Invoice factoring platforms enable businesses to sell outstanding invoices to third-party financiers at a discount, improving cash flow and reducing credit risk. Reverse factoring, also known as supply chain financing, involves a buyer initiating payments to suppliers through a financial institution, enhancing supplier payment terms and buyer's working capital management. Explore the key differences and benefits of each method to optimize your company's financial strategy.

Why it is important

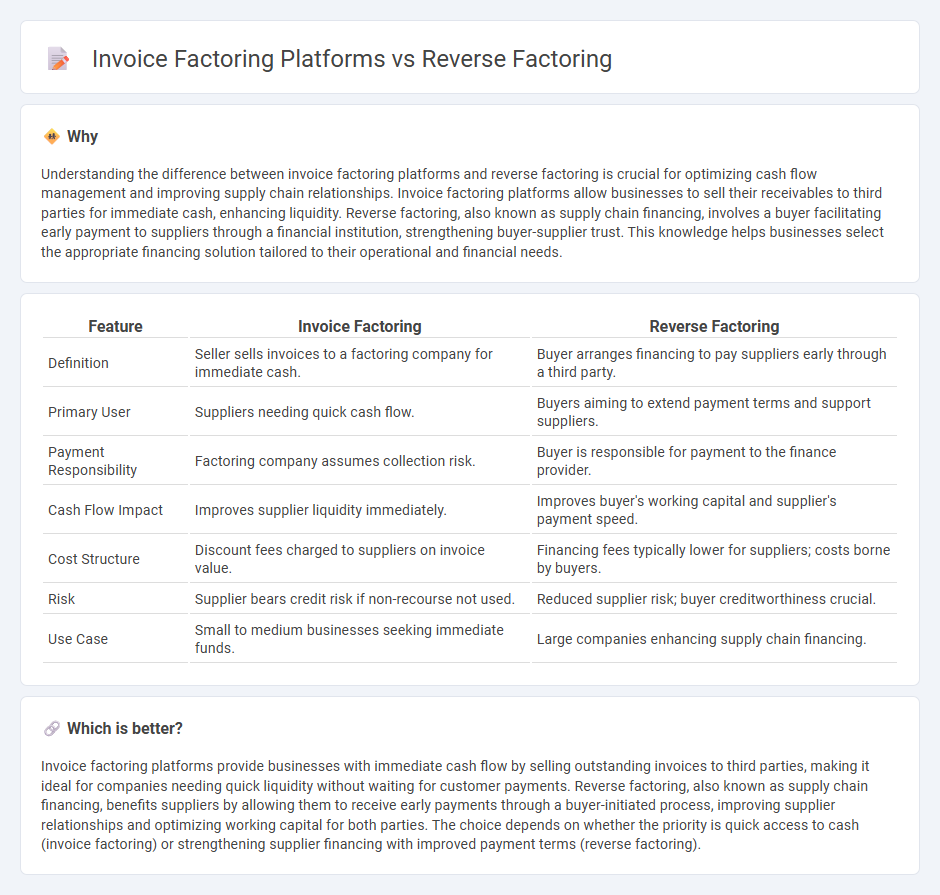

Understanding the difference between invoice factoring platforms and reverse factoring is crucial for optimizing cash flow management and improving supply chain relationships. Invoice factoring platforms allow businesses to sell their receivables to third parties for immediate cash, enhancing liquidity. Reverse factoring, also known as supply chain financing, involves a buyer facilitating early payment to suppliers through a financial institution, strengthening buyer-supplier trust. This knowledge helps businesses select the appropriate financing solution tailored to their operational and financial needs.

Comparison Table

| Feature | Invoice Factoring | Reverse Factoring |

|---|---|---|

| Definition | Seller sells invoices to a factoring company for immediate cash. | Buyer arranges financing to pay suppliers early through a third party. |

| Primary User | Suppliers needing quick cash flow. | Buyers aiming to extend payment terms and support suppliers. |

| Payment Responsibility | Factoring company assumes collection risk. | Buyer is responsible for payment to the finance provider. |

| Cash Flow Impact | Improves supplier liquidity immediately. | Improves buyer's working capital and supplier's payment speed. |

| Cost Structure | Discount fees charged to suppliers on invoice value. | Financing fees typically lower for suppliers; costs borne by buyers. |

| Risk | Supplier bears credit risk if non-recourse not used. | Reduced supplier risk; buyer creditworthiness crucial. |

| Use Case | Small to medium businesses seeking immediate funds. | Large companies enhancing supply chain financing. |

Which is better?

Invoice factoring platforms provide businesses with immediate cash flow by selling outstanding invoices to third parties, making it ideal for companies needing quick liquidity without waiting for customer payments. Reverse factoring, also known as supply chain financing, benefits suppliers by allowing them to receive early payments through a buyer-initiated process, improving supplier relationships and optimizing working capital for both parties. The choice depends on whether the priority is quick access to cash (invoice factoring) or strengthening supplier financing with improved payment terms (reverse factoring).

Connection

Invoice factoring platforms and reverse factoring both streamline cash flow management by accelerating payment cycles; invoice factoring allows businesses to sell unpaid invoices for immediate liquidity, while reverse factoring involves suppliers receiving early payment through a financer initiated by the buyer. These financial technologies leverage digital platforms to reduce credit risk and improve working capital efficiency for both suppliers and buyers. Integration of these methods helps create a seamless supply chain finance ecosystem, enhancing overall business liquidity and operational stability.

Key Terms

Supply Chain Finance

Reverse factoring accelerates supplier payments by allowing buyers to approve invoices and financiers to pay suppliers promptly, improving cash flow across the supply chain. Invoice factoring platforms enable businesses to sell their receivables to third parties for immediate liquidity but primarily focus on the seller's financial needs rather than entire supply chain optimization. Explore how supply chain finance through reverse factoring platforms can strengthen supplier relationships and working capital management.

Accounts Receivable

Reverse factoring platforms streamline accounts receivable by enabling suppliers to receive early payments through buyer-initiated financing, improving cash flow without increasing supplier debt. Invoice factoring platforms involve businesses selling their receivables to third-party financiers at a discount, providing immediate cash but often at higher costs and risks. Explore our detailed comparison to understand how each impacts your accounts receivable management and business liquidity.

Early Payment

Reverse factoring platforms enable suppliers to receive early payment by allowing buyers to approve invoices for financing, improving cash flow without increasing supplier risk. Invoice factoring platforms provide businesses with immediate cash by selling outstanding invoices to a third party, which then manages collections and assumes credit risk. Explore detailed comparisons and benefits of early payment solutions to optimize your financial operations.

Source and External Links

What Is Reverse Factoring? - NetSuite - Reverse factoring is a financing method that improves cash flow for both buyers and suppliers by involving a third-party financier to pay suppliers early.

What is reverse factoring? | Definition & Meaning | SAP Taulia - Reverse factoring is a supplier finance solution that allows buyers to offer early payments to their suppliers based on approved invoices.

Invoice Factoring vs Reverse Factoring: Which is Best for Your Business - Reverse factoring lets buyers arrange for suppliers to receive early payments through a finance company, improving the cash flow for both parties.

dowidth.com

dowidth.com