Cryptocurrency valuation requires distinct methods compared to traditional accounting standards like the Lower of Cost or Market (LCM) rule, which typically applies to inventory assets. Unlike LCM, which adjusts asset values to reflect the lower of historical cost or current market price, cryptocurrency valuation often considers volatility, regulatory factors, and ongoing technological developments. Explore the complexities and best practices in cryptocurrency accounting to enhance your financial reporting accuracy.

Why it is important

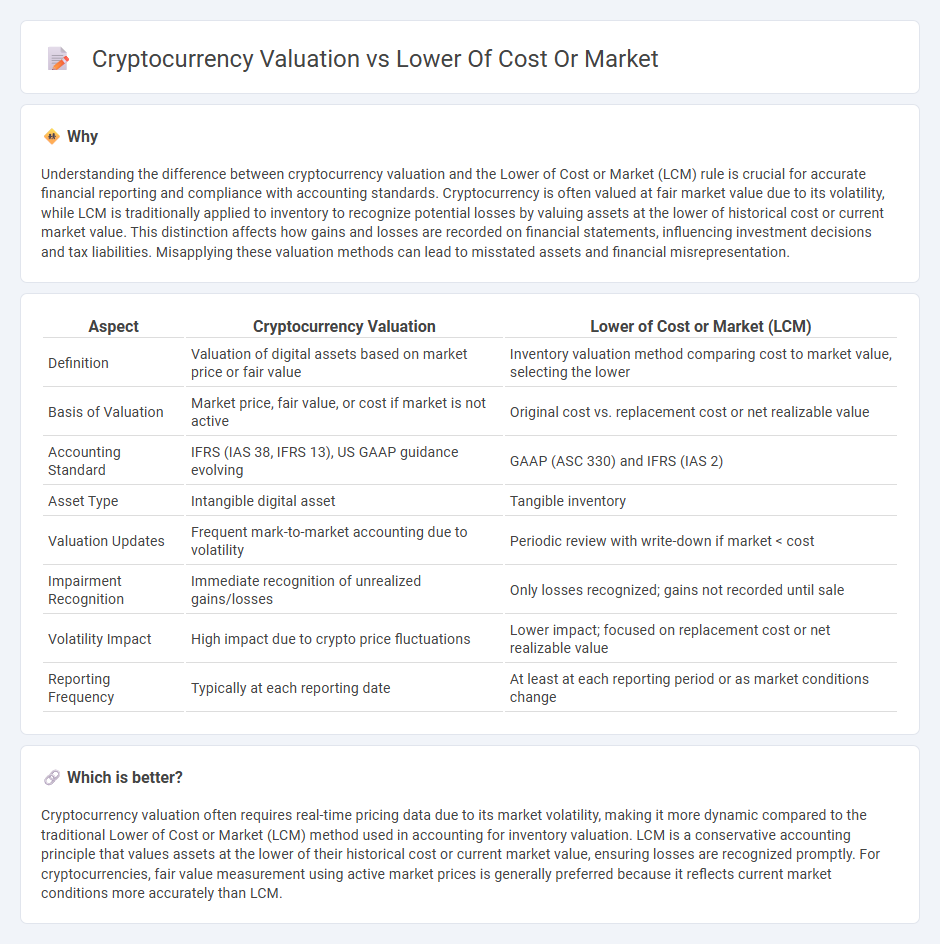

Understanding the difference between cryptocurrency valuation and the Lower of Cost or Market (LCM) rule is crucial for accurate financial reporting and compliance with accounting standards. Cryptocurrency is often valued at fair market value due to its volatility, while LCM is traditionally applied to inventory to recognize potential losses by valuing assets at the lower of historical cost or current market value. This distinction affects how gains and losses are recorded on financial statements, influencing investment decisions and tax liabilities. Misapplying these valuation methods can lead to misstated assets and financial misrepresentation.

Comparison Table

| Aspect | Cryptocurrency Valuation | Lower of Cost or Market (LCM) |

|---|---|---|

| Definition | Valuation of digital assets based on market price or fair value | Inventory valuation method comparing cost to market value, selecting the lower |

| Basis of Valuation | Market price, fair value, or cost if market is not active | Original cost vs. replacement cost or net realizable value |

| Accounting Standard | IFRS (IAS 38, IFRS 13), US GAAP guidance evolving | GAAP (ASC 330) and IFRS (IAS 2) |

| Asset Type | Intangible digital asset | Tangible inventory |

| Valuation Updates | Frequent mark-to-market accounting due to volatility | Periodic review with write-down if market < cost |

| Impairment Recognition | Immediate recognition of unrealized gains/losses | Only losses recognized; gains not recorded until sale |

| Volatility Impact | High impact due to crypto price fluctuations | Lower impact; focused on replacement cost or net realizable value |

| Reporting Frequency | Typically at each reporting date | At least at each reporting period or as market conditions change |

Which is better?

Cryptocurrency valuation often requires real-time pricing data due to its market volatility, making it more dynamic compared to the traditional Lower of Cost or Market (LCM) method used in accounting for inventory valuation. LCM is a conservative accounting principle that values assets at the lower of their historical cost or current market value, ensuring losses are recognized promptly. For cryptocurrencies, fair value measurement using active market prices is generally preferred because it reflects current market conditions more accurately than LCM.

Connection

Cryptocurrency valuation often involves determining the fair market value, which can fluctuate significantly due to market volatility, making the Lower of Cost or Market (LCM) method critical for accurate financial reporting. The LCM rule requires businesses to record inventory, including digital assets like cryptocurrencies, at the lower of its historical cost or current market value, preventing overstatement of assets. This accounting approach ensures conservative reporting by recognizing losses promptly when cryptocurrency market prices drop below acquisition costs.

Key Terms

Historical Cost

Historical cost accounting values assets based on their original purchase price, providing a stable benchmark unaffected by market volatility commonly seen in cryptocurrency pricing. The lower of cost or market (LCM) rule requires reporting cryptocurrencies at the lower of their historical cost or current market value, ensuring conservative valuation and mitigating risk from sudden price drops. Explore how applying LCM principles impacts financial statements and investment strategies in the volatile crypto landscape.

Fair Value

The Lower of Cost or Market (LCM) principle requires valuing assets, including cryptocurrencies, at the lesser of their historical cost or current market price, ensuring conservative reporting especially in volatile markets. Fair Value accounting for cryptocurrencies, conversely, reflects real-time market prices and provides a more dynamic valuation in financial statements, aligning with IFRS 13 standards for fair value measurement. Explore in-depth analysis of fair value implications on cryptocurrency valuation for accurate financial reporting and risk assessment.

Impairment

The lower of cost or market (LCM) method applies to cryptocurrency valuation by requiring companies to report impairment losses when the market value of digital assets falls below their acquisition cost, ensuring conservative financial reporting. Cryptocurrency is treated as an intangible asset under US GAAP, subject to impairment testing but no upward revaluation, which can lead to write-downs without recognizing subsequent recoveries. Explore how impairment rules impact financial statements and disclosures in the evolving landscape of digital asset accounting.

Source and External Links

Lower of Cost or Market (LCM) - The lower of cost or market rule states that businesses must record inventory at the lower of its original cost or current market value, often applicable when inventory becomes outdated or market prices decline.

Lower of Cost or Market (LCM): Definition, Overview & FAQs - This rule is a GAAP principle that requires businesses to report inventory at the lower of its cost or current market value, providing accurate inventory valuation and transparency.

Lower of Cost or Market - This accounting approach values inventory at the lower of its historical cost or current market value, reducing its carrying value if it declines below historical cost.

dowidth.com

dowidth.com