Intercompany automation streamlines the recording and processing of transactions between affiliated entities, reducing manual errors and improving efficiency in financial reporting. Elimination entries, on the other hand, are crucial adjustments that remove the effects of intercompany transactions from consolidated financial statements to prevent double counting. Explore the differences and benefits of these processes to enhance your accounting practices.

Why it is important

Understanding the difference between intercompany automation and elimination entries is crucial for accurate consolidated financial statements and regulatory compliance. Intercompany automation streamlines transactions between affiliated entities, improving efficiency by automatically recording intercompany activities. Elimination entries remove intra-group transactions to prevent double counting of revenue, expenses, assets, and liabilities in consolidated reports. Mastery of both processes ensures precise financial reporting and aids in identifying true company performance.

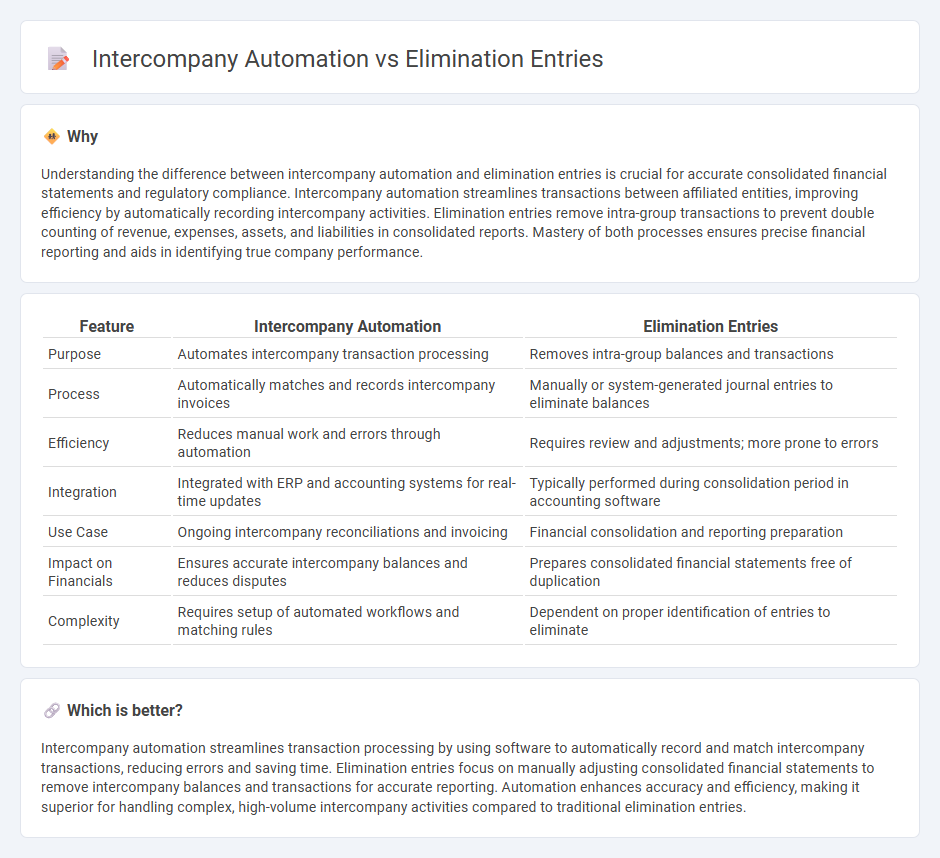

Comparison Table

| Feature | Intercompany Automation | Elimination Entries |

|---|---|---|

| Purpose | Automates intercompany transaction processing | Removes intra-group balances and transactions |

| Process | Automatically matches and records intercompany invoices | Manually or system-generated journal entries to eliminate balances |

| Efficiency | Reduces manual work and errors through automation | Requires review and adjustments; more prone to errors |

| Integration | Integrated with ERP and accounting systems for real-time updates | Typically performed during consolidation period in accounting software |

| Use Case | Ongoing intercompany reconciliations and invoicing | Financial consolidation and reporting preparation |

| Impact on Financials | Ensures accurate intercompany balances and reduces disputes | Prepares consolidated financial statements free of duplication |

| Complexity | Requires setup of automated workflows and matching rules | Dependent on proper identification of entries to eliminate |

Which is better?

Intercompany automation streamlines transaction processing by using software to automatically record and match intercompany transactions, reducing errors and saving time. Elimination entries focus on manually adjusting consolidated financial statements to remove intercompany balances and transactions for accurate reporting. Automation enhances accuracy and efficiency, making it superior for handling complex, high-volume intercompany activities compared to traditional elimination entries.

Connection

Intercompany automation streamlines the process of generating elimination entries by automatically identifying and reconciling intercompany transactions across subsidiaries. This integration reduces manual errors and accelerates financial close cycles, ensuring the accurate consolidation of financial statements. Accurate elimination entries remove intercompany profits and balances, preventing double counting and providing a clear view of the organization's overall financial health.

Key Terms

Consolidation

Elimination entries are manual adjustments in consolidation accounting used to remove intercompany transactions and balances to prevent double counting. Intercompany automation leverages software to streamline this process, reducing errors and improving efficiency in consolidation reporting. Explore how automation transforms consolidation accuracy and accelerates financial close cycles.

Intercompany Transactions

Intercompany transactions require precise elimination entries to avoid double counting in consolidated financial statements, ensuring accurate reflection of group financial health. Automation streamlines the reconciliation and elimination process, reduces human errors, and accelerates period-end close activities. Explore how integrating intercompany automation enhances transaction efficiency and compliance.

Reconciliation

Elimination entries streamline the consolidation process by removing intercompany transactions to prevent double-counting in financial statements, ensuring accuracy during reconciliation. Intercompany automation enhances efficiency by using software tools to automatically match and reconcile intercompany balances, reducing manual errors and improving audit trails. Discover how integrating elimination entries with intercompany automation can optimize your reconciliation workflow for seamless financial reporting.

Source and External Links

Create Elimination Entries - This webpage explains how to create elimination entries in Deltek Costpoint, which are used to eliminate duplicate revenue, expenses, receivables, and payables in consolidated financial statements.

Examples of Elimination Entries - This page provides examples of how to eliminate intercompany transactions during consolidation, using InFusion ledgers as case studies.

Elimination Rules - This article guides users on setting up elimination rules in Microsoft Dynamics 365 Finance, including how to create financial dimensions and define processing rules for intercompany transactions.

dowidth.com

dowidth.com