Cryptofinance reconciliation involves verifying cryptocurrency transactions and balances across digital wallets and blockchain records, ensuring accuracy and preventing fraud. Account receivable reconciliation focuses on matching incoming payments with outstanding invoices to maintain precise customer account balances and financial reporting. Explore more to understand the distinct processes and benefits of each reconciliation method in modern accounting.

Why it is important

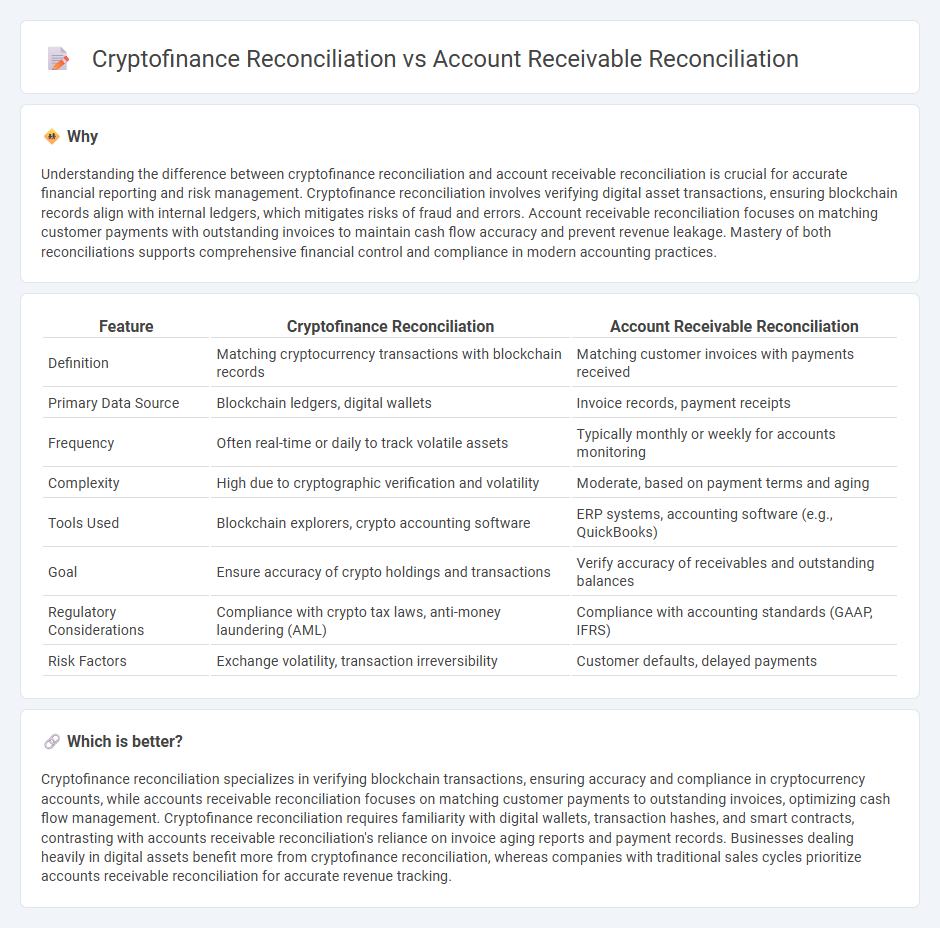

Understanding the difference between cryptofinance reconciliation and account receivable reconciliation is crucial for accurate financial reporting and risk management. Cryptofinance reconciliation involves verifying digital asset transactions, ensuring blockchain records align with internal ledgers, which mitigates risks of fraud and errors. Account receivable reconciliation focuses on matching customer payments with outstanding invoices to maintain cash flow accuracy and prevent revenue leakage. Mastery of both reconciliations supports comprehensive financial control and compliance in modern accounting practices.

Comparison Table

| Feature | Cryptofinance Reconciliation | Account Receivable Reconciliation |

|---|---|---|

| Definition | Matching cryptocurrency transactions with blockchain records | Matching customer invoices with payments received |

| Primary Data Source | Blockchain ledgers, digital wallets | Invoice records, payment receipts |

| Frequency | Often real-time or daily to track volatile assets | Typically monthly or weekly for accounts monitoring |

| Complexity | High due to cryptographic verification and volatility | Moderate, based on payment terms and aging |

| Tools Used | Blockchain explorers, crypto accounting software | ERP systems, accounting software (e.g., QuickBooks) |

| Goal | Ensure accuracy of crypto holdings and transactions | Verify accuracy of receivables and outstanding balances |

| Regulatory Considerations | Compliance with crypto tax laws, anti-money laundering (AML) | Compliance with accounting standards (GAAP, IFRS) |

| Risk Factors | Exchange volatility, transaction irreversibility | Customer defaults, delayed payments |

Which is better?

Cryptofinance reconciliation specializes in verifying blockchain transactions, ensuring accuracy and compliance in cryptocurrency accounts, while accounts receivable reconciliation focuses on matching customer payments to outstanding invoices, optimizing cash flow management. Cryptofinance reconciliation requires familiarity with digital wallets, transaction hashes, and smart contracts, contrasting with accounts receivable reconciliation's reliance on invoice aging reports and payment records. Businesses dealing heavily in digital assets benefit more from cryptofinance reconciliation, whereas companies with traditional sales cycles prioritize accounts receivable reconciliation for accurate revenue tracking.

Connection

Cryptofinance reconciliation and accounts receivable reconciliation are connected through their shared objective of ensuring accurate financial records by verifying and matching transactions across blockchain-based assets and traditional accounting ledgers. Both processes involve systematically validating incoming payments against issued invoices, thereby minimizing discrepancies and enhancing the reliability of financial statements. Integrating cryptofinance reconciliation with accounts receivable reconciliation leverages blockchain transparency to streamline cash flow management and audit trails.

Key Terms

**Account Receivable Reconciliation:**

Account receivable reconciliation involves matching the company's recorded receivables with actual transactions to ensure accuracy in financial statements and cash flow management. This process detects discrepancies from payments, returns, or billing errors, improving the accuracy of accounts receivable balance and preventing revenue leakage. Explore detailed methodologies and best practices to optimize your account receivable reconciliation process.

Aging Report

Account receivable reconciliation involves matching outstanding invoices with payments to ensure accurate aging reports, which categorize receivables based on the length of time they have been outstanding. In contrast, cryptofinance reconciliation deals with tracking cryptocurrency transactions and verifying wallet balances, where aging reports must consider blockchain confirmation times and volatility in asset values. Explore the difference in detail to optimize financial management strategies across traditional and digital asset accounting.

Invoice Matching

Account receivable reconciliation involves verifying customer payments against outstanding invoices to ensure accurate financial records, primarily focusing on invoice matching and payment application within traditional accounting systems. Cryptofinance reconciliation extends this process by incorporating blockchain transaction verification and cryptocurrency wallet balance matching, addressing the volatility and transparency challenges unique to digital assets. Explore detailed strategies for optimizing invoice matching in both domains to enhance accuracy and operational efficiency.

Source and External Links

Accounts Receivable Reconciliation Tips - Stripe - This webpage provides a breakdown of the typical accounts receivable reconciliation process, including gathering documents, comparing entries, and investigating discrepancies.

How to Reconcile Accounts Receivable - AccountingTools - This article explains the reconciliation process by matching detailed amounts of unpaid customer billings to the accounts receivable total in the general ledger.

Accounts Receivable Reconciliation - Parabola - This webpage describes accounts receivable reconciliation as a systematic process to verify that customer payment records match bank deposits and internal accounting records.

dowidth.com

dowidth.com