Intercompany automation streamlines transaction processing between subsidiaries, reducing errors and accelerating reconciliation. Financial consolidation integrates these transactions into unified financial statements, ensuring compliance and accurate reporting across the entire organization. Explore how optimizing both processes enhances your company's financial efficiency and accuracy.

Why it is important

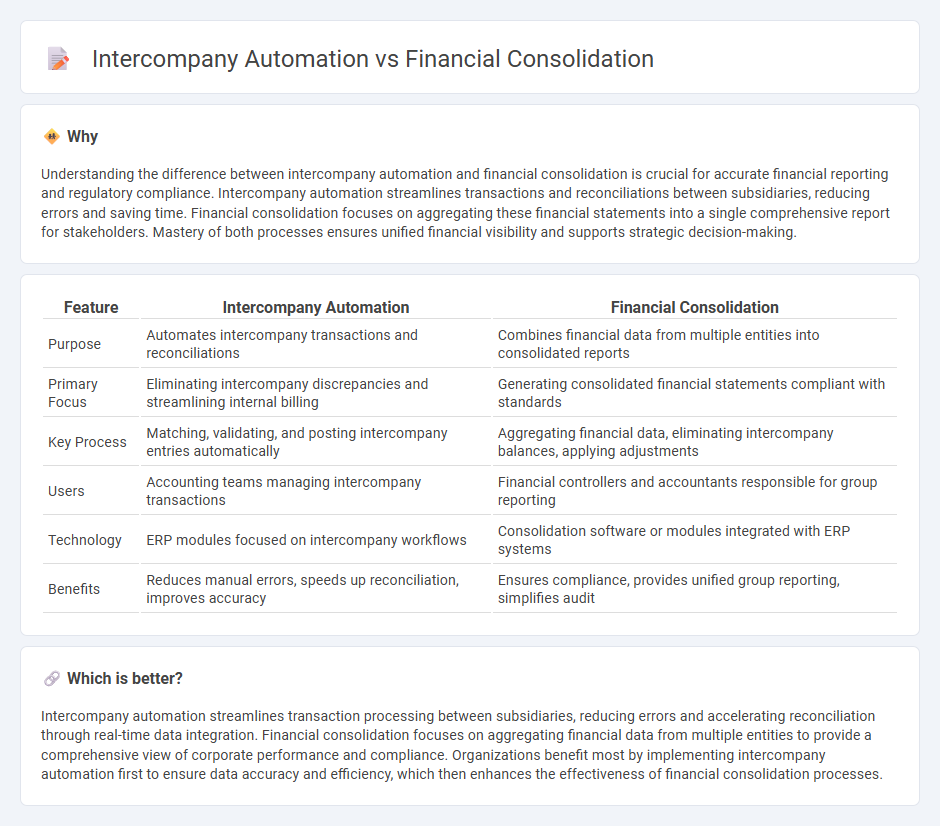

Understanding the difference between intercompany automation and financial consolidation is crucial for accurate financial reporting and regulatory compliance. Intercompany automation streamlines transactions and reconciliations between subsidiaries, reducing errors and saving time. Financial consolidation focuses on aggregating these financial statements into a single comprehensive report for stakeholders. Mastery of both processes ensures unified financial visibility and supports strategic decision-making.

Comparison Table

| Feature | Intercompany Automation | Financial Consolidation |

|---|---|---|

| Purpose | Automates intercompany transactions and reconciliations | Combines financial data from multiple entities into consolidated reports |

| Primary Focus | Eliminating intercompany discrepancies and streamlining internal billing | Generating consolidated financial statements compliant with standards |

| Key Process | Matching, validating, and posting intercompany entries automatically | Aggregating financial data, eliminating intercompany balances, applying adjustments |

| Users | Accounting teams managing intercompany transactions | Financial controllers and accountants responsible for group reporting |

| Technology | ERP modules focused on intercompany workflows | Consolidation software or modules integrated with ERP systems |

| Benefits | Reduces manual errors, speeds up reconciliation, improves accuracy | Ensures compliance, provides unified group reporting, simplifies audit |

Which is better?

Intercompany automation streamlines transaction processing between subsidiaries, reducing errors and accelerating reconciliation through real-time data integration. Financial consolidation focuses on aggregating financial data from multiple entities to provide a comprehensive view of corporate performance and compliance. Organizations benefit most by implementing intercompany automation first to ensure data accuracy and efficiency, which then enhances the effectiveness of financial consolidation processes.

Connection

Intercompany automation streamlines transaction processing between subsidiaries by eliminating manual errors and accelerating data reconciliation, which directly enhances the accuracy and efficiency of financial consolidation. Automated intercompany processes ensure real-time visibility into intercompany balances and eliminate discrepancies, enabling faster and more reliable consolidation of financial statements. This integration reduces the complexity and time required during the closing cycle, supporting compliance with accounting standards such as IFRS and GAAP.

Key Terms

Financial Consolidation:

Financial consolidation centralizes financial data from multiple subsidiaries, ensuring accurate and compliant group reporting for multinational organizations. It streamlines the process of aggregating financial statements by eliminating intercompany transactions and harmonizing accounting standards. Explore more about how financial consolidation enhances transparency and decision-making in complex corporate structures.

Group Reporting

Financial consolidation integrates financial data from multiple subsidiaries into a unified group report, ensuring accuracy and compliance with accounting standards like IFRS or GAAP. Intercompany automation streamlines the elimination of intercompany transactions and balances, reducing errors and accelerating the group reporting process. Discover how optimizing these processes can enhance the efficiency and reliability of your group financial statements.

Consolidation Adjustments

Consolidation adjustments reconcile financial statements by eliminating intercompany transactions and balances, ensuring accurate group reporting without duplication. Intercompany automation streamlines this process by automating data matching, transaction elimination, and reconciliation to reduce errors and improve efficiency. Explore comprehensive strategies to optimize consolidation adjustments and enhance financial accuracy.

Source and External Links

What is financial consolidation? A guide for 2025 - Prophix - Financial consolidation is the process of combining financial data and statements from multiple entities through three stages: data collection, consolidation by adjusting and eliminating intercompany transactions, and reporting consolidated results for internal or external use.

Financial Consolidation and Close Explained - NetSuite - Financial consolidation involves combining financial data from multiple subsidiaries into a single set of financial statements following a multi-step close process, starting with collecting adjusted trial balances and processing that data for alignment.

What Is Financial Consolidation in Accounting? Your Clear Guide - Financial consolidation aggregates transaction data from multiple entities into unified financial reports, including elimination of intercompany transactions and currency conversion, enabling parent companies to analyze consolidated financial health as one economic unit.

dowidth.com

dowidth.com