Blockchain-based accounting offers enhanced transparency, immutability, and real-time transaction verification compared to traditional manual accounting systems that rely on paper records and spreadsheets. This technology minimizes human errors, reduces fraud risks, and accelerates audit processes by providing a secure and decentralized ledger. Explore the transformative impact of blockchain on accounting to understand its potential benefits and implementation strategies.

Why it is important

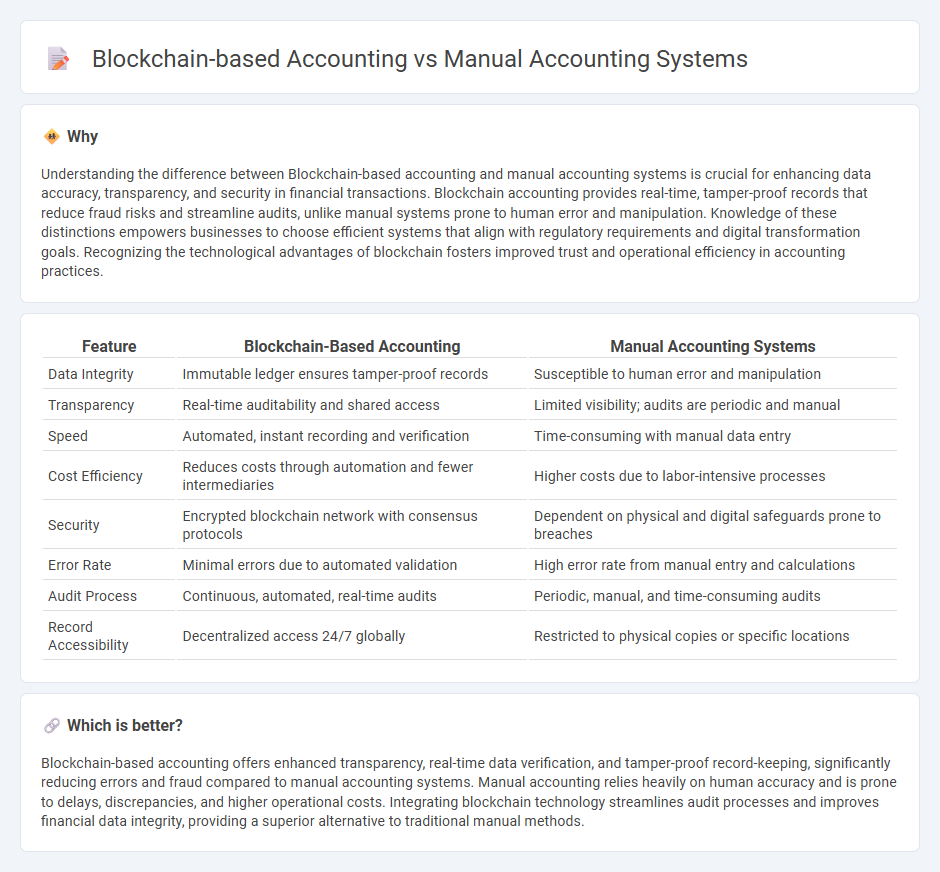

Understanding the difference between Blockchain-based accounting and manual accounting systems is crucial for enhancing data accuracy, transparency, and security in financial transactions. Blockchain accounting provides real-time, tamper-proof records that reduce fraud risks and streamline audits, unlike manual systems prone to human error and manipulation. Knowledge of these distinctions empowers businesses to choose efficient systems that align with regulatory requirements and digital transformation goals. Recognizing the technological advantages of blockchain fosters improved trust and operational efficiency in accounting practices.

Comparison Table

| Feature | Blockchain-Based Accounting | Manual Accounting Systems |

|---|---|---|

| Data Integrity | Immutable ledger ensures tamper-proof records | Susceptible to human error and manipulation |

| Transparency | Real-time auditability and shared access | Limited visibility; audits are periodic and manual |

| Speed | Automated, instant recording and verification | Time-consuming with manual data entry |

| Cost Efficiency | Reduces costs through automation and fewer intermediaries | Higher costs due to labor-intensive processes |

| Security | Encrypted blockchain network with consensus protocols | Dependent on physical and digital safeguards prone to breaches |

| Error Rate | Minimal errors due to automated validation | High error rate from manual entry and calculations |

| Audit Process | Continuous, automated, real-time audits | Periodic, manual, and time-consuming audits |

| Record Accessibility | Decentralized access 24/7 globally | Restricted to physical copies or specific locations |

Which is better?

Blockchain-based accounting offers enhanced transparency, real-time data verification, and tamper-proof record-keeping, significantly reducing errors and fraud compared to manual accounting systems. Manual accounting relies heavily on human accuracy and is prone to delays, discrepancies, and higher operational costs. Integrating blockchain technology streamlines audit processes and improves financial data integrity, providing a superior alternative to traditional manual methods.

Connection

Blockchain-based accounting and manual accounting systems are connected through their shared goal of recording financial transactions accurately and transparently. Blockchain enhances traditional manual accounting by providing immutable, real-time ledgers that reduce errors and fraud risks inherent in manual entries. Integrating blockchain technology with manual accounting processes improves auditability, data integrity, and operational efficiency for businesses.

Key Terms

Ledger

Manual accounting systems rely on physical ledgers and spreadsheets, which are prone to human error, data manipulation, and limited accessibility. Blockchain-based accounting leverages decentralized, immutable ledgers that enhance security, transparency, and real-time verification of transactions. Discover how blockchain technology transforms traditional ledger management for more accurate and efficient financial reporting.

Transparency

Manual accounting systems often suffer from limited transparency due to human errors and the need for manual reconciliation, which can delay the detection of discrepancies. Blockchain-based accounting leverages distributed ledger technology to provide immutable, real-time records accessible to authorized participants, significantly enhancing transparency and trust. Explore how blockchain transforms accounting transparency to streamline audits and financial reporting.

Auditability

Manual accounting systems often face challenges in auditability due to human errors, data tampering risks, and limited traceability. Blockchain-based accounting enhances auditability by providing an immutable ledger with transparent, time-stamped transactions, ensuring data integrity and real-time audit trails. Explore how blockchain technology revolutionizes audit processes in accounting for greater accuracy and trust.

Source and External Links

Manual system definition - AccountingTools - A manual accounting system is a bookkeeping method where financial records are maintained by hand in journals without computer use, offering low cost, simplicity, and enhanced data security, though it is slower and error-prone compared to computerized systems, typically used by small businesses.

manual accounting system | Wex - Law.Cornell.Edu - In a manual accounting system, transactions are recorded by hand in physical ledgers and books, commonly used by small businesses to avoid expenses on software and hardware, with several ledgers often maintained for different account types such as payroll and sales.

4.8: Accounting systems: From manual to computerize - Manual accounting systems use journals and ledgers on paper, sometimes multiple specialized journals and subsidiary ledgers for detailed records, and historically included innovations like the pegboard system for efficiency, though they have largely been replaced by computerized systems today.

dowidth.com

dowidth.com