Tax equity financing leverages tax benefits such as investment tax credits and accelerated depreciation, making it a popular choice for renewable energy projects seeking to minimize upfront costs. Traditional equity financing involves direct ownership stakes with returns driven by company profits and capital appreciation, often lacking the tax-driven incentives present in tax equity structures. Discover more about how each financing method can impact your investment strategy and financial outcomes.

Why it is important

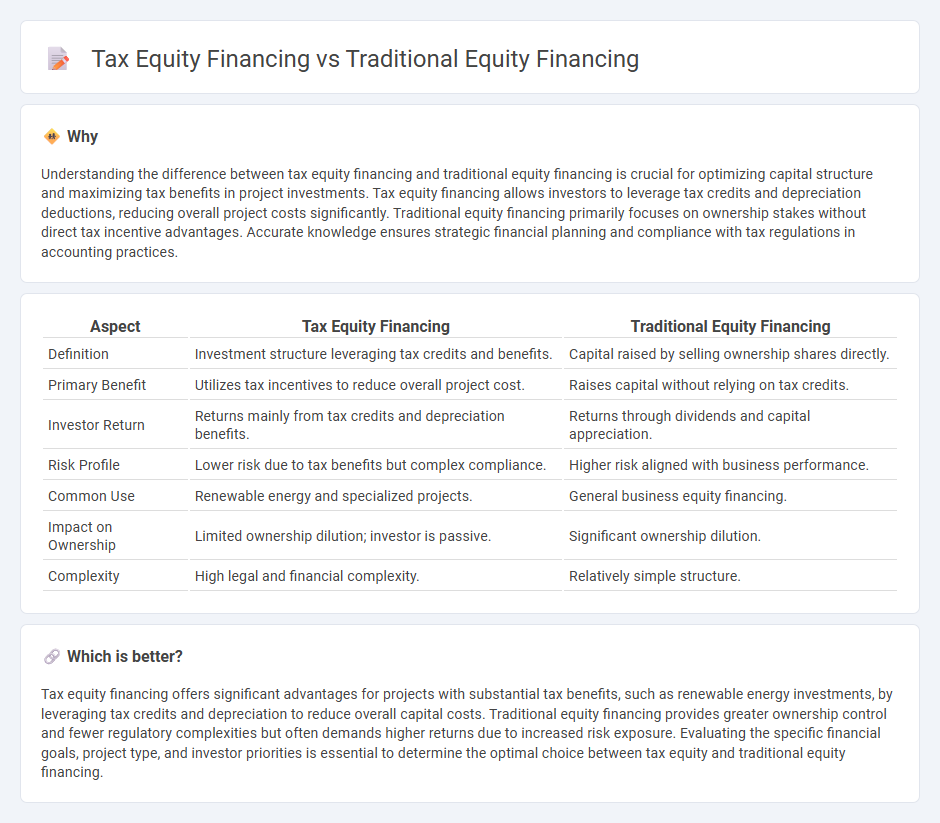

Understanding the difference between tax equity financing and traditional equity financing is crucial for optimizing capital structure and maximizing tax benefits in project investments. Tax equity financing allows investors to leverage tax credits and depreciation deductions, reducing overall project costs significantly. Traditional equity financing primarily focuses on ownership stakes without direct tax incentive advantages. Accurate knowledge ensures strategic financial planning and compliance with tax regulations in accounting practices.

Comparison Table

| Aspect | Tax Equity Financing | Traditional Equity Financing |

|---|---|---|

| Definition | Investment structure leveraging tax credits and benefits. | Capital raised by selling ownership shares directly. |

| Primary Benefit | Utilizes tax incentives to reduce overall project cost. | Raises capital without relying on tax credits. |

| Investor Return | Returns mainly from tax credits and depreciation benefits. | Returns through dividends and capital appreciation. |

| Risk Profile | Lower risk due to tax benefits but complex compliance. | Higher risk aligned with business performance. |

| Common Use | Renewable energy and specialized projects. | General business equity financing. |

| Impact on Ownership | Limited ownership dilution; investor is passive. | Significant ownership dilution. |

| Complexity | High legal and financial complexity. | Relatively simple structure. |

Which is better?

Tax equity financing offers significant advantages for projects with substantial tax benefits, such as renewable energy investments, by leveraging tax credits and depreciation to reduce overall capital costs. Traditional equity financing provides greater ownership control and fewer regulatory complexities but often demands higher returns due to increased risk exposure. Evaluating the specific financial goals, project type, and investor priorities is essential to determine the optimal choice between tax equity and traditional equity financing.

Connection

Tax equity financing and traditional equity financing intersect in structuring capital for projects, particularly in renewable energy sectors where tax benefits like Investment Tax Credits (ITC) and Production Tax Credits (PTC) are significant. Tax equity investors provide capital in exchange for tax advantages, influencing the financial modeling and risk allocation compared to traditional equity investors who seek ownership and dividends. Both financing methods are integrated to optimize project funding, balancing tax incentive utilization with equity control and returns.

Key Terms

Ownership Shares

Traditional equity financing involves investors acquiring ownership shares proportional to their capital contributions, granting them voting rights and a claim on company profits. Tax equity financing, commonly used in renewable energy projects, allows investors to earn returns primarily through tax benefits like investment tax credits and depreciation, often without full ownership or control rights. Explore the nuances of ownership structures and benefits between these financing methods to optimize your investment strategy.

Tax Credits

Tax equity financing leverages tax credits, such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC), to attract investors who can utilize these credits to offset their tax liabilities, making it distinct from traditional equity financing where returns are primarily driven by capital appreciation and dividends. In tax equity deals, investors provide capital in exchange for the allocated tax benefits generated by renewable energy projects, often resulting in lower cost of capital and enhanced project feasibility. Explore how tax credit structures can optimize your renewable energy investments by learning more about tax equity financing strategies.

Capital Structure

Traditional equity financing involves investors providing capital in exchange for ownership shares, impacting the overall capital structure by increasing shareholder equity and diluting ownership. Tax equity financing, commonly used in renewable energy projects, leverages tax credits and incentives to attract investors who contribute capital primarily to benefit from tax advantages rather than direct ownership control, altering capital structure with a focus on tax benefits rather than equity dilution. Explore further to understand how each financing method shapes project funding and investor returns.

Source and External Links

Equity Financing Examples - Liquidity - Traditional equity financing involves raising capital by selling shares or ownership stakes in a company, allowing businesses to obtain funds without incurring debt by offering common stock, preferred stock, or convertible preferred stock to investors such as angel investors or venture capitalists.

Equity Financing Explained: A Guide for Growing Businesses - The traditional equity financing process includes determining capital needs, attracting investors with a business plan, formalizing deals via shareholder agreements, and often involves long-term partnerships where investors gain ownership stakes and participate in major liquidity events like IPOs or acquisitions.

Equity Financing - Definition, How it Works, Pros, Cons - Traditional equity financing is especially important for startups and involves selling company shares to investors such as angel investors, venture capital firms, or through crowdfunding, with investors gaining ownership rights and potential returns through dividends or increased share value.

dowidth.com

dowidth.com