Real-time expense reconciliation enables immediate matching of transactions with recorded expenses, enhancing financial accuracy and reducing discrepancies. Continuous accounting integrates ongoing data entry and automated processes to maintain up-to-date financial records throughout the accounting period. Explore the advantages and implementation strategies of both methods to optimize your organization's financial management.

Why it is important

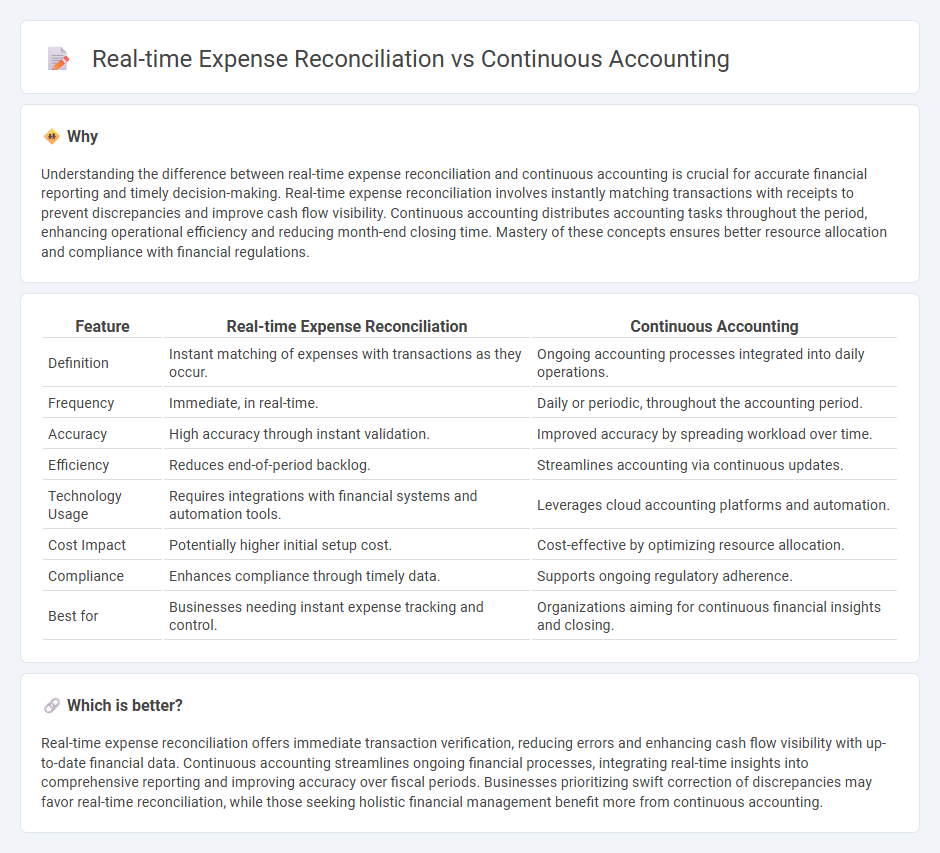

Understanding the difference between real-time expense reconciliation and continuous accounting is crucial for accurate financial reporting and timely decision-making. Real-time expense reconciliation involves instantly matching transactions with receipts to prevent discrepancies and improve cash flow visibility. Continuous accounting distributes accounting tasks throughout the period, enhancing operational efficiency and reducing month-end closing time. Mastery of these concepts ensures better resource allocation and compliance with financial regulations.

Comparison Table

| Feature | Real-time Expense Reconciliation | Continuous Accounting |

|---|---|---|

| Definition | Instant matching of expenses with transactions as they occur. | Ongoing accounting processes integrated into daily operations. |

| Frequency | Immediate, in real-time. | Daily or periodic, throughout the accounting period. |

| Accuracy | High accuracy through instant validation. | Improved accuracy by spreading workload over time. |

| Efficiency | Reduces end-of-period backlog. | Streamlines accounting via continuous updates. |

| Technology Usage | Requires integrations with financial systems and automation tools. | Leverages cloud accounting platforms and automation. |

| Cost Impact | Potentially higher initial setup cost. | Cost-effective by optimizing resource allocation. |

| Compliance | Enhances compliance through timely data. | Supports ongoing regulatory adherence. |

| Best for | Businesses needing instant expense tracking and control. | Organizations aiming for continuous financial insights and closing. |

Which is better?

Real-time expense reconciliation offers immediate transaction verification, reducing errors and enhancing cash flow visibility with up-to-date financial data. Continuous accounting streamlines ongoing financial processes, integrating real-time insights into comprehensive reporting and improving accuracy over fiscal periods. Businesses prioritizing swift correction of discrepancies may favor real-time reconciliation, while those seeking holistic financial management benefit more from continuous accounting.

Connection

Real-time expense reconciliation enables continuous accounting by providing immediate, accurate transaction data for ongoing financial updates. Continuous accounting relies on this real-time data to streamline closing processes, reduce errors, and enhance decision-making. Integrating both practices improves financial transparency and operational efficiency across accounting functions.

Key Terms

**Continuous accounting:**

Continuous accounting integrates financial processes into daily operations, enabling timely data entry and up-to-date financial reports. This method enhances accuracy and reduces month-end close time by distributing accounting tasks evenly throughout the accounting period. Discover more about how continuous accounting can transform your financial workflow.

Automated workflows

Continuous accounting integrates automated workflows to streamline periodic financial tasks, enhancing accuracy and efficiency throughout the accounting cycle. Real-time expense reconciliation leverages these automated processes to immediately match transactions with records, minimizing errors and improving cash flow visibility. Explore how automated workflows transform both methods to elevate financial management.

Periodic closing

Continuous accounting integrates financial data daily to streamline the periodic closing process, reducing end-of-period workload and enhancing accuracy. Real-time expense reconciliation updates transactions immediately, improving expense tracking precision and ensuring timely financial reporting. Explore how these methodologies transform period-end closing efficiency for deeper insights.

Source and External Links

Continuous Accounting: The Future of Finance - FEI Weekly - Continuous accounting is an approach that distributes accounting tasks evenly over the accounting period, embedding automation and period-end processes into daily activities to enable real-time reporting and reduce the end-of-period workload spikes.

What is continuous accounting? - Atlar - Continuous accounting leverages automation, real-time transaction processing, connected technology, and continuous improvement to perform accounting tasks continuously rather than at fixed periods, improving accuracy and operational efficiency.

What is Continuous Accounting | F&A Glossary - BlackLine - Continuous accounting applies digital technology to perform accounting and reconciliations continuously and automatically in real time, aligning accounting processes much closer with ongoing business activity instead of traditional fixed schedules.

dowidth.com

dowidth.com