Embedded finance reconciliation automates the integration of financial services within non-financial platforms, streamlining payment tracking and reducing manual errors. Cash reconciliation focuses on verifying cash transactions and balances to ensure accuracy in physical and digital cash flows. Explore more to understand how these reconciliation methods enhance financial accuracy and operational efficiency.

Why it is important

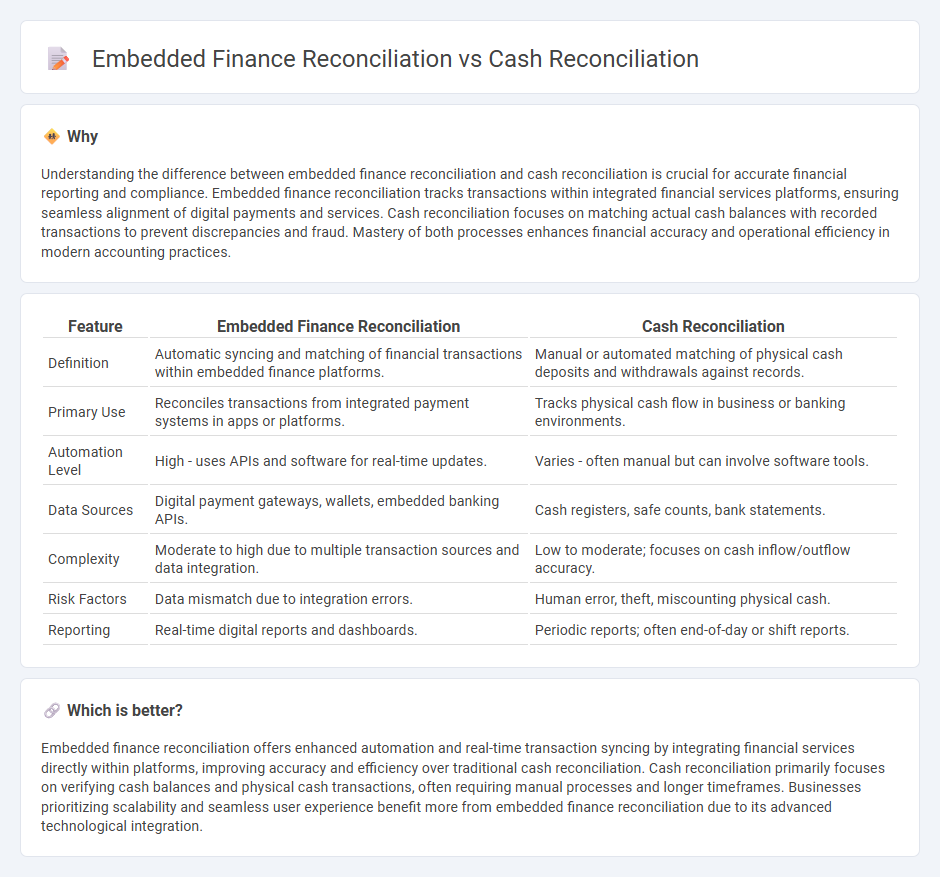

Understanding the difference between embedded finance reconciliation and cash reconciliation is crucial for accurate financial reporting and compliance. Embedded finance reconciliation tracks transactions within integrated financial services platforms, ensuring seamless alignment of digital payments and services. Cash reconciliation focuses on matching actual cash balances with recorded transactions to prevent discrepancies and fraud. Mastery of both processes enhances financial accuracy and operational efficiency in modern accounting practices.

Comparison Table

| Feature | Embedded Finance Reconciliation | Cash Reconciliation |

|---|---|---|

| Definition | Automatic syncing and matching of financial transactions within embedded finance platforms. | Manual or automated matching of physical cash deposits and withdrawals against records. |

| Primary Use | Reconciles transactions from integrated payment systems in apps or platforms. | Tracks physical cash flow in business or banking environments. |

| Automation Level | High - uses APIs and software for real-time updates. | Varies - often manual but can involve software tools. |

| Data Sources | Digital payment gateways, wallets, embedded banking APIs. | Cash registers, safe counts, bank statements. |

| Complexity | Moderate to high due to multiple transaction sources and data integration. | Low to moderate; focuses on cash inflow/outflow accuracy. |

| Risk Factors | Data mismatch due to integration errors. | Human error, theft, miscounting physical cash. |

| Reporting | Real-time digital reports and dashboards. | Periodic reports; often end-of-day or shift reports. |

Which is better?

Embedded finance reconciliation offers enhanced automation and real-time transaction syncing by integrating financial services directly within platforms, improving accuracy and efficiency over traditional cash reconciliation. Cash reconciliation primarily focuses on verifying cash balances and physical cash transactions, often requiring manual processes and longer timeframes. Businesses prioritizing scalability and seamless user experience benefit more from embedded finance reconciliation due to its advanced technological integration.

Connection

Embedded finance reconciliation integrates transactional data from financial services directly into accounting systems, enhancing the accuracy of cash reconciliation by automating the matching of payments and receipts. This seamless integration reduces manual errors and accelerates the verification process, ensuring real-time alignment between embedded finance platforms and cash accounts. Effective synchronization of embedded finance reconciliation with cash reconciliation improves overall financial reporting precision and operational efficiency.

Key Terms

**Cash Reconciliation:**

Cash reconciliation involves matching cash records with bank statements to ensure accuracy and detect discrepancies in an organization's financial transactions. This process is crucial for maintaining transparent financial reporting and preventing errors or fraud in cash handling. Discover how effective cash reconciliation techniques can optimize your financial management.

Bank Statement

Cash reconciliation involves matching cash transactions recorded in a company's ledger with its bank statement to ensure accuracy and identify discrepancies. Embedded finance reconciliation integrates financial services within non-financial platforms, requiring synchronization of bank statement data with digital wallets or payment gateways for comprehensive transaction validation. Explore detailed methodologies and best practices for efficient bank statement reconciliation in both cash and embedded finance contexts.

Ledger Balance

Cash reconciliation involves matching cash transactions to the ledger balance to ensure accuracy in recorded funds, while embedded finance reconciliation integrates financial services directly within platforms, syncing transactional data with ledger balances in real-time for seamless financial oversight. Ledger balance accuracy is critical in both processes to maintain trust, prevent discrepancies, and ensure regulatory compliance. Explore more to understand how advanced reconciliation tools optimize ledger management and financial integrity.

Source and External Links

What is Cash Reconciliation: Steps, Examples and ... - Cash reconciliation is the process of comparing a company's accounting records in its cash book with the bank statement, ensuring all transactions are properly recorded and discrepancies are investigated and corrected to match balances.

Cash Reconciliation Defined & Its Importance - Cash reconciliation verifies that cash receipts from sales equal the cash recorded, involving steps like collecting receipts, comparing balances, investigating discrepancies, adjusting records, and documenting the process for accuracy.

How to Perform a Cash Reconciliation: A Step-... - Performing cash reconciliation entails determining the period, gathering cash-related reports from billing, payment systems, and bank statements, filtering transactions, and matching records to ensure accuracy.

dowidth.com

dowidth.com