Triple entry accounting enhances traditional double entry bookkeeping by introducing a cryptographic receipt, enabling greater transparency and fraud reduction in financial records. Project accounting focuses on tracking costs, revenues, and profitability specifically for individual projects, ensuring precise budget management and financial control. Discover the key differences and advantages of these accounting methods to optimize your financial strategies.

Why it is important

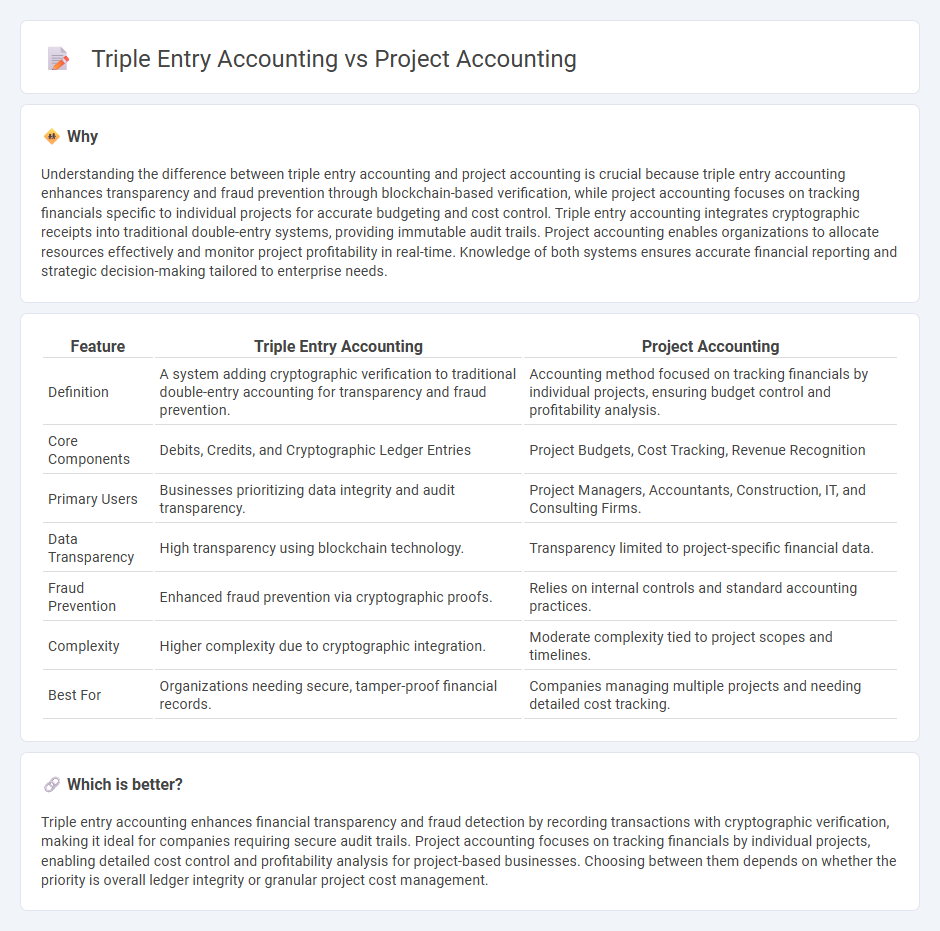

Understanding the difference between triple entry accounting and project accounting is crucial because triple entry accounting enhances transparency and fraud prevention through blockchain-based verification, while project accounting focuses on tracking financials specific to individual projects for accurate budgeting and cost control. Triple entry accounting integrates cryptographic receipts into traditional double-entry systems, providing immutable audit trails. Project accounting enables organizations to allocate resources effectively and monitor project profitability in real-time. Knowledge of both systems ensures accurate financial reporting and strategic decision-making tailored to enterprise needs.

Comparison Table

| Feature | Triple Entry Accounting | Project Accounting |

|---|---|---|

| Definition | A system adding cryptographic verification to traditional double-entry accounting for transparency and fraud prevention. | Accounting method focused on tracking financials by individual projects, ensuring budget control and profitability analysis. |

| Core Components | Debits, Credits, and Cryptographic Ledger Entries | Project Budgets, Cost Tracking, Revenue Recognition |

| Primary Users | Businesses prioritizing data integrity and audit transparency. | Project Managers, Accountants, Construction, IT, and Consulting Firms. |

| Data Transparency | High transparency using blockchain technology. | Transparency limited to project-specific financial data. |

| Fraud Prevention | Enhanced fraud prevention via cryptographic proofs. | Relies on internal controls and standard accounting practices. |

| Complexity | Higher complexity due to cryptographic integration. | Moderate complexity tied to project scopes and timelines. |

| Best For | Organizations needing secure, tamper-proof financial records. | Companies managing multiple projects and needing detailed cost tracking. |

Which is better?

Triple entry accounting enhances financial transparency and fraud detection by recording transactions with cryptographic verification, making it ideal for companies requiring secure audit trails. Project accounting focuses on tracking financials by individual projects, enabling detailed cost control and profitability analysis for project-based businesses. Choosing between them depends on whether the priority is overall ledger integrity or granular project cost management.

Connection

Triple entry accounting enhances project accounting by adding a cryptographic receipt to each transaction, ensuring transparency and preventing fraud in project cost tracking. Project accounting relies on accurate, real-time financial data, which is strengthened by the immutable ledger features of triple entry accounting. This integration improves accountability and precision in budgeting, resource allocation, and financial reporting for complex projects.

Key Terms

Project accounting:

Project accounting focuses on tracking the financial performance and resources of specific projects by monitoring budgets, costs, and revenues to ensure profitability and compliance. It involves detailed cost allocation, time tracking, and progress billing to provide accurate financial insights tailored to project needs. Explore more to understand how project accounting drives better decision-making and project success.

Budget tracking

Project accounting emphasizes detailed budget tracking by monitoring expenses, revenues, and resource allocation specific to individual projects, ensuring financial accountability and performance analysis. Triple entry accounting introduces a cryptographic receipt system that enhances transparency and traceability of budget transactions across multiple stakeholders. Explore how these accounting methods transform budget tracking in project management.

Cost allocation

Project accounting emphasizes precise cost allocation by tracking expenses directly to specific projects, ensuring accurate budgeting and financial control. Triple entry accounting introduces a blockchain-based record system, enhancing transparency and accountability in cost allocations through cryptographic verification. Explore how these methodologies impact financial accuracy and project management efficiency.

Source and External Links

Project Accounting: A Complete Guide to Mastering Project Finances - Project accounting involves setting budgets, tracking costs, recognizing revenue, billing, financial reporting, monitoring, auditing, and closing project accounts with a focus on aligning projects to business goals and using software for transparency and standardization.

What Is Project Accounting? Principles, Methods & More - Project accounting tracks all financial transactions of a project including costs, billing, and revenue, with project accountants responsible for monitoring expenses, ensuring correct billing, collecting payments, and maintaining project financial records.

Project Accounting Concepts and Business Calculations - NetSuite - Project accounting is a strategic financial reporting method tailored to projects, providing detailed oversight of costs, billing, revenue, profitability, and compliance to help project managers make informed decisions and reduce financial risks.

dowidth.com

dowidth.com