Fractional CFO services provide strategic financial leadership on a part-time basis, focusing on high-level decision-making, cash flow management, and long-term growth planning. Financial Planning & Analysis (FP&A) specializes in budgeting, forecasting, and analyzing financial data to optimize business performance and support operational decisions. Explore the key differences and benefits of Fractional CFO services versus FP&A to determine the best fit for your company's financial needs.

Why it is important

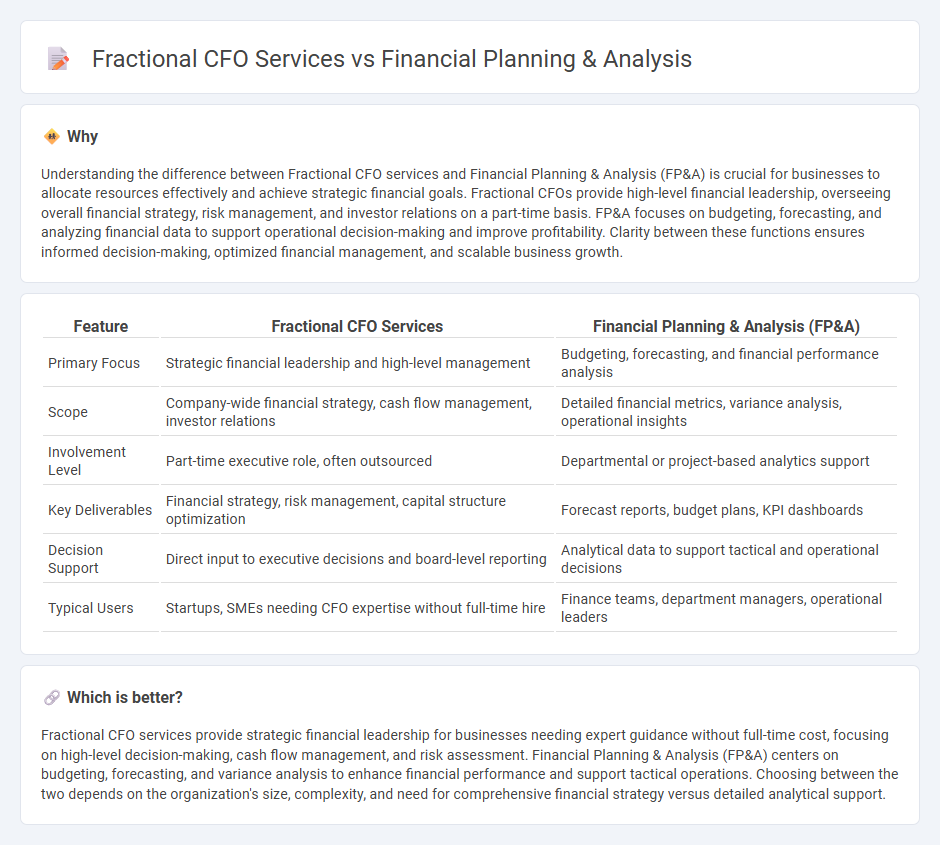

Understanding the difference between Fractional CFO services and Financial Planning & Analysis (FP&A) is crucial for businesses to allocate resources effectively and achieve strategic financial goals. Fractional CFOs provide high-level financial leadership, overseeing overall financial strategy, risk management, and investor relations on a part-time basis. FP&A focuses on budgeting, forecasting, and analyzing financial data to support operational decision-making and improve profitability. Clarity between these functions ensures informed decision-making, optimized financial management, and scalable business growth.

Comparison Table

| Feature | Fractional CFO Services | Financial Planning & Analysis (FP&A) |

|---|---|---|

| Primary Focus | Strategic financial leadership and high-level management | Budgeting, forecasting, and financial performance analysis |

| Scope | Company-wide financial strategy, cash flow management, investor relations | Detailed financial metrics, variance analysis, operational insights |

| Involvement Level | Part-time executive role, often outsourced | Departmental or project-based analytics support |

| Key Deliverables | Financial strategy, risk management, capital structure optimization | Forecast reports, budget plans, KPI dashboards |

| Decision Support | Direct input to executive decisions and board-level reporting | Analytical data to support tactical and operational decisions |

| Typical Users | Startups, SMEs needing CFO expertise without full-time hire | Finance teams, department managers, operational leaders |

Which is better?

Fractional CFO services provide strategic financial leadership for businesses needing expert guidance without full-time cost, focusing on high-level decision-making, cash flow management, and risk assessment. Financial Planning & Analysis (FP&A) centers on budgeting, forecasting, and variance analysis to enhance financial performance and support tactical operations. Choosing between the two depends on the organization's size, complexity, and need for comprehensive financial strategy versus detailed analytical support.

Connection

Fractional CFO services provide specialized financial leadership on a part-time basis, enabling businesses to access expert guidance without the cost of a full-time CFO. Financial Planning & Analysis (FP&A) is a core function within these services, focusing on budgeting, forecasting, and strategic decision support to drive business growth. The integration of Fractional CFO expertise with FP&A ensures accurate financial insights and optimized resource allocation for improved profitability.

Key Terms

**Financial Planning & Analysis:**

Financial Planning & Analysis (FP&A) centers on budgeting, forecasting, and evaluating financial performance to inform strategic business decisions, using tools such as variance analysis and financial modeling. FP&A teams analyze revenue trends, cost structures, and cash flow to optimize profitability and support sustainable growth. Explore detailed insights to understand how FP&A enhances financial clarity and drives effective resource allocation.

Budgeting

Financial Planning & Analysis (FP&A) primarily focuses on detailed budgeting processes, including forecasting revenues and expenses to align with organizational goals. Fractional CFO services provide strategic oversight and guidance on budgeting, ensuring financial plans support long-term growth and investment decisions. Explore how these budgeting approaches can optimize your financial performance and fiscal strategy.

Forecasting

Financial Planning & Analysis (FP&A) primarily centers on creating detailed financial forecasts and budgets to guide company decision-making and performance monitoring. Fractional CFO services extend beyond forecasting by offering strategic financial leadership, risk management, and cash flow optimization on a part-time basis to drive business growth. Explore how integrating both FP&A and Fractional CFO services can enhance your company's financial forecasting accuracy and strategic planning.

Source and External Links

What Is Financial Planning & Analysis? Definition, Process ... - Financial Planning & Analysis (FP&A) is a comprehensive strategic financial management approach that includes budgeting, forecasting, financial modeling, variance analysis, and reporting to guide a company's financial decisions and performance evaluation.

What is FP&A (financial planning and analysis)? - Oracle - FP&A encompasses processes like planning, budgeting, forecasting, scenario modeling, and performance reporting to help organizations make informed strategic financial decisions based on current and historical data.

What is FP&A? - Corporate Finance Institute - FP&A teams support corporate leadership by performing budgeting, forecasting, and financial analysis, evaluating company performance, predicting future results, and managing cash flow to drive growth and profitability.

dowidth.com

dowidth.com