Transfer pricing analytics involves examining pricing strategies between related business entities to ensure compliance with tax regulations and optimize financial performance. Intercompany transactions refer to the exchange of goods, services, or funds between subsidiaries within the same corporate group, requiring careful documentation and analysis to avoid transfer pricing risks. Explore deeper insights into how transfer pricing analytics can enhance the management of intercompany transactions.

Why it is important

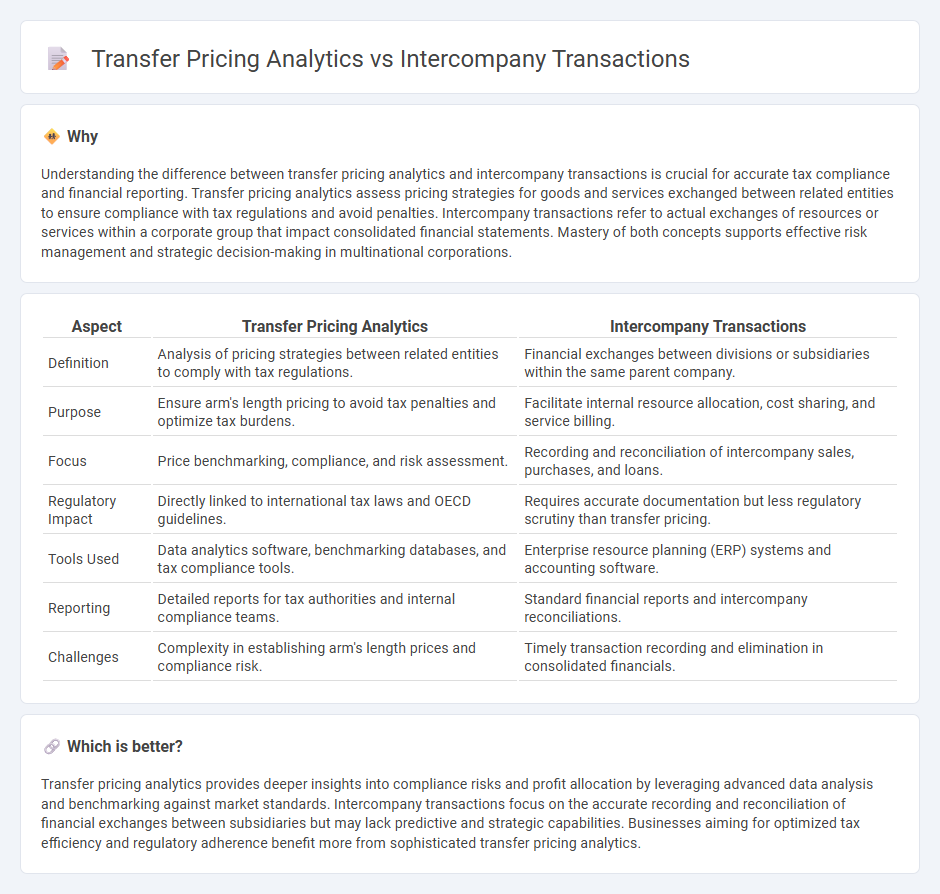

Understanding the difference between transfer pricing analytics and intercompany transactions is crucial for accurate tax compliance and financial reporting. Transfer pricing analytics assess pricing strategies for goods and services exchanged between related entities to ensure compliance with tax regulations and avoid penalties. Intercompany transactions refer to actual exchanges of resources or services within a corporate group that impact consolidated financial statements. Mastery of both concepts supports effective risk management and strategic decision-making in multinational corporations.

Comparison Table

| Aspect | Transfer Pricing Analytics | Intercompany Transactions |

|---|---|---|

| Definition | Analysis of pricing strategies between related entities to comply with tax regulations. | Financial exchanges between divisions or subsidiaries within the same parent company. |

| Purpose | Ensure arm's length pricing to avoid tax penalties and optimize tax burdens. | Facilitate internal resource allocation, cost sharing, and service billing. |

| Focus | Price benchmarking, compliance, and risk assessment. | Recording and reconciliation of intercompany sales, purchases, and loans. |

| Regulatory Impact | Directly linked to international tax laws and OECD guidelines. | Requires accurate documentation but less regulatory scrutiny than transfer pricing. |

| Tools Used | Data analytics software, benchmarking databases, and tax compliance tools. | Enterprise resource planning (ERP) systems and accounting software. |

| Reporting | Detailed reports for tax authorities and internal compliance teams. | Standard financial reports and intercompany reconciliations. |

| Challenges | Complexity in establishing arm's length prices and compliance risk. | Timely transaction recording and elimination in consolidated financials. |

Which is better?

Transfer pricing analytics provides deeper insights into compliance risks and profit allocation by leveraging advanced data analysis and benchmarking against market standards. Intercompany transactions focus on the accurate recording and reconciliation of financial exchanges between subsidiaries but may lack predictive and strategic capabilities. Businesses aiming for optimized tax efficiency and regulatory adherence benefit more from sophisticated transfer pricing analytics.

Connection

Transfer pricing analytics plays a crucial role in monitoring and optimizing intercompany transactions by assessing the pricing structures used between affiliated entities to ensure compliance with tax regulations and prevent profit shifting. Analyzing large volumes of transactional data enables companies to establish arm's length prices that reflect market conditions, minimizing transfer pricing risks and potential tax penalties. Effective transfer pricing analytics supports transparency and accurate reporting, enhancing overall financial strategy and global tax compliance.

Key Terms

Elimination Entries

Intercompany transactions involve the exchange of goods, services, or funds between subsidiaries of the same parent company, requiring accurate recording to maintain financial integrity. Transfer pricing analytics assess pricing strategies used in these transactions to ensure compliance with tax regulations while optimizing profit allocation across jurisdictions. Explore the critical role of elimination entries in consolidating financial statements and minimizing discrepancies in intercompany reporting.

Arm’s Length Principle

Intercompany transactions involve the exchange of goods, services, or funds between related corporate entities, requiring strict compliance with the Arm's Length Principle to ensure pricing mirrors independent market conditions. Transfer pricing analytics utilize data-driven methods and benchmarking studies to assess and justify the prices set in these related-party transactions, minimizing tax risks and regulatory scrutiny. Explore our detailed insights to master the application of the Arm's Length Principle in transfer pricing strategies.

Comparable Uncontrolled Price (CUP) Method

The Comparable Uncontrolled Price (CUP) Method evaluates intercompany transactions by comparing prices charged in controlled transactions with those in comparable uncontrolled transactions, ensuring compliance with transfer pricing regulations. This method provides precise benchmark data for analyzing the arm's length nature of intercompany pricing, particularly useful in industries with standardized products or services. Explore detailed methodologies and case studies to optimize transfer pricing analytics and mitigate audit risks.

Source and External Links

Intercompany Transactions - This webpage provides an overview of intercompany transactions, including their definition, how they work, and best practices for managing them in multinational companies.

What Are Intercompany Transactions? - This article explains intercompany transactions as purchases or sales between a parent company and its subsidiaries, detailing types such as downstream, upstream, and lateral transactions.

What Is Intercompany Accounting? - This resource discusses intercompany transactions, categorizing them into downstream, upstream, and lateral transactions, and highlights best practices for their management.

dowidth.com

dowidth.com