Zero trust accounting implements strict verification protocols at every transaction stage to prevent fraud and ensure data integrity, contrasting with single-entry accounting's simplistic one-sided record approach. Single-entry accounting tracks transactions using only one ledger entry, making it easier but more prone to errors and less secure. Explore the key differences and benefits of both systems to enhance your financial accuracy and security.

Why it is important

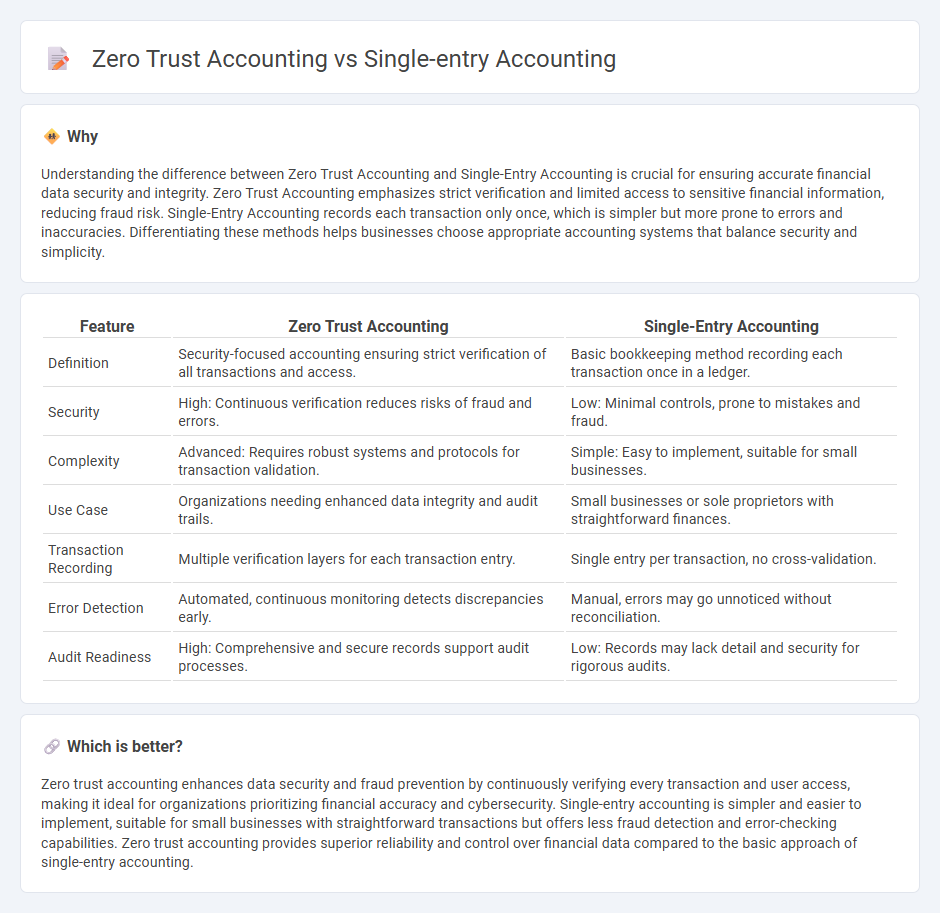

Understanding the difference between Zero Trust Accounting and Single-Entry Accounting is crucial for ensuring accurate financial data security and integrity. Zero Trust Accounting emphasizes strict verification and limited access to sensitive financial information, reducing fraud risk. Single-Entry Accounting records each transaction only once, which is simpler but more prone to errors and inaccuracies. Differentiating these methods helps businesses choose appropriate accounting systems that balance security and simplicity.

Comparison Table

| Feature | Zero Trust Accounting | Single-Entry Accounting |

|---|---|---|

| Definition | Security-focused accounting ensuring strict verification of all transactions and access. | Basic bookkeeping method recording each transaction once in a ledger. |

| Security | High: Continuous verification reduces risks of fraud and errors. | Low: Minimal controls, prone to mistakes and fraud. |

| Complexity | Advanced: Requires robust systems and protocols for transaction validation. | Simple: Easy to implement, suitable for small businesses. |

| Use Case | Organizations needing enhanced data integrity and audit trails. | Small businesses or sole proprietors with straightforward finances. |

| Transaction Recording | Multiple verification layers for each transaction entry. | Single entry per transaction, no cross-validation. |

| Error Detection | Automated, continuous monitoring detects discrepancies early. | Manual, errors may go unnoticed without reconciliation. |

| Audit Readiness | High: Comprehensive and secure records support audit processes. | Low: Records may lack detail and security for rigorous audits. |

Which is better?

Zero trust accounting enhances data security and fraud prevention by continuously verifying every transaction and user access, making it ideal for organizations prioritizing financial accuracy and cybersecurity. Single-entry accounting is simpler and easier to implement, suitable for small businesses with straightforward transactions but offers less fraud detection and error-checking capabilities. Zero trust accounting provides superior reliability and control over financial data compared to the basic approach of single-entry accounting.

Connection

Zero trust accounting enhances security by verifying every transaction independently, which complements single-entry accounting's streamlined approach by ensuring each entry is accurate and authenticated. Both methods prioritize data integrity: zero trust through rigorous validation protocols and single-entry accounting through simplified, transparent record-keeping. Integrating zero trust principles into single-entry accounting systems can reduce fraud risks and improve financial accuracy for small businesses and sole proprietors.

Key Terms

Single-entry accounting:

Single-entry accounting records financial transactions in a single ledger, emphasizing simplicity and ease of use for small businesses and personal finances, with each transaction documented once. This method contrasts with double-entry accounting that requires every entry to be recorded twice, ensuring accuracy but increasing complexity. Discover more about how Single-entry accounting can streamline your bookkeeping processes and when it's the appropriate choice.

Cash Book

Single-entry accounting records cash transactions in a simple, linear format within the Cash Book, making it easy for small businesses to track cash inflows and outflows but less effective for comprehensive financial analysis. Zero trust accounting emphasizes rigorous verification of each transaction's authenticity and security, ensuring high integrity and reducing fraud risks in Cash Book entries. Explore detailed methodologies and benefits of each approach for optimal cash management.

Receipts and Payments

Single-entry accounting simplifies financial tracking by recording only receipts and payments, ideal for small businesses with straightforward transactions. Zero trust accounting enhances security by verifying every transaction independently, preventing unauthorized access and fraud in financial records. Explore how these methods impact accuracy and security in financial management.

Source and External Links

single-entry accounting | Wex - Law.Cornell.Edu - Single-entry accounting is a method of recording each financial transaction once, tracking assets, liabilities, income, and expenses without a double-entry system, typically suitable for small or simple businesses but unable to produce a full balance sheet or accurately track inventory.

Single Entry System In Accounting | Definition, Types & ... - Single-entry accounting records each transaction only once, typically in a simple table format reflecting income, expenses, and balance, making it straightforward but less comprehensive than double-entry bookkeeping.

Single Entry Bookkeeping: Everything You Need to Know - Single-entry bookkeeping records one entry per transaction, usually in a cash book that logs the date, description, income or expense amount, and running balance, focusing chiefly on cash flow without tracking assets or liabilities in detail.

dowidth.com

dowidth.com