Lease accounting software specializes in tracking and managing lease agreements, ensuring compliance with ASC 842 and IFRS 16 standards, while expense management software focuses on capturing, approving, and reimbursing business expenses for better cost control. Lease accounting solutions automate lease classification, payment schedules, and reporting, whereas expense management platforms streamline employee spending, receipt collection, and policy enforcement. Explore the key differences and benefits of each to optimize your financial operations.

Why it is important

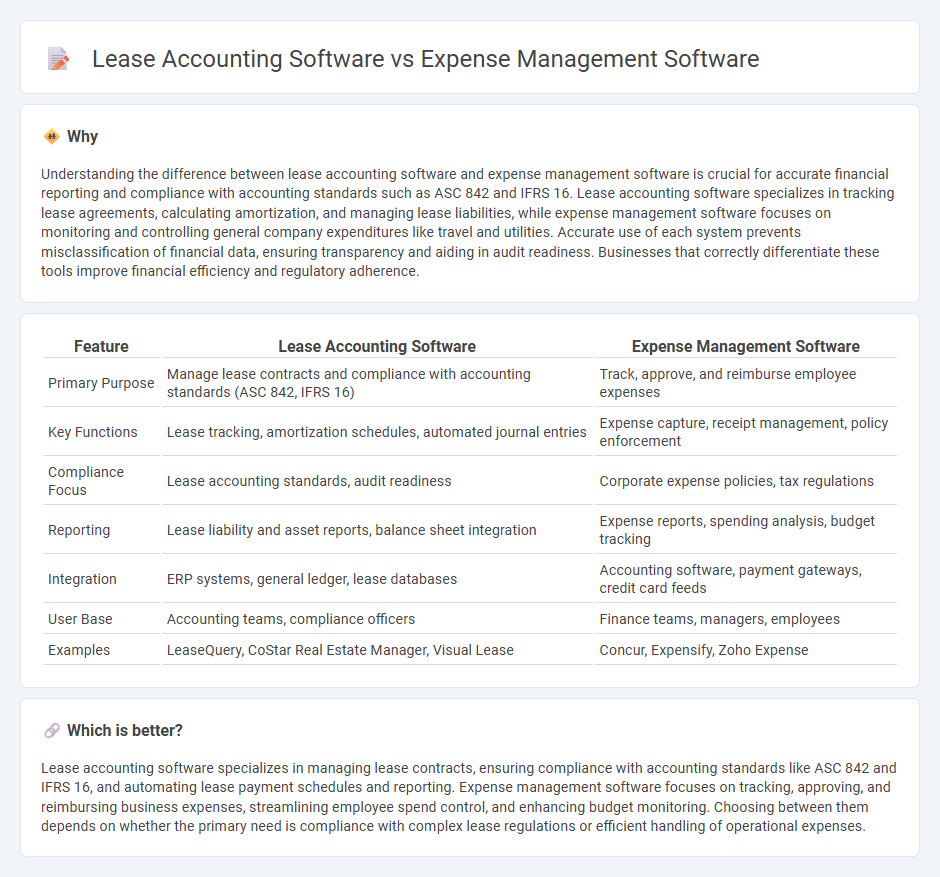

Understanding the difference between lease accounting software and expense management software is crucial for accurate financial reporting and compliance with accounting standards such as ASC 842 and IFRS 16. Lease accounting software specializes in tracking lease agreements, calculating amortization, and managing lease liabilities, while expense management software focuses on monitoring and controlling general company expenditures like travel and utilities. Accurate use of each system prevents misclassification of financial data, ensuring transparency and aiding in audit readiness. Businesses that correctly differentiate these tools improve financial efficiency and regulatory adherence.

Comparison Table

| Feature | Lease Accounting Software | Expense Management Software |

|---|---|---|

| Primary Purpose | Manage lease contracts and compliance with accounting standards (ASC 842, IFRS 16) | Track, approve, and reimburse employee expenses |

| Key Functions | Lease tracking, amortization schedules, automated journal entries | Expense capture, receipt management, policy enforcement |

| Compliance Focus | Lease accounting standards, audit readiness | Corporate expense policies, tax regulations |

| Reporting | Lease liability and asset reports, balance sheet integration | Expense reports, spending analysis, budget tracking |

| Integration | ERP systems, general ledger, lease databases | Accounting software, payment gateways, credit card feeds |

| User Base | Accounting teams, compliance officers | Finance teams, managers, employees |

| Examples | LeaseQuery, CoStar Real Estate Manager, Visual Lease | Concur, Expensify, Zoho Expense |

Which is better?

Lease accounting software specializes in managing lease contracts, ensuring compliance with accounting standards like ASC 842 and IFRS 16, and automating lease payment schedules and reporting. Expense management software focuses on tracking, approving, and reimbursing business expenses, streamlining employee spend control, and enhancing budget monitoring. Choosing between them depends on whether the primary need is compliance with complex lease regulations or efficient handling of operational expenses.

Connection

Lease accounting software and expense management software integrate to streamline financial reporting and control by automating lease expense tracking and ensuring accurate allocation of costs. This connection enhances compliance with accounting standards such as ASC 842 and IFRS 16 by providing real-time data synchronization between lease obligations and overall expense management. Leveraging both software types reduces manual errors, improves audit readiness, and optimizes cash flow management in corporate accounting.

Key Terms

Expense Tracking

Expense management software streamlines the process of tracking, categorizing, and approving expenses to enhance financial control and visibility. Lease accounting software focuses on compliance with lease accounting standards such as ASC 842, providing detailed lease expense tracking and reporting to ensure accurate financial statements. Explore our comprehensive guide to understand which solution best fits your business needs in expense tracking.

Lease Compliance

Expense management software streamlines tracking and approving business expenditures but often lacks specialized tools for lease accounting compliance, such as adhering to ASC 842 or IFRS 16 standards. Lease accounting software specifically addresses lease compliance by automating lease classification, calculating right-of-use assets, liabilities, and ensuring accurate financial reporting aligned with regulatory requirements. Discover how integrating robust lease accounting solutions can enhance your lease compliance and financial accuracy.

Asset Amortization

Expense management software tracks and controls operational costs, providing real-time visibility into spending patterns, while lease accounting software focuses on compliance with lease standards such as ASC 842 and IFRS 16, specifically managing asset amortization schedules and lease liability calculations. Asset amortization within lease accounting software ensures accurate depreciation of right-of-use assets over lease terms, crucial for financial reporting and balance sheet accuracy. Explore how integrating both software solutions can optimize financial workflows and regulatory compliance.

Source and External Links

Gartner Expense Management Software Reviews - Provides reviews and comparisons of top expense management software options to help businesses choose the best fit.

Paychex Expense Management - Offers cloud-based expense reporting and management software integrated with Paychex Flex for seamless expense tracking and reimbursement.

Ramp Expense Management - Automates expense management through corporate cards, reimbursements, and reporting, allowing for pre-set spending policies and real-time expense oversight.

dowidth.com

dowidth.com