Embedded finance reconciliation focuses on integrating financial services within non-financial platforms, emphasizing seamless transactional tracking and real-time payment verification. Subscription revenue reconciliation entails matching recurring income records with actual payments received, ensuring accurate revenue recognition and compliance with accounting standards like ASC 606. Explore deeper insights on how each method enhances financial accuracy and operational efficiency.

Why it is important

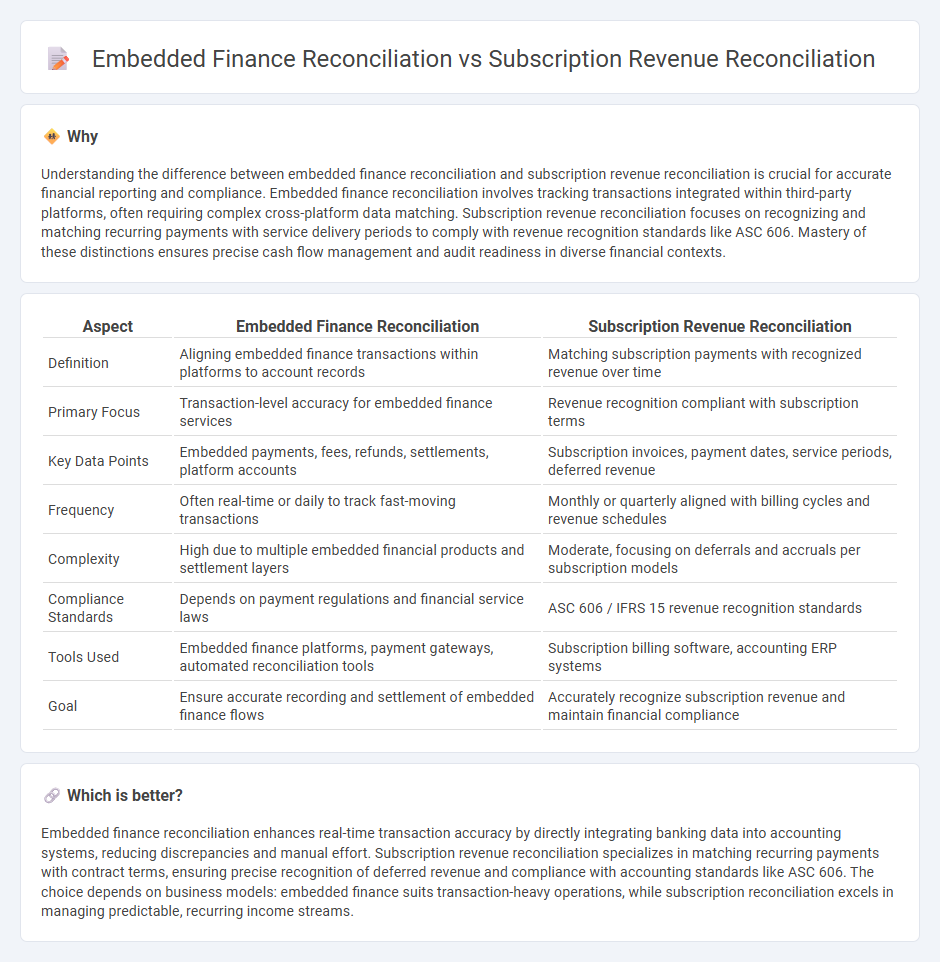

Understanding the difference between embedded finance reconciliation and subscription revenue reconciliation is crucial for accurate financial reporting and compliance. Embedded finance reconciliation involves tracking transactions integrated within third-party platforms, often requiring complex cross-platform data matching. Subscription revenue reconciliation focuses on recognizing and matching recurring payments with service delivery periods to comply with revenue recognition standards like ASC 606. Mastery of these distinctions ensures precise cash flow management and audit readiness in diverse financial contexts.

Comparison Table

| Aspect | Embedded Finance Reconciliation | Subscription Revenue Reconciliation |

|---|---|---|

| Definition | Aligning embedded finance transactions within platforms to account records | Matching subscription payments with recognized revenue over time |

| Primary Focus | Transaction-level accuracy for embedded finance services | Revenue recognition compliant with subscription terms |

| Key Data Points | Embedded payments, fees, refunds, settlements, platform accounts | Subscription invoices, payment dates, service periods, deferred revenue |

| Frequency | Often real-time or daily to track fast-moving transactions | Monthly or quarterly aligned with billing cycles and revenue schedules |

| Complexity | High due to multiple embedded financial products and settlement layers | Moderate, focusing on deferrals and accruals per subscription models |

| Compliance Standards | Depends on payment regulations and financial service laws | ASC 606 / IFRS 15 revenue recognition standards |

| Tools Used | Embedded finance platforms, payment gateways, automated reconciliation tools | Subscription billing software, accounting ERP systems |

| Goal | Ensure accurate recording and settlement of embedded finance flows | Accurately recognize subscription revenue and maintain financial compliance |

Which is better?

Embedded finance reconciliation enhances real-time transaction accuracy by directly integrating banking data into accounting systems, reducing discrepancies and manual effort. Subscription revenue reconciliation specializes in matching recurring payments with contract terms, ensuring precise recognition of deferred revenue and compliance with accounting standards like ASC 606. The choice depends on business models: embedded finance suits transaction-heavy operations, while subscription reconciliation excels in managing predictable, recurring income streams.

Connection

Embedded finance reconciliation streamlines transaction tracking by integrating payment data directly within platforms, enhancing accuracy in financial records. Subscription revenue reconciliation relies on this seamless data flow to match recurring payments with billing cycles, ensuring precise revenue recognition. Together, they enable automated financial reporting and reduce discrepancies in accounting systems.

Key Terms

Deferred Revenue

Subscription revenue reconciliation primarily focuses on tracking recognized and deferred revenue associated with recurring billing cycles, ensuring accurate matching of invoices, payments, and revenue recognition schedules. Embedded finance reconciliation involves managing transactions within integrated financial services such as payments and lending, emphasizing the timely allocation of funds and the accurate reflection of deferred revenue arising from bundled offerings. Explore our detailed analysis to understand the nuanced differences in deferred revenue handling across these reconciliation processes.

Transaction Matching

Subscription revenue reconciliation centers on aligning recurring billing transactions with recorded revenue to ensure accuracy in recognizing income from subscription services. Embedded finance reconciliation involves verifying integrated financial services transactions within non-financial platforms, focusing on seamless transaction matching between third-party providers and core systems. Explore the nuances of transaction matching techniques in both areas to optimize financial accuracy and operational efficiency.

Platform Fees

Subscription revenue reconciliation involves tracking and verifying income generated from recurring user subscriptions, ensuring accuracy in billing and revenue recognition. Embedded finance reconciliation centers on managing financial flows within integrated services, with a critical focus on platform fees deducted for facilitating transactions between users and service providers. Discover how mastering these reconciliations can optimize financial operations and improve business insights.

Source and External Links

What is Revenue Reconciliation? | DealHub - Revenue reconciliation is the accounting process of comparing revenue records across systems to verify accurate revenue recognition, particularly vital for subscription models like SaaS to handle billing cycles, discounts, refunds, and currency exchange complexities.

Subscription-Based eCommerce Models: Reconciliation Best - Best practices for subscription revenue reconciliation include consolidating invoices, clear communication of billing cycles, providing flexible billing options, and automating processes with accounting software to reduce errors and administrative burden.

Revenue Reconciliation: The Ultimate Guide (2024) - Revenue reconciliation involves gathering all financial data from different sources, matching payments to invoices, identifying discrepancies, investigating causes, and making adjustments to ensure financial statements accurately reflect actual subscription revenue.

dowidth.com

dowidth.com