Dynamic discounting offers businesses flexible, real-time discounts based on early invoice payments, enhancing cash flow management. Early payment discounts are predetermined savings agreed upon in advance, rewarding buyers who settle invoices before the due date. Discover the strategic advantages of each approach to optimize your company's working capital.

Why it is important

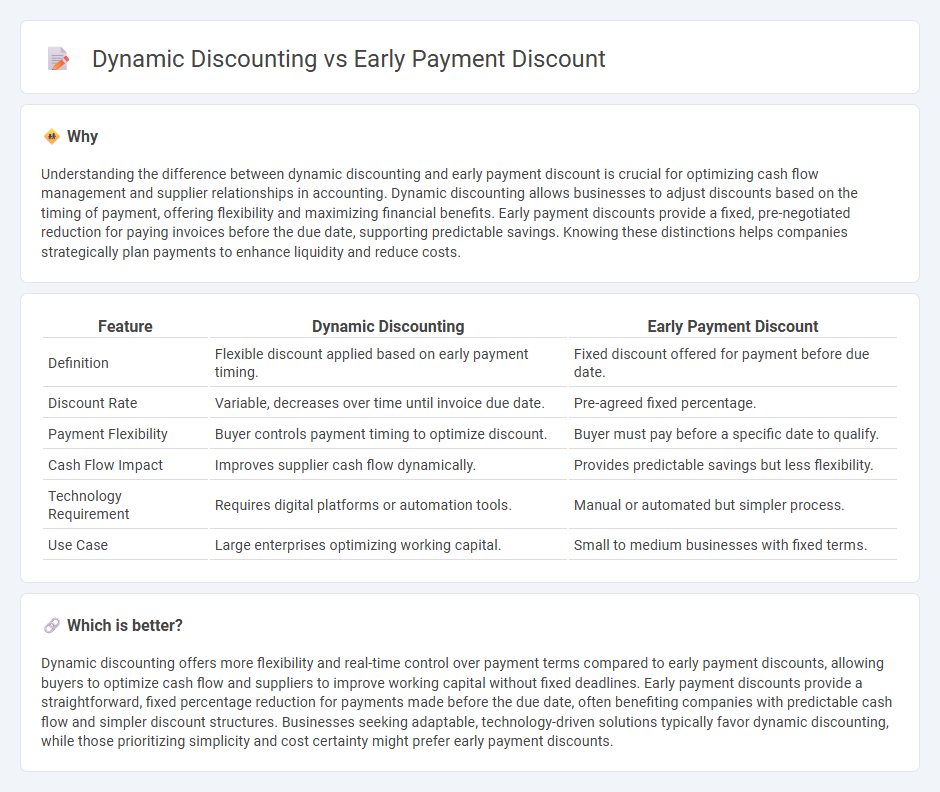

Understanding the difference between dynamic discounting and early payment discount is crucial for optimizing cash flow management and supplier relationships in accounting. Dynamic discounting allows businesses to adjust discounts based on the timing of payment, offering flexibility and maximizing financial benefits. Early payment discounts provide a fixed, pre-negotiated reduction for paying invoices before the due date, supporting predictable savings. Knowing these distinctions helps companies strategically plan payments to enhance liquidity and reduce costs.

Comparison Table

| Feature | Dynamic Discounting | Early Payment Discount |

|---|---|---|

| Definition | Flexible discount applied based on early payment timing. | Fixed discount offered for payment before due date. |

| Discount Rate | Variable, decreases over time until invoice due date. | Pre-agreed fixed percentage. |

| Payment Flexibility | Buyer controls payment timing to optimize discount. | Buyer must pay before a specific date to qualify. |

| Cash Flow Impact | Improves supplier cash flow dynamically. | Provides predictable savings but less flexibility. |

| Technology Requirement | Requires digital platforms or automation tools. | Manual or automated but simpler process. |

| Use Case | Large enterprises optimizing working capital. | Small to medium businesses with fixed terms. |

Which is better?

Dynamic discounting offers more flexibility and real-time control over payment terms compared to early payment discounts, allowing buyers to optimize cash flow and suppliers to improve working capital without fixed deadlines. Early payment discounts provide a straightforward, fixed percentage reduction for payments made before the due date, often benefiting companies with predictable cash flow and simpler discount structures. Businesses seeking adaptable, technology-driven solutions typically favor dynamic discounting, while those prioritizing simplicity and cost certainty might prefer early payment discounts.

Connection

Dynamic discounting and early payment discounts both incentivize faster invoice payments by offering financial benefits to buyers, enhancing cash flow management. Dynamic discounting adjusts the discount rate based on the payment date, providing flexible savings opportunities, while early payment discounts set a fixed reduction for payments made within a specific period. This connection optimizes working capital and strengthens supplier-buyer relationships through strategic payment scheduling.

Key Terms

Cash Flow

Early payment discounts offer suppliers a fixed percentage reduction for prompt invoice settlement, improving buyer cash flow predictability and supplier liquidity. Dynamic discounting provides variable discounts based on payment timing, maximizing cash flow optimization through flexible, real-time settlement adjustments. Explore the advantages of each strategy to enhance your working capital management effectively.

Invoice Settlement

Early payment discount offers a fixed percentage reduction on invoices paid before the due date, incentivizing quicker settlement. Dynamic discounting enables flexible, real-time discount rates adjusted based on payment timing and cash flow needs, maximizing savings for buyers and suppliers. Explore how both strategies optimize invoice settlement efficiency and improve working capital management.

Discount Rate

Early payment discounts typically offer a fixed discount rate, such as 2% if paid within 10 days, providing predictable cost savings for buyers. Dynamic discounting, on the other hand, adjusts the discount rate based on payment timing, allowing suppliers to optimize cash flow while buyers benefit from flexible, variable savings. Explore the advantages and applications of both models to determine the best strategy for your business.

Source and External Links

Early Payment Discount: What Is It & Should You Use It? - This resource explains the basics of early payment discounts, including their types, benefits, and drawbacks, as a strategy to reduce late payments.

Should you take advantage of early payment discounts? - This article discusses whether businesses should take advantage of early payment discounts, analyzing the financial implications and potential returns.

What is Early Payment Discount? - This webpage provides an overview of early payment discounts, including their definition, types, and role in trade finance, offering insights into dynamic discounting programs.

dowidth.com

dowidth.com