Blockchain-based accounting ensures immutable, transparent ledger entries secured by cryptographic validation, reducing fraud and enhancing trust in financial records. Cloud-based accounting offers scalable, real-time access to financial data with automated backups and seamless integration across multiple devices and applications. Explore how each technology transforms financial management by balancing security, accessibility, and efficiency.

Why it is important

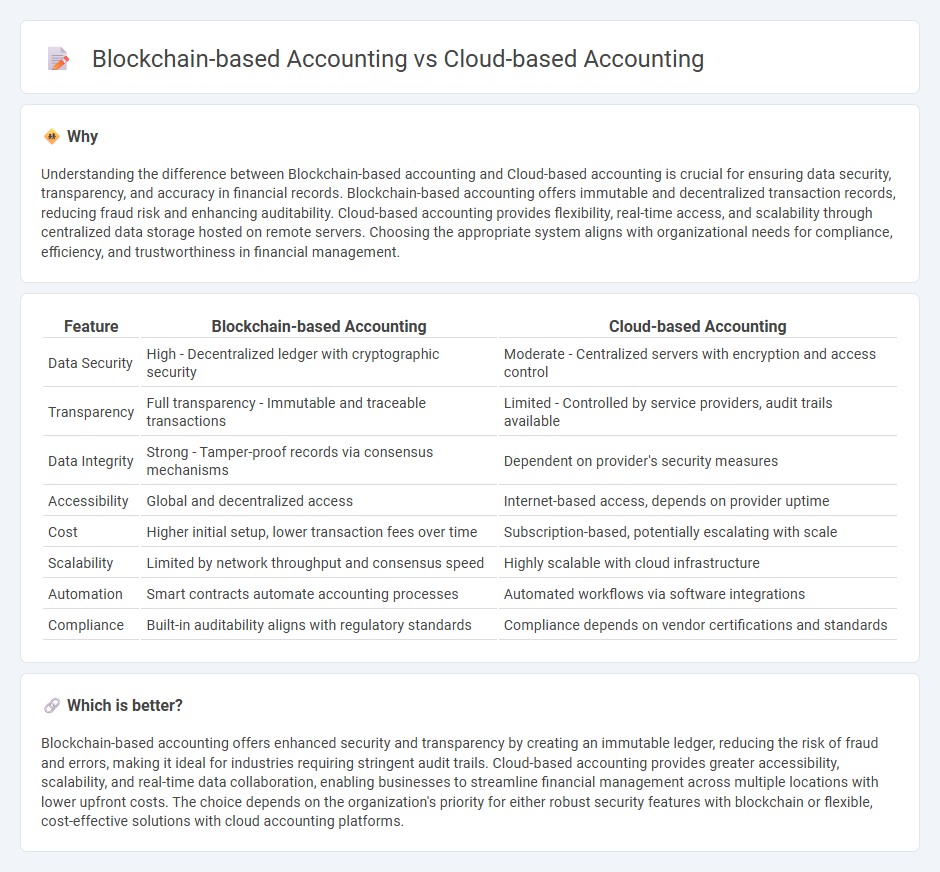

Understanding the difference between Blockchain-based accounting and Cloud-based accounting is crucial for ensuring data security, transparency, and accuracy in financial records. Blockchain-based accounting offers immutable and decentralized transaction records, reducing fraud risk and enhancing auditability. Cloud-based accounting provides flexibility, real-time access, and scalability through centralized data storage hosted on remote servers. Choosing the appropriate system aligns with organizational needs for compliance, efficiency, and trustworthiness in financial management.

Comparison Table

| Feature | Blockchain-based Accounting | Cloud-based Accounting |

|---|---|---|

| Data Security | High - Decentralized ledger with cryptographic security | Moderate - Centralized servers with encryption and access control |

| Transparency | Full transparency - Immutable and traceable transactions | Limited - Controlled by service providers, audit trails available |

| Data Integrity | Strong - Tamper-proof records via consensus mechanisms | Dependent on provider's security measures |

| Accessibility | Global and decentralized access | Internet-based access, depends on provider uptime |

| Cost | Higher initial setup, lower transaction fees over time | Subscription-based, potentially escalating with scale |

| Scalability | Limited by network throughput and consensus speed | Highly scalable with cloud infrastructure |

| Automation | Smart contracts automate accounting processes | Automated workflows via software integrations |

| Compliance | Built-in auditability aligns with regulatory standards | Compliance depends on vendor certifications and standards |

Which is better?

Blockchain-based accounting offers enhanced security and transparency by creating an immutable ledger, reducing the risk of fraud and errors, making it ideal for industries requiring stringent audit trails. Cloud-based accounting provides greater accessibility, scalability, and real-time data collaboration, enabling businesses to streamline financial management across multiple locations with lower upfront costs. The choice depends on the organization's priority for either robust security features with blockchain or flexible, cost-effective solutions with cloud accounting platforms.

Connection

Blockchain-based accounting enhances data transparency and security by recording transactions on an immutable ledger, while cloud-based accounting offers scalable, remote access to financial data and automated processing. Integrating blockchain with cloud platforms enables real-time verification and synchronization of accounting records across multiple users, reducing errors and fraud. This synergy improves audit trails, compliance monitoring, and overall financial accuracy in accounting systems.

Key Terms

Data Security

Cloud-based accounting leverages centralized servers with encryption protocols and multi-factor authentication to protect financial data, yet it remains vulnerable to cyberattacks and server outages. Blockchain-based accounting offers enhanced data security through decentralized ledgers, immutability, and consensus algorithms, reducing risks of unauthorized data tampering and fraud. Discover how integrating these technologies can revolutionize financial data security by exploring their comparative benefits and challenges.

Real-time Access

Cloud-based accounting enables real-time access to financial data by storing information on remote servers accessible via the internet, facilitating instant updates and collaboration across multiple devices. Blockchain-based accounting offers decentralized, tamper-proof ledger access with real-time synchronization across all network participants, enhancing transparency and security in financial transactions. Explore how these technologies revolutionize real-time access and decision-making in modern accounting systems.

Immutability

Cloud-based accounting offers centralized data storage with regular backups, allowing for efficient access and modification but potential vulnerability to unauthorized changes. Blockchain-based accounting ensures immutability by recording transactions on a decentralized ledger secured through cryptographic algorithms, preventing any alteration once data is committed. Explore the differences in data security and integrity between these two accounting technologies to understand their impact on financial record-keeping.

Source and External Links

Cloud Based Accounting: What is It and Why You Need It - Certinia - Cloud accounting is software hosted on remote servers, enabling real-time updates, scalability, flexibility, and collaborative access from various devices without the need for desktop installation or maintenance.

Cloud Accounting: What It Is, How It Works And Its Benefits - Cloud accounting uses secure web-based software allowing small businesses and finance teams to access and collaborate on financial data remotely, increasing efficiency and data security with automatic backup and disaster recovery.

6 Cloud Accounting Benefits for Small Businesses Explained - Cloud accounting enhances accessibility, automates many accounting tasks like bank reconciliation and invoicing, ensures all team members work from the same up-to-date data, and eliminates time-consuming software installations and backups.

dowidth.com

dowidth.com