Cryptocurrency valuation requires specialized approaches due to its volatility and lack of intrinsic cash flows, contrasting with the equity method that accounts for significant influence in investee companies by recording the investor's share of net assets. While cryptocurrency is often valued using fair value measurement or cost methods depending on intent and classification, the equity method relies on adjusting investment value based on the investee's financial performance and dividends received. Explore the nuances and standards governing these distinct accounting treatments to understand their impact on financial reporting.

Why it is important

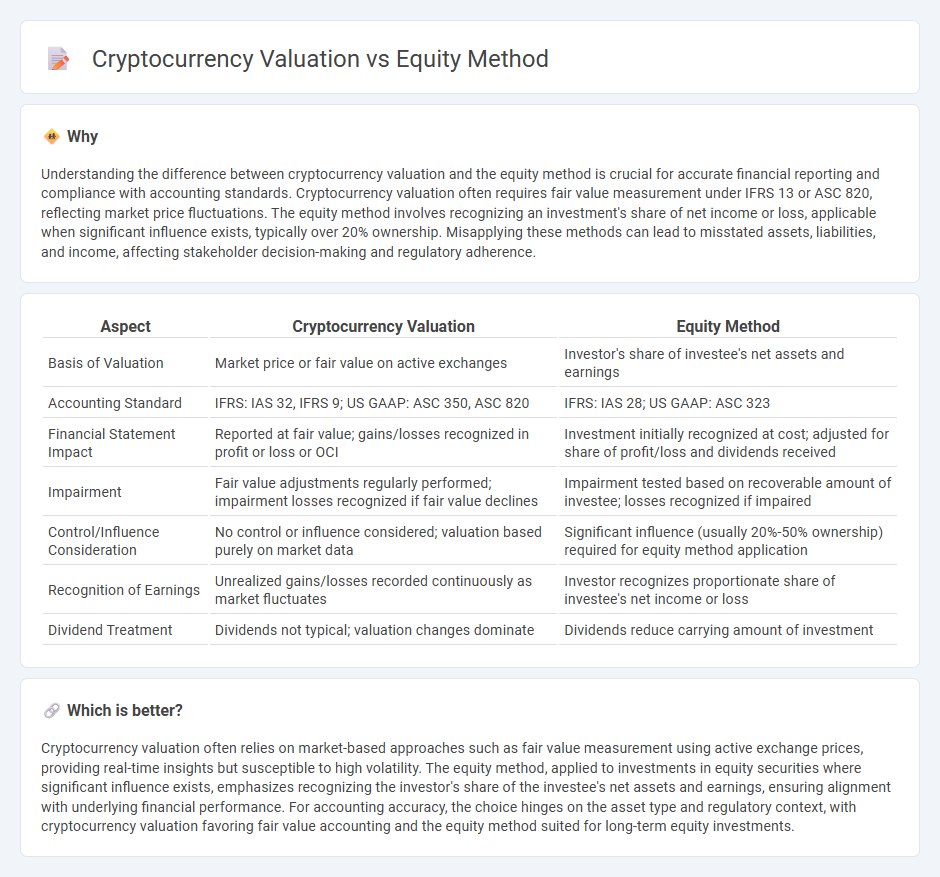

Understanding the difference between cryptocurrency valuation and the equity method is crucial for accurate financial reporting and compliance with accounting standards. Cryptocurrency valuation often requires fair value measurement under IFRS 13 or ASC 820, reflecting market price fluctuations. The equity method involves recognizing an investment's share of net income or loss, applicable when significant influence exists, typically over 20% ownership. Misapplying these methods can lead to misstated assets, liabilities, and income, affecting stakeholder decision-making and regulatory adherence.

Comparison Table

| Aspect | Cryptocurrency Valuation | Equity Method |

|---|---|---|

| Basis of Valuation | Market price or fair value on active exchanges | Investor's share of investee's net assets and earnings |

| Accounting Standard | IFRS: IAS 32, IFRS 9; US GAAP: ASC 350, ASC 820 | IFRS: IAS 28; US GAAP: ASC 323 |

| Financial Statement Impact | Reported at fair value; gains/losses recognized in profit or loss or OCI | Investment initially recognized at cost; adjusted for share of profit/loss and dividends received |

| Impairment | Fair value adjustments regularly performed; impairment losses recognized if fair value declines | Impairment tested based on recoverable amount of investee; losses recognized if impaired |

| Control/Influence Consideration | No control or influence considered; valuation based purely on market data | Significant influence (usually 20%-50% ownership) required for equity method application |

| Recognition of Earnings | Unrealized gains/losses recorded continuously as market fluctuates | Investor recognizes proportionate share of investee's net income or loss |

| Dividend Treatment | Dividends not typical; valuation changes dominate | Dividends reduce carrying amount of investment |

Which is better?

Cryptocurrency valuation often relies on market-based approaches such as fair value measurement using active exchange prices, providing real-time insights but susceptible to high volatility. The equity method, applied to investments in equity securities where significant influence exists, emphasizes recognizing the investor's share of the investee's net assets and earnings, ensuring alignment with underlying financial performance. For accounting accuracy, the choice hinges on the asset type and regulatory context, with cryptocurrency valuation favoring fair value accounting and the equity method suited for long-term equity investments.

Connection

Cryptocurrency valuation directly impacts the equity method's application when an investor holds significant influence over an investee with digital assets on its balance sheet. The fair value measurement of cryptocurrencies determines the carrying amount of the investment and affects the investor's share of net income or losses under the equity method. Accurate valuation ensures financial statements reflect true economic interests and comply with accounting standards like IFRS or GAAP.

Key Terms

Investment Carrying Amount

The equity method values investments based on the investor's share of the investee's net assets, reflecting changes in carrying amount due to profits, losses, and dividends. Cryptocurrency valuation relies on fluctuating market prices, with carrying amounts often adjusted to fair value, impacting reported gains or losses. Explore detailed comparisons to understand how these approaches affect investment carrying amounts in financial statements.

Fair Value

Equity method valuation involves recognizing a company's share of net assets and profits based on ownership percentage, reflecting fair value through book adjustments rather than market prices. Cryptocurrency valuation relies heavily on fair value determination using active market prices, considering volatility and liquidity challenges unique to digital assets. Explore detailed methodologies to understand the nuances between equity method accounting and cryptocurrency fair value assessment.

Unrealized Gains/Losses

The equity method records unrealized gains and losses in investments based on proportional ownership and changes in the investee's net assets, reflecting long-term financial performance. Cryptocurrency valuation treats unrealized gains and losses as market fluctuations, often recorded at fair value with high volatility impacting the investor's balance sheet immediately. Explore detailed strategies for managing unrealized gains and losses in both equity investments and digital assets.

Source and External Links

Equity Investments -- Fair Value Method and Equity Method - The equity method records the investor's share of the investee's net income as revenue and reduces the investment account by dividends received, applicable when the investor has significant influence over the investee, such as representation on the board or involvement in policy-making.

Equity method - The equity method applies when an investor holds 20-50% of voting stock, indicating significant influence, and involves adjusting the investment on the balance sheet by the investor's share of the associate's net income or loss and dividends received.

Equity Method Accounting - The CPA Journal - Equity method accounting is used when an investor has significant influence but not control over an investee, recognizing the investment as an asset and adjusting it for the investor's share of earnings or losses, distinct from consolidation or fair value methods.

dowidth.com

dowidth.com