Taxonomy alignment in accounting ensures consistent classification and reporting of financial data across various systems, enhancing comparability and regulatory compliance. Consolidation adjustments involve eliminating intercompany transactions and balances to present a unified financial statement for the group. Explore how aligning taxonomy and performing consolidation adjustments optimize financial reporting accuracy and transparency.

Why it is important

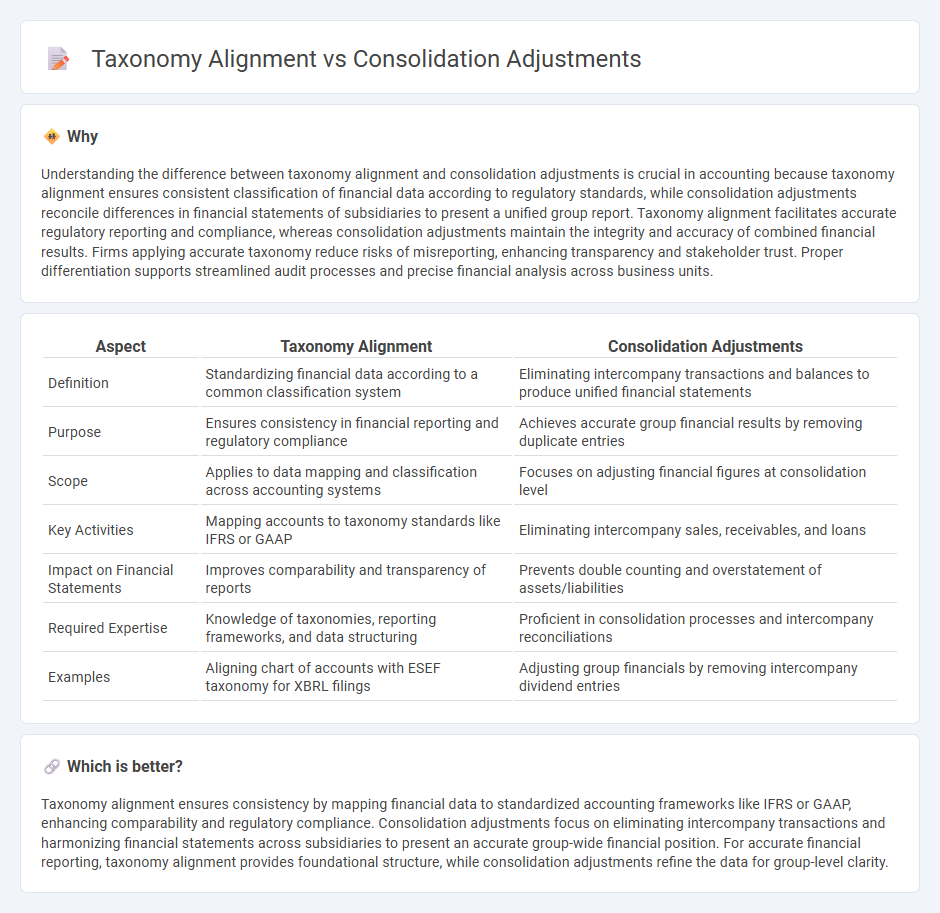

Understanding the difference between taxonomy alignment and consolidation adjustments is crucial in accounting because taxonomy alignment ensures consistent classification of financial data according to regulatory standards, while consolidation adjustments reconcile differences in financial statements of subsidiaries to present a unified group report. Taxonomy alignment facilitates accurate regulatory reporting and compliance, whereas consolidation adjustments maintain the integrity and accuracy of combined financial results. Firms applying accurate taxonomy reduce risks of misreporting, enhancing transparency and stakeholder trust. Proper differentiation supports streamlined audit processes and precise financial analysis across business units.

Comparison Table

| Aspect | Taxonomy Alignment | Consolidation Adjustments |

|---|---|---|

| Definition | Standardizing financial data according to a common classification system | Eliminating intercompany transactions and balances to produce unified financial statements |

| Purpose | Ensures consistency in financial reporting and regulatory compliance | Achieves accurate group financial results by removing duplicate entries |

| Scope | Applies to data mapping and classification across accounting systems | Focuses on adjusting financial figures at consolidation level |

| Key Activities | Mapping accounts to taxonomy standards like IFRS or GAAP | Eliminating intercompany sales, receivables, and loans |

| Impact on Financial Statements | Improves comparability and transparency of reports | Prevents double counting and overstatement of assets/liabilities |

| Required Expertise | Knowledge of taxonomies, reporting frameworks, and data structuring | Proficient in consolidation processes and intercompany reconciliations |

| Examples | Aligning chart of accounts with ESEF taxonomy for XBRL filings | Adjusting group financials by removing intercompany dividend entries |

Which is better?

Taxonomy alignment ensures consistency by mapping financial data to standardized accounting frameworks like IFRS or GAAP, enhancing comparability and regulatory compliance. Consolidation adjustments focus on eliminating intercompany transactions and harmonizing financial statements across subsidiaries to present an accurate group-wide financial position. For accurate financial reporting, taxonomy alignment provides foundational structure, while consolidation adjustments refine the data for group-level clarity.

Connection

Taxonomy alignment ensures consistent classification and reporting of financial data across multiple accounting systems, facilitating accurate consolidation adjustments. Consolidation adjustments reconcile intercompany transactions and balances, eliminating duplication and ensuring the financial statements reflect a unified economic entity. Proper taxonomy alignment streamlines the consolidation process by enabling standardized data mapping and enhancing comparability of financial information.

Key Terms

**Consolidation Adjustments:**

Consolidation adjustments are critical in preparing consolidated financial statements, ensuring the elimination of intercompany transactions, balances, and unrealized profits to present a true financial position. These adjustments also address differences in accounting policies among subsidiaries and recognize non-controlling interests accurately. Explore more about how consolidation adjustments optimize financial reporting and compliance.

Intercompany Eliminations

Intercompany eliminations require precise consolidation adjustments to remove transactions between entities, ensuring accurate group financial statements without duplication of revenue, expenses, assets, or liabilities. Taxonomy alignment facilitates standardized reporting by mapping these adjustments to regulatory frameworks like IFRS or GAAP, improving transparency and comparability across financial reports. Explore how mastering these processes enhances financial accuracy and regulatory compliance.

Non-controlling Interest

Consolidation adjustments ensure accurate representation of Non-controlling Interest (NCI) by eliminating intercompany transactions and aligning ownership percentages within consolidated financial statements. Taxonomy alignment involves mapping NCI disclosures to standardized reporting frameworks like IFRS or US GAAP, enhancing consistency and comparability across financial reports. Explore detailed methodologies and compliance requirements to optimize NCI reporting and improve financial transparency.

Source and External Links

Financial Consolidation and Close Explained - NetSuite - Discusses various consolidation adjustments, including those for intercompany transactions, inconsistent accounting policies, and impairment of intangible assets.

Consolidation Adjustments - Financial Accounting II - Explains that consolidation adjustments eliminate intercompany transactions and balances to ensure accurate financial reporting for a group as a single entity.

Consolidation Accounting: A Guide for FP&A Teams - Prophix - Guides FP&A teams through the consolidation process, including steps like adjusting for intercompany transactions and presenting non-controlling interests.

dowidth.com

dowidth.com