Embedded finance reporting integrates financial services directly into business processes, enabling real-time data flow and enhanced decision-making. Integrated reporting combines financial and non-financial information to provide a holistic view of organizational performance and sustainability. Explore how these reporting methods revolutionize accounting practices and corporate transparency.

Why it is important

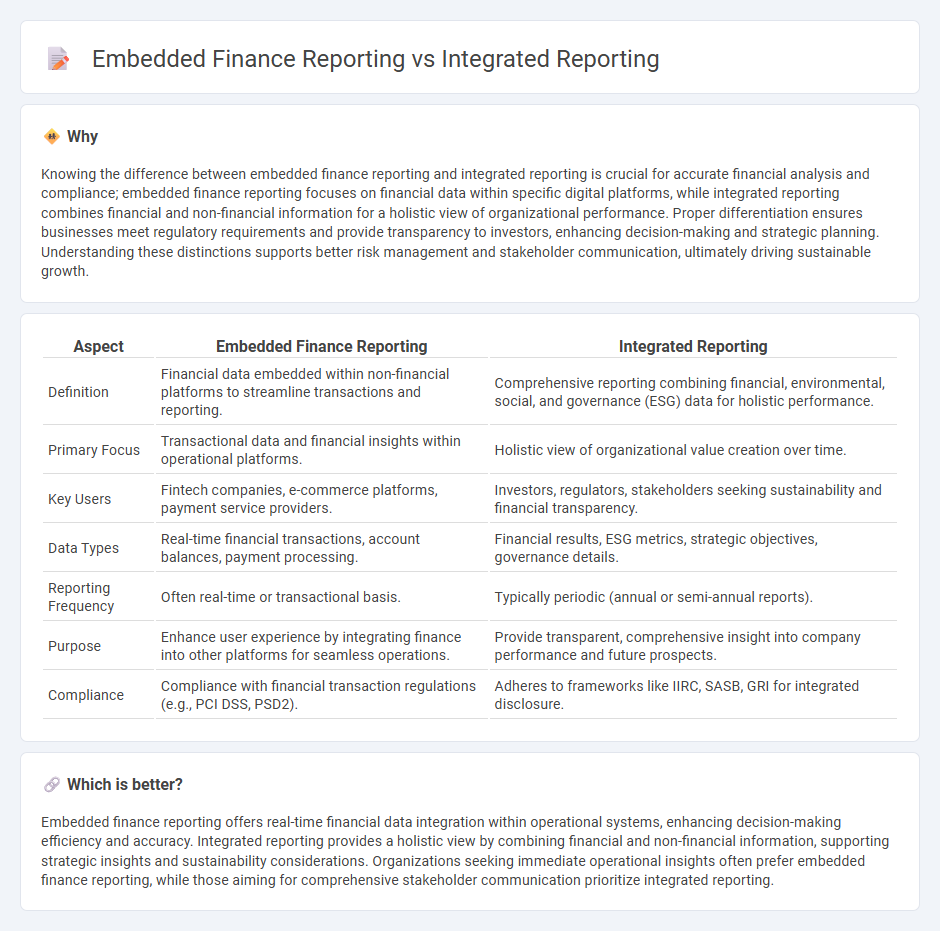

Knowing the difference between embedded finance reporting and integrated reporting is crucial for accurate financial analysis and compliance; embedded finance reporting focuses on financial data within specific digital platforms, while integrated reporting combines financial and non-financial information for a holistic view of organizational performance. Proper differentiation ensures businesses meet regulatory requirements and provide transparency to investors, enhancing decision-making and strategic planning. Understanding these distinctions supports better risk management and stakeholder communication, ultimately driving sustainable growth.

Comparison Table

| Aspect | Embedded Finance Reporting | Integrated Reporting |

|---|---|---|

| Definition | Financial data embedded within non-financial platforms to streamline transactions and reporting. | Comprehensive reporting combining financial, environmental, social, and governance (ESG) data for holistic performance. |

| Primary Focus | Transactional data and financial insights within operational platforms. | Holistic view of organizational value creation over time. |

| Key Users | Fintech companies, e-commerce platforms, payment service providers. | Investors, regulators, stakeholders seeking sustainability and financial transparency. |

| Data Types | Real-time financial transactions, account balances, payment processing. | Financial results, ESG metrics, strategic objectives, governance details. |

| Reporting Frequency | Often real-time or transactional basis. | Typically periodic (annual or semi-annual reports). |

| Purpose | Enhance user experience by integrating finance into other platforms for seamless operations. | Provide transparent, comprehensive insight into company performance and future prospects. |

| Compliance | Compliance with financial transaction regulations (e.g., PCI DSS, PSD2). | Adheres to frameworks like IIRC, SASB, GRI for integrated disclosure. |

Which is better?

Embedded finance reporting offers real-time financial data integration within operational systems, enhancing decision-making efficiency and accuracy. Integrated reporting provides a holistic view by combining financial and non-financial information, supporting strategic insights and sustainability considerations. Organizations seeking immediate operational insights often prefer embedded finance reporting, while those aiming for comprehensive stakeholder communication prioritize integrated reporting.

Connection

Embedded finance reporting integrates real-time financial data into business operations, enhancing transparency and decision-making. Integrated reporting combines financial and non-financial information to provide a comprehensive view of organizational performance. Together, these approaches enable seamless, holistic accounting practices that improve accuracy and stakeholder communication.

Key Terms

**Integrated reporting:**

Integrated reporting combines financial and non-financial data to provide a holistic view of an organization's performance, strategy, governance, and value creation over time. It emphasizes connectivity of information across environmental, social, and governance (ESG) factors alongside traditional financial metrics. Explore the comprehensive benefits and frameworks of integrated reporting to enhance your corporate transparency and stakeholder communication.

Value creation

Integrated reporting focuses on delivering a holistic view of an organization's strategy, governance, performance, and prospects, emphasizing how value is created over time through financial and non-financial capitals. Embedded finance reporting, on the other hand, centers on detailing financial services seamlessly integrated into non-financial platforms, highlighting real-time transaction data and user engagement metrics that drive immediate value creation. Discover the nuances of value creation in both reporting approaches to enhance strategic decision-making and stakeholder communication.

Capitals (financial, manufactured, intellectual, etc.)

Integrated reporting encompasses a holistic framework that captures financial, manufactured, intellectual, human, social, and natural capitals to provide a comprehensive view of an organization's value creation over time. Embedded finance reporting focuses primarily on financial capital by integrating financial services seamlessly into non-financial platforms, emphasizing transaction data and user engagement metrics. Explore detailed comparisons of how each reporting approach leverages capitals to enhance strategic decision-making and transparency.

Source and External Links

Integrated reporting - Wikipedia - Integrated reporting (IR) is a concise communication about how an organization's strategy, governance, performance, and prospects lead to value creation over the short, medium, and long term, combining financial and non-financial information to provide context for decision making mainly for providers of financial capital.

What is Integrated Reporting? - ESG - Integrated reporting presents a comprehensive view of a company's financial and non-financial factors, emphasizing ESG issues and governance to showcase how sustainable value is created and builds accountability and trust among stakeholders.

Integrated Reporting Explained - YouTube - Integrated reporting is a process based on integrated thinking that results in periodic reports showing how a company uses various resources (the six capitals) to create value over time, providing a forward-looking perspective beyond traditional financial statements.

dowidth.com

dowidth.com