Fair value measurement reflects an asset's current market price, providing a timely and transparent valuation based on observable inputs and market conditions. Net realizable value estimates the amount expected to be collected from asset sales, deducting expected costs of completion and disposal, offering a more conservative approach focused on actual cash flow potential. Explore the differences and applications of these valuation methods to enhance your accounting accuracy and compliance.

Why it is important

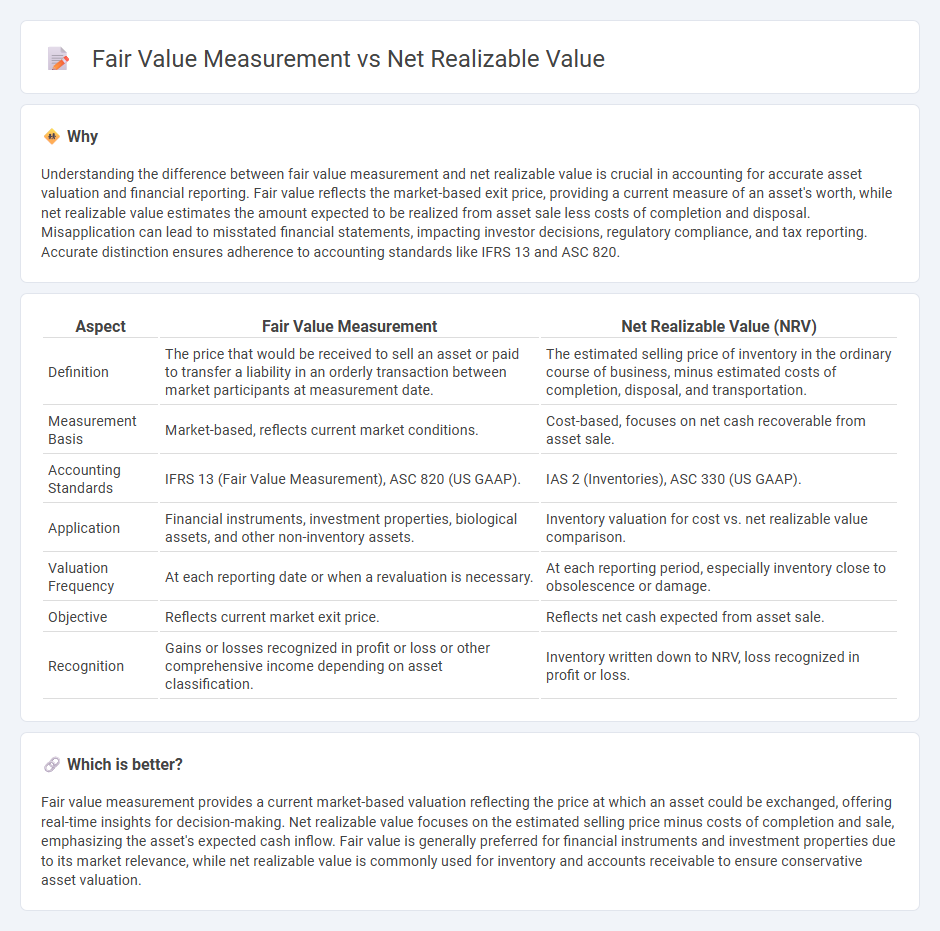

Understanding the difference between fair value measurement and net realizable value is crucial in accounting for accurate asset valuation and financial reporting. Fair value reflects the market-based exit price, providing a current measure of an asset's worth, while net realizable value estimates the amount expected to be realized from asset sale less costs of completion and disposal. Misapplication can lead to misstated financial statements, impacting investor decisions, regulatory compliance, and tax reporting. Accurate distinction ensures adherence to accounting standards like IFRS 13 and ASC 820.

Comparison Table

| Aspect | Fair Value Measurement | Net Realizable Value (NRV) |

|---|---|---|

| Definition | The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at measurement date. | The estimated selling price of inventory in the ordinary course of business, minus estimated costs of completion, disposal, and transportation. |

| Measurement Basis | Market-based, reflects current market conditions. | Cost-based, focuses on net cash recoverable from asset sale. |

| Accounting Standards | IFRS 13 (Fair Value Measurement), ASC 820 (US GAAP). | IAS 2 (Inventories), ASC 330 (US GAAP). |

| Application | Financial instruments, investment properties, biological assets, and other non-inventory assets. | Inventory valuation for cost vs. net realizable value comparison. |

| Valuation Frequency | At each reporting date or when a revaluation is necessary. | At each reporting period, especially inventory close to obsolescence or damage. |

| Objective | Reflects current market exit price. | Reflects net cash expected from asset sale. |

| Recognition | Gains or losses recognized in profit or loss or other comprehensive income depending on asset classification. | Inventory written down to NRV, loss recognized in profit or loss. |

Which is better?

Fair value measurement provides a current market-based valuation reflecting the price at which an asset could be exchanged, offering real-time insights for decision-making. Net realizable value focuses on the estimated selling price minus costs of completion and sale, emphasizing the asset's expected cash inflow. Fair value is generally preferred for financial instruments and investment properties due to its market relevance, while net realizable value is commonly used for inventory and accounts receivable to ensure conservative asset valuation.

Connection

Fair value measurement and net realizable value both serve as critical valuation bases in accounting, with fair value reflecting the estimated market price for an asset or liability, while net realizable value represents the expected settlement amount after deducting costs. These concepts are interconnected in inventory valuation and impairment testing, where net realizable value provides a conservative estimate aligned with fair value principles under specific circumstances. Accurate application of these measures ensures compliance with IFRS and GAAP standards, enhancing financial statement reliability and comparability.

Key Terms

Estimated Selling Price

Net realizable value (NRV) represents the estimated selling price of an asset in the ordinary course of business minus any costs necessary to complete and sell the asset, emphasizing the actual cash inflow expected. Fair value measurement, defined by IFRS 13, reflects the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, focusing on market-based assumptions rather than transaction-specific costs. Explore further to understand how these valuation methods impact financial reporting and decision-making.

Deductible Costs

Net realizable value (NRV) reflects the estimated selling price of an asset minus the estimated costs necessary to make the sale, emphasizing deductible costs directly reducing the asset's expected cash inflows. Fair value measurement, according to IFRS 13, represents the price received to sell an asset in an orderly transaction between market participants at the measurement date, often excluding specific cost deductions but considering market-based evidence. Explore detailed accounting standards and practical applications to better understand deductible costs' impact on asset valuation.

Market-Based Valuation

Net realizable value (NRV) measures the estimated selling price of inventory in the ordinary course of business minus any costs to complete and sell, focusing on the inventory's market-based value less disposal costs. Fair value measurement, defined by IFRS 13, represents the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, often relying on observable market data for valuation. Explore detailed comparison and applications of NRV and fair value measurement to understand their impact on financial reporting and decision-making.

Source and External Links

How To Calculate a Net Realizable Value in 3 Steps | Indeed.com - Net realizable value (NRV) is the amount of cash a company expects to receive from the sale or disposal of an item after subtracting all related costs such as production and selling expenses, calculated as Expected Selling Price minus Total Costs.

Net realizable value - NRV measures an asset's worth when held in inventory and is defined as the expected sales price less completion and disposal costs, used under GAAP and IFRS to prevent over- or understating inventory value by recording the lower of cost or NRV.

Net Realizable Value - Definition, How to Calculate, Example - NRV represents the net value an asset can be sold for after deducting estimated selling or disposal costs and is a key conservative accounting measure ensuring assets like inventory or accounts receivable are not overstated.

dowidth.com

dowidth.com