Embedded finance reporting integrates financial data directly within operational platforms, enhancing real-time insights and decision-making efficiency. Statutory reporting adheres to regulatory standards, ensuring compliance by presenting audited financial statements for external stakeholders. Explore the key differences and benefits of these reporting methods to optimize your accounting processes.

Why it is important

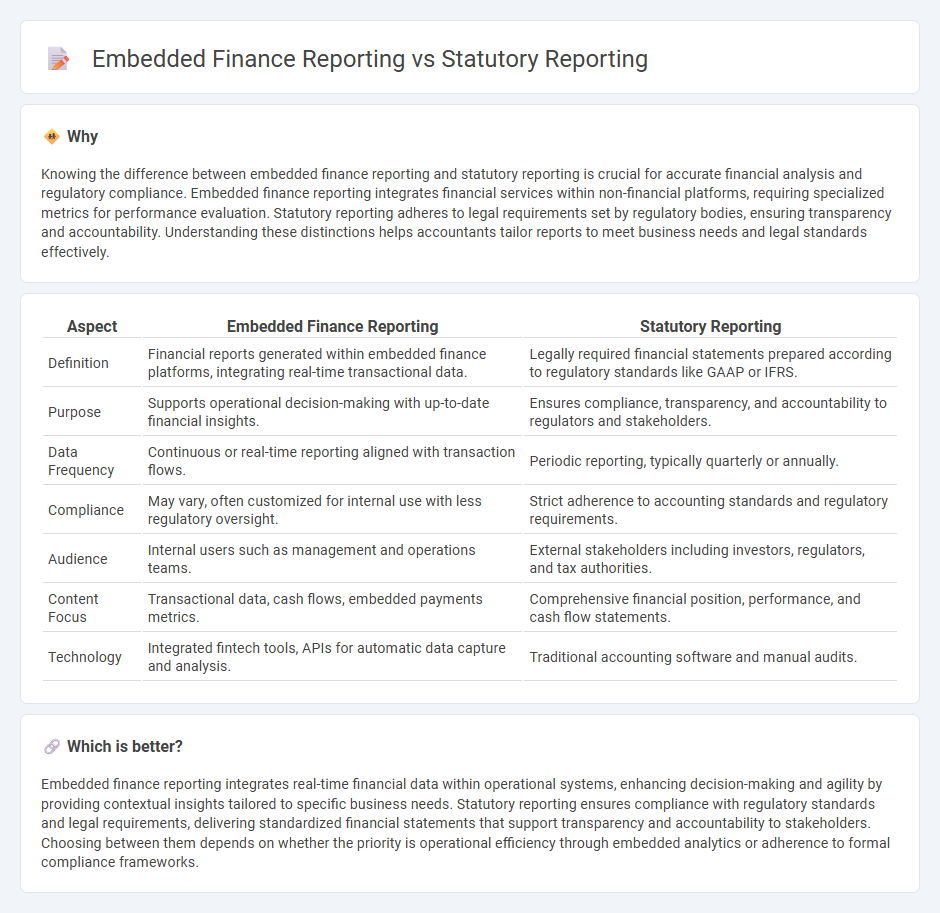

Knowing the difference between embedded finance reporting and statutory reporting is crucial for accurate financial analysis and regulatory compliance. Embedded finance reporting integrates financial services within non-financial platforms, requiring specialized metrics for performance evaluation. Statutory reporting adheres to legal requirements set by regulatory bodies, ensuring transparency and accountability. Understanding these distinctions helps accountants tailor reports to meet business needs and legal standards effectively.

Comparison Table

| Aspect | Embedded Finance Reporting | Statutory Reporting |

|---|---|---|

| Definition | Financial reports generated within embedded finance platforms, integrating real-time transactional data. | Legally required financial statements prepared according to regulatory standards like GAAP or IFRS. |

| Purpose | Supports operational decision-making with up-to-date financial insights. | Ensures compliance, transparency, and accountability to regulators and stakeholders. |

| Data Frequency | Continuous or real-time reporting aligned with transaction flows. | Periodic reporting, typically quarterly or annually. |

| Compliance | May vary, often customized for internal use with less regulatory oversight. | Strict adherence to accounting standards and regulatory requirements. |

| Audience | Internal users such as management and operations teams. | External stakeholders including investors, regulators, and tax authorities. |

| Content Focus | Transactional data, cash flows, embedded payments metrics. | Comprehensive financial position, performance, and cash flow statements. |

| Technology | Integrated fintech tools, APIs for automatic data capture and analysis. | Traditional accounting software and manual audits. |

Which is better?

Embedded finance reporting integrates real-time financial data within operational systems, enhancing decision-making and agility by providing contextual insights tailored to specific business needs. Statutory reporting ensures compliance with regulatory standards and legal requirements, delivering standardized financial statements that support transparency and accountability to stakeholders. Choosing between them depends on whether the priority is operational efficiency through embedded analytics or adherence to formal compliance frameworks.

Connection

Embedded finance reporting integrates financial services within non-financial platforms, enabling real-time transaction data capture that enhances the accuracy and timeliness of statutory reporting. Statutory reporting mandates organizations to comply with regulatory standards by providing verified financial statements, which increasingly rely on automated data from embedded finance systems. This connection streamlines compliance processes, reduces manual errors, and supports transparent financial disclosures for regulators and stakeholders.

Key Terms

Compliance

Statutory reporting mandates companies to comply with regulatory requirements by submitting accurate financial statements to government agencies, ensuring transparency and adherence to legal standards. Embedded finance reporting integrates financial services within non-financial platforms, requiring specialized compliance measures aligned with both financial regulations and industry-specific guidelines. Discover more about how these reporting frameworks impact business compliance strategies and operational efficiency.

Revenue Recognition

Statutory reporting mandates adherence to accounting standards such as IFRS 15 for revenue recognition, ensuring consistent and transparent financial disclosures. Embedded finance reporting requires specialized treatment of revenue streams from integrated financial services, often involving complex transaction mapping and real-time recognition aligned with customer interactions. Explore detailed frameworks and examples to master revenue recognition in both statutory and embedded finance contexts.

Transaction Data

Statutory reporting requires transaction data to comply with regulatory standards, ensuring accuracy, transparency, and auditability for financial oversight. Embedded finance reporting leverages real-time transaction data to provide granular insights into customer behavior and operational efficiency, driving improved decision-making and personalized financial services. Explore how integrating transaction data enhances both statutory compliance and embedded finance strategies.

Source and External Links

What is Statutory Reporting? Understand Its types & Importance - This webpage provides an overview of statutory reporting, highlighting its importance in ensuring compliance with laws and transparency for stakeholders.

Prepare for Regulatory and Statutory Reporting - This blog post offers guidance on handling statutory reporting, focusing on the preparation, audit, and filing processes.

What is statutory reporting? - This article discusses the process of statutory reporting, including identifying regulations, collecting data, preparing reports, and submitting them on time.

dowidth.com

dowidth.com