Supply chain finance accounting focuses on optimizing the financial flows between buyers, suppliers, and financial institutions to enhance liquidity and reduce working capital costs. Fair value accounting measures assets and liabilities at their current market value, providing transparency and relevance in financial statements. Explore the key differences and implications of these accounting methods to understand their impact on business financial strategies.

Why it is important

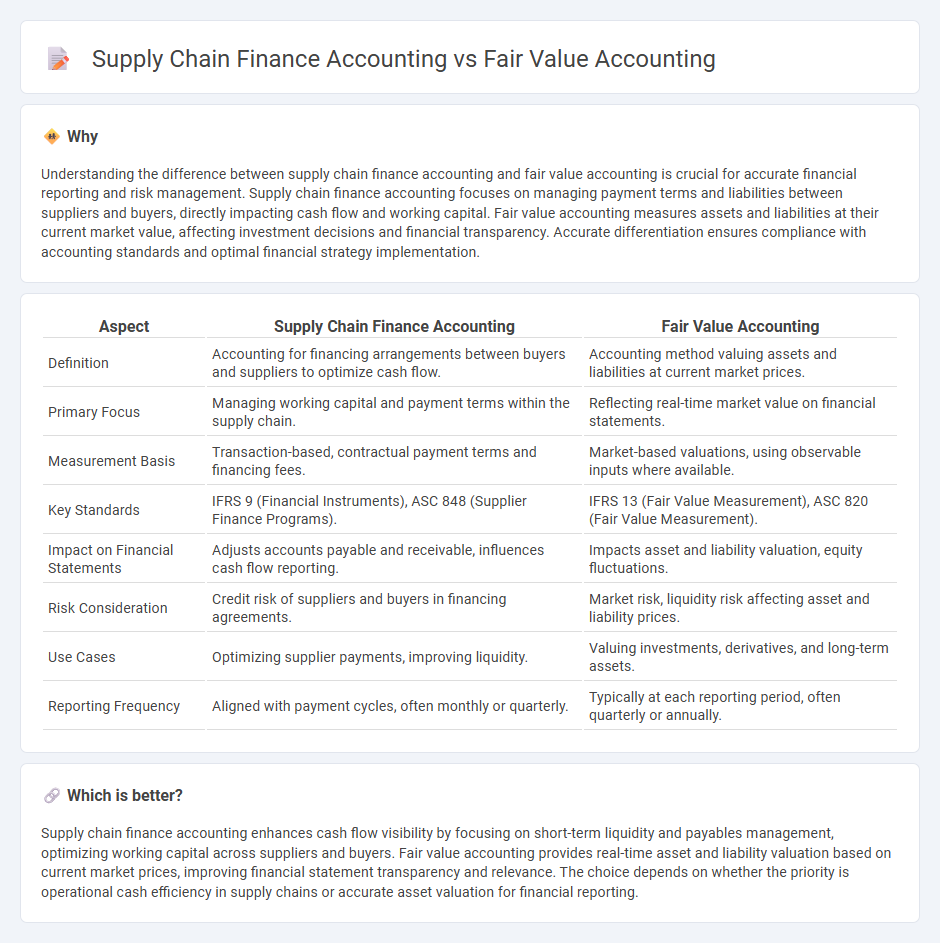

Understanding the difference between supply chain finance accounting and fair value accounting is crucial for accurate financial reporting and risk management. Supply chain finance accounting focuses on managing payment terms and liabilities between suppliers and buyers, directly impacting cash flow and working capital. Fair value accounting measures assets and liabilities at their current market value, affecting investment decisions and financial transparency. Accurate differentiation ensures compliance with accounting standards and optimal financial strategy implementation.

Comparison Table

| Aspect | Supply Chain Finance Accounting | Fair Value Accounting |

|---|---|---|

| Definition | Accounting for financing arrangements between buyers and suppliers to optimize cash flow. | Accounting method valuing assets and liabilities at current market prices. |

| Primary Focus | Managing working capital and payment terms within the supply chain. | Reflecting real-time market value on financial statements. |

| Measurement Basis | Transaction-based, contractual payment terms and financing fees. | Market-based valuations, using observable inputs where available. |

| Key Standards | IFRS 9 (Financial Instruments), ASC 848 (Supplier Finance Programs). | IFRS 13 (Fair Value Measurement), ASC 820 (Fair Value Measurement). |

| Impact on Financial Statements | Adjusts accounts payable and receivable, influences cash flow reporting. | Impacts asset and liability valuation, equity fluctuations. |

| Risk Consideration | Credit risk of suppliers and buyers in financing agreements. | Market risk, liquidity risk affecting asset and liability prices. |

| Use Cases | Optimizing supplier payments, improving liquidity. | Valuing investments, derivatives, and long-term assets. |

| Reporting Frequency | Aligned with payment cycles, often monthly or quarterly. | Typically at each reporting period, often quarterly or annually. |

Which is better?

Supply chain finance accounting enhances cash flow visibility by focusing on short-term liquidity and payables management, optimizing working capital across suppliers and buyers. Fair value accounting provides real-time asset and liability valuation based on current market prices, improving financial statement transparency and relevance. The choice depends on whether the priority is operational cash efficiency in supply chains or accurate asset valuation for financial reporting.

Connection

Supply chain finance accounting and fair value accounting intersect significantly in the valuation of receivables and payables within supply chain transactions. Fair value accounting provides a basis for measuring financial instruments at their current market value, which is essential for accurately reflecting the cost and liability associated with supply chain finance arrangements. This connection ensures transparency and reliability in financial reporting, enhancing the assessment of risks and performance in supply chain finance operations.

Key Terms

Measurement Basis

Fair value accounting measures assets and liabilities based on current market prices, reflecting real-time economic conditions for accurate financial reporting. Supply chain finance accounting records transactions using historical or contractual values, emphasizing payment terms and cash flow management within supply chains. Explore the detailed differences to better understand their impact on financial statements and decision-making.

Financial Instruments

Fair value accounting for financial instruments involves measuring assets and liabilities at their current market price, reflecting real-time economic conditions and providing transparent valuation. Supply chain finance accounting focuses on optimizing working capital by recording transactions such as payables and receivables factoring, often at discounted values aligned with agreed payment terms. Explore how these accounting methods impact financial reporting and operational efficiency in depth.

Trade Payables

Fair value accounting measures trade payables at their current market value, reflecting real-time financial obligations and potential risks associated with price fluctuations. Supply chain finance accounting records trade payables based on agreed payment terms and financing arrangements between suppliers and buyers, often optimizing cash flow and working capital management. To explore the impacts of these accounting methods on financial statements and operational efficiency, discover more insights here.

Source and External Links

What Is Fair Value Accounting? - GoCardless - Fair value accounting measures business assets and liabilities at their current market value, reflecting the amount an asset could be sold for or a liability settled for in an orderly transaction between unrelated parties under current market conditions, regardless of the holder's intention.

Fair value - Wikipedia - Fair value in accounting is the price that would be received to sell an asset or paid to transfer a liability in an orderly market transaction at the measurement date, as defined by US GAAP and IFRS standards; it applies mainly when market prices are determinable.

IFRS 13 Fair Value Measurement - IFRS Foundation - IFRS 13 provides the framework for fair value measurement, defining it as the price to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date, using market participant assumptions and excluding the reporting entity's own intent.

dowidth.com

dowidth.com