logs |

Which is better?

Tokenized assets accounting enhances transparency and liquidity by utilizing blockchain technology to record asset ownership and transactions securely. Physical asset accounting relies on traditional methods with paper-based records or centralized databases, often leading to slower reconciliation and limited real-time tracking. The efficiency and accuracy of tokenized assets accounting make it superior for modern financial ecosystems demanding rapid verification and decentralized auditability.

Connection

Tokenized assets accounting and physical asset accounting are interconnected through the representation of real-world assets on blockchain platforms, enabling transparent and immutable record-keeping for asset ownership and transactions. This integration facilitates accurate valuation, tracking, and auditing of assets by linking digital tokens to their underlying physical counterparts. Effective accounting practices must reconcile the blockchain ledger with traditional asset records to ensure compliance, financial reporting accuracy, and risk management.

Key Terms

Depreciation vs. Token Valuation

Physical asset accounting relies on systematic depreciation methods like straight-line or declining balance to allocate asset costs over useful life, reflecting wear and obsolescence. Tokenized assets accounting prioritizes token valuation, incorporating market-driven price fluctuations, liquidity, and blockchain-based provenance for real-time valuation. Explore the nuances of asset management by understanding how depreciation contrasts with dynamic token valuation models.

Tangible Asset Registry vs. Blockchain Ledger

Tangible Asset Registry systems manage physical asset accounting by recording ownership, depreciation, and maintenance details within centralized databases, ensuring compliance with traditional financial standards. Blockchain Ledger technology supports tokenized asset accounting by providing decentralized, immutable records that enable real-time tracking, fractional ownership, and transparent transactions of digital representations of physical assets. Explore how integrating Tangible Asset Registries with Blockchain Ledgers can revolutionize asset management and accounting practices.

Ownership Certificate vs. Smart Contract

Physical asset accounting relies on Ownership Certificates to verify legal possession and transfer of tangible assets, creating a tangible, paper-based record trusted in traditional financial systems. Tokenized assets accounting uses Smart Contracts on blockchain platforms to automate ownership, transfer, and compliance processes with enhanced transparency and security through immutable digital records. Explore further how these accounting mechanisms transform asset management and regulatory reporting.

Source and External Links

Asset Capitalizing Rules, Do's & Don'ts - A comprehensive guide on fixed asset accounting do's and don'ts, including capitalizing costs and managing depreciation.

Fixed-Asset Accounting Basics - Details the lifecycle of fixed assets, from purchase to disposal, and explains the importance of distinguishing between capitalized and expensed costs.

Draft Chapter 3 Physical Asset Accounts - Discusses the management of physical asset accounts, including inventoried assets and changes in classification.

dowidth.com

dowidth.com