Triple entry accounting enhances transparency and security by recording transactions with cryptographic verification across three ledgers, offering a more reliable audit trail compared to traditional double entry systems. Cost accounting focuses on tracking, recording, and analyzing production costs to optimize budgeting and improve profitability in manufacturing and business operations. Explore the distinctions and benefits of triple entry and cost accounting to better understand their impact on financial accuracy and management.

Why it is important

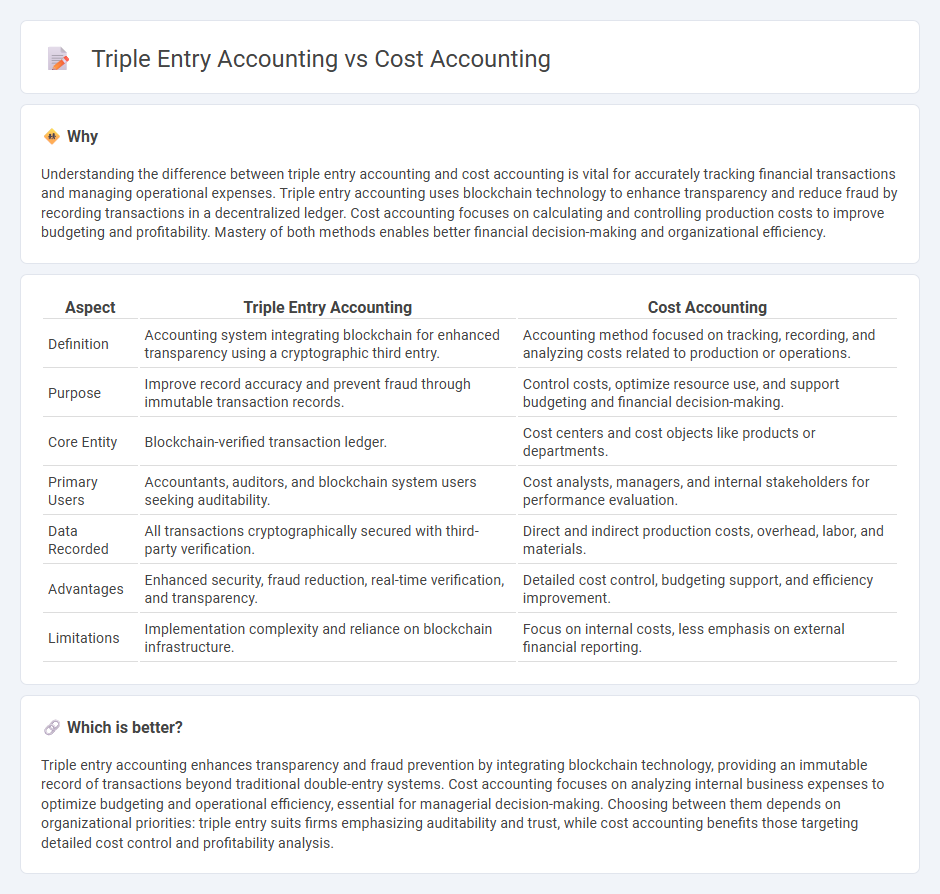

Understanding the difference between triple entry accounting and cost accounting is vital for accurately tracking financial transactions and managing operational expenses. Triple entry accounting uses blockchain technology to enhance transparency and reduce fraud by recording transactions in a decentralized ledger. Cost accounting focuses on calculating and controlling production costs to improve budgeting and profitability. Mastery of both methods enables better financial decision-making and organizational efficiency.

Comparison Table

| Aspect | Triple Entry Accounting | Cost Accounting |

|---|---|---|

| Definition | Accounting system integrating blockchain for enhanced transparency using a cryptographic third entry. | Accounting method focused on tracking, recording, and analyzing costs related to production or operations. |

| Purpose | Improve record accuracy and prevent fraud through immutable transaction records. | Control costs, optimize resource use, and support budgeting and financial decision-making. |

| Core Entity | Blockchain-verified transaction ledger. | Cost centers and cost objects like products or departments. |

| Primary Users | Accountants, auditors, and blockchain system users seeking auditability. | Cost analysts, managers, and internal stakeholders for performance evaluation. |

| Data Recorded | All transactions cryptographically secured with third-party verification. | Direct and indirect production costs, overhead, labor, and materials. |

| Advantages | Enhanced security, fraud reduction, real-time verification, and transparency. | Detailed cost control, budgeting support, and efficiency improvement. |

| Limitations | Implementation complexity and reliance on blockchain infrastructure. | Focus on internal costs, less emphasis on external financial reporting. |

Which is better?

Triple entry accounting enhances transparency and fraud prevention by integrating blockchain technology, providing an immutable record of transactions beyond traditional double-entry systems. Cost accounting focuses on analyzing internal business expenses to optimize budgeting and operational efficiency, essential for managerial decision-making. Choosing between them depends on organizational priorities: triple entry suits firms emphasizing auditability and trust, while cost accounting benefits those targeting detailed cost control and profitability analysis.

Connection

Triple entry accounting enhances cost accounting by providing an immutable and transparent ledger that records every transaction's financial impact across cost centers. This integration enables precise tracking of expenses, revenues, and resource allocations, improving overall cost control and financial accuracy. Implementing triple entry accounting allows cost accountants to verify data integrity, minimizing discrepancies and optimizing budgeting processes.

Key Terms

Costing Methods (Cost accounting)

Cost accounting employs various costing methods such as job costing, process costing, and activity-based costing to accurately track and allocate production costs for enhanced financial control. Triple entry accounting integrates blockchain technology to record transactions with cryptographic verification, offering improved transparency but does not focus primarily on costing methods. Explore deeper insights into how these accounting approaches optimize financial accuracy and decision-making.

Blockchain Ledger (Triple entry accounting)

Cost accounting tracks, analyzes, and reports production costs to optimize efficiency and profitability, primarily using traditional double-entry bookkeeping. Triple-entry accounting leverages blockchain technology to create a decentralized, tamper-proof ledger that records transactions with cryptographic verification, increasing transparency and trust. Explore how blockchain's triple-entry accounting revolutionizes financial accuracy and auditability for deeper insights.

Overhead Allocation (Cost accounting)

Overhead allocation in cost accounting involves systematic distribution of indirect costs such as utilities, rent, and administrative expenses to different departments or products based on predetermined rates or activity drivers. This method enhances accuracy in product costing and performance evaluation by ensuring that indirect costs are appropriately traced to cost objects. Explore how triple entry accounting integrates overhead data with blockchain technology to revolutionize transparency and traceability in expense management.

Source and External Links

Cost Accounting Defined: What It Is & Why It Matters - NetSuite - Cost accounting is the process of tracking, analyzing, and summarizing all fixed and variable input costs related to production or services to help internal management control costs and inform pricing decisions, differing from financial accounting which is external-focused and regulated by standards.

Cost Accounting: Everything You Need to Know - Fyle - Cost accounting is a managerial accounting technique that analyzes production costs (variable and fixed) to optimize pricing, budgeting, and efficiency, with methods like job costing used to track costs of specific projects or products.

Cost accounting - Wikipedia - Cost accounting involves systematic procedures to record and report manufacturing and service costs, using methods like standard costing to compare actual costs to predefined standards for variance analysis and inventory valuation.

dowidth.com

dowidth.com