Payroll automation significantly reduces errors and saves time by streamlining salary calculations, tax deductions, and compliance, compared to traditional payroll spreadsheets prone to manual entry mistakes and inefficiencies. Automated systems enhance data accuracy and ensure timely payments, improving overall payroll management for businesses of any size. Discover how integrating payroll automation can transform your accounting processes and boost operational efficiency.

Why it is important

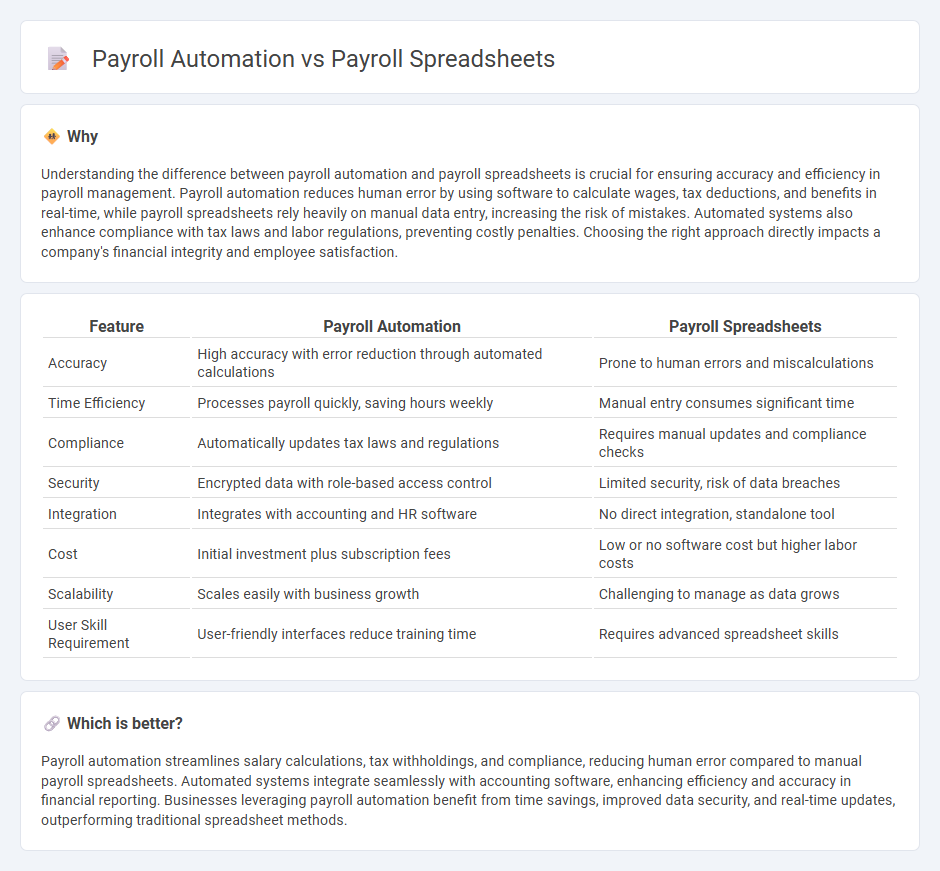

Understanding the difference between payroll automation and payroll spreadsheets is crucial for ensuring accuracy and efficiency in payroll management. Payroll automation reduces human error by using software to calculate wages, tax deductions, and benefits in real-time, while payroll spreadsheets rely heavily on manual data entry, increasing the risk of mistakes. Automated systems also enhance compliance with tax laws and labor regulations, preventing costly penalties. Choosing the right approach directly impacts a company's financial integrity and employee satisfaction.

Comparison Table

| Feature | Payroll Automation | Payroll Spreadsheets |

|---|---|---|

| Accuracy | High accuracy with error reduction through automated calculations | Prone to human errors and miscalculations |

| Time Efficiency | Processes payroll quickly, saving hours weekly | Manual entry consumes significant time |

| Compliance | Automatically updates tax laws and regulations | Requires manual updates and compliance checks |

| Security | Encrypted data with role-based access control | Limited security, risk of data breaches |

| Integration | Integrates with accounting and HR software | No direct integration, standalone tool |

| Cost | Initial investment plus subscription fees | Low or no software cost but higher labor costs |

| Scalability | Scales easily with business growth | Challenging to manage as data grows |

| User Skill Requirement | User-friendly interfaces reduce training time | Requires advanced spreadsheet skills |

Which is better?

Payroll automation streamlines salary calculations, tax withholdings, and compliance, reducing human error compared to manual payroll spreadsheets. Automated systems integrate seamlessly with accounting software, enhancing efficiency and accuracy in financial reporting. Businesses leveraging payroll automation benefit from time savings, improved data security, and real-time updates, outperforming traditional spreadsheet methods.

Connection

Payroll automation integrates seamlessly with payroll spreadsheets by streamlining data entry and reducing human error, enhancing payroll accuracy and efficiency. Automated systems generate, update, and manage payroll spreadsheets in real-time, facilitating faster processing of employee salaries, tax calculations, and reporting. This connectivity between payroll automation and spreadsheets supports compliance with tax regulations and organizational financial management.

Key Terms

Data Entry (Spreadsheets)

Manual payroll spreadsheets involve extensive data entry, increasing the risk of human error and consuming significant time resources. Payroll automation streamlines data input by integrating with existing HR systems, ensuring higher accuracy and faster processing. Discover how automating payroll data entry can improve efficiency and reduce mistakes in your business.

Integration (Automation)

Payroll spreadsheets often lack seamless integration capabilities, requiring manual data entry and increasing the risk of errors, whereas payroll automation systems offer robust integration with accounting software, time tracking tools, and HR platforms to streamline processes. Automated payroll ensures real-time synchronization of employee data, tax updates, and compliance requirements, reducing administrative workload and enhancing accuracy. Discover how integrating payroll automation can transform your payroll management by exploring our detailed insights.

Error Reduction (Automation)

Payroll automation significantly reduces errors by eliminating manual data entry common in payroll spreadsheets, which can cause costly mistakes in tax calculations and employee payments. Automated systems use built-in validation checks and real-time updates to ensure accuracy and compliance with payroll regulations. Discover how payroll automation can optimize your payroll process and minimize errors today.

Source and External Links

Free Payroll Template for Google Sheets - A video tutorial showing how to create a payroll spreadsheet in Google Sheets.

Free Payroll Templates by Clockify - Provides customizable payroll templates for Google Sheets, including basic weekly and monthly options.

How to Do Payroll in Excel - Offers a step-by-step guide to managing payroll in Excel, including templates and year-to-date tracking.

dowidth.com

dowidth.com